21.06.21 Technical analysis BTC / USD – bears increase pressure, will it withstand key support?

3 min readBTC has made some progress since yesterday, so for example, we are returning the much-coveted dynamics that the market has been missing for a long time. In any case, the fourth test of key support in the last few weeks took place over the weekend, so we are logically interested in what the result will be. Will there be a breakthrough, will there not be a breakthrough? We need to monitor the whole situation closely, because the sellers seem to be stepping up their aggression.

BTC shorts

As I just showed yesterday, the volume of BTC in short positions massively declines and this process continues until these moments. In the last four days, someone got rid of shorts in the amount of 20,500 BTC, which is a relative decrease of about 82%. And honestly, I don’t really understand what the goal of this effort was.

In fact, the big player made money on it, because during the rise in price he gained, while gradually falling shorts closed. However, with such a volume, I would imagine that the position will hold for a much longer time. At the same time, I cannot say whether the information in question is of a bull nature or, conversely, a bear.

On the one hand, it can be deduced that the big player does not expect any further decline. On the other hand, the potential fuel for short squeeze has also disappeared and we can confirm with certainty that the market is not over-horticultured. Conversely, long positions are still at an all time high – the market is still translated. Many holders of these positions are still trapped, and with a potential breakthrough of $ 30,000, they will begin to have liquidations and stop losses.

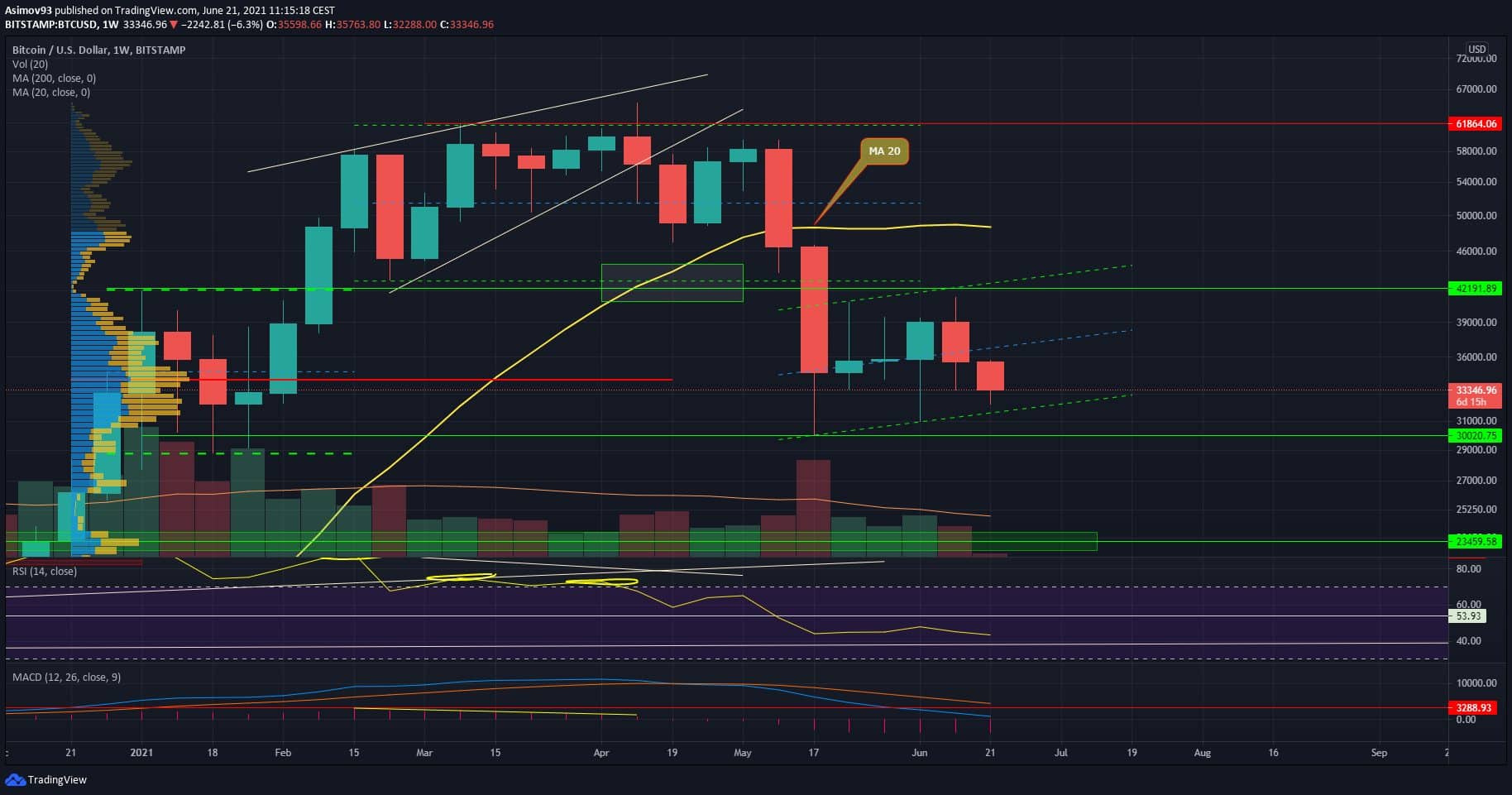

Current situation at 1W TF BTC / USD

So as for the weekly chart, we have a fresh close from last week behind us, so we also have the final form of a candle. The candle as such is not purely bearish in nature, but as I often repeat – it is quite subjective. I would say that it is rather neutral in nature and has just confirmed that BTC really respects the $ 42,000 as key resistance.

As for the structure of the market in recent weeks, I would venture to say that we have before us bear flag. But it’s not entirely textbook, because we don’t have both contact with the tips of the upper wicks at the top wall. In any case, more and more analysts are beginning to notice the flags, so in general we can assume that the pattern is there, at least visually.

However, this does not automatically mean that it will be applied. In order for the department to start implementing, it is necessary to break through just 30,000 USD. Then BTC would definitely start responding.

In conclusion

We will see in what form today’s close ends. If we see a daylight similar to yesterday’s, support will probably last in the end. Even from low time frames, everything seems to be that BTC is defending itself against another slump. As for Death Cross, I’m currently wondering if a game changer will turn out and move with the market.

ATTENTION: No data in the article is an investment board. Before you invest, do your own research and analysis, you always trade only at your own risk. Cryptheory team strongly recommends individual risk considerations!