50k $ or100k $? TOP hedge funds predict the BTC price at the end of this year

3 min read

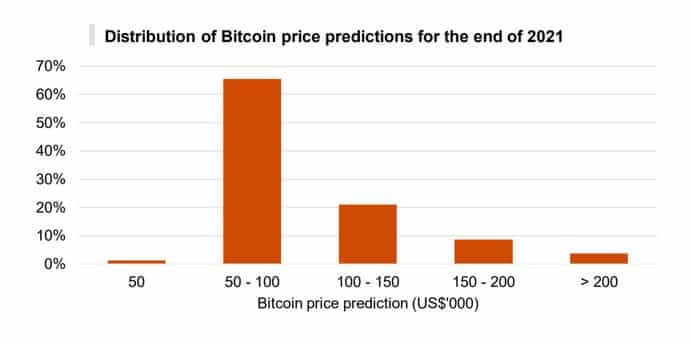

We have another positive message for cryptocurrency fans. The newly published report shows that 65% of cryptocurrency hedge funds believe that the price of BTC will be between $ 50,000 and $ 100,000 on December 31, 2021.

According to the results of a survey of cryptocurrency price predictions and cryptocurrency market capitalization, which they conducted in the first quarter of 2021 Elwood Asset Management and PWC’s cryptocurrency team, which was published in Q2 2021, look very promising. Out of a total of 55 cryptocurrency funds, most were optimistic and expected to reach the April peak of $ 65,000.

There is a bullish mood about BTC

Most of the predictions where the price of BTC will move at the end of the year were within range $ 50,000 to $ 100,000, while 21% of respondents said the price would exceed $ 100,000 to stop just under $ 150,000. 4% of respondents then said that the price would exceed $ 200,000. Less than 1 percent of respondents think that BTC will be below $ 50,000 at the end of the year.

According to the published results, then 56% of funds reported trading at least half of their daily cryptocurrent volume trading with BTC. Other top cryptocurrencies on the list include Ehereum (67%), Litecoin (34%), Chainlink (30%), Polkadot (28%) and AAVE (27%).

Most cryptocurrency fund managers also commented positively on the overall direction of the market capitalization of cryptocurrencies, with the vast majority of respondents saying that the market capitalization of cryptocurrencies would be between $ 2-5 trillion on December 31.

Growing interest of institutions

Although up to 67% of managers cite reputational risk as one of the main challenges of investing in digital assets, 50% fear regulatory uncertainty and 33% fear a lack of infrastructure, the research team has also seen an extraordinary increase in interest from institutional investors.

This growth began in 2020 and continues this year, when the volume of trading in BTC on exchanges “exploded” from hundreds of millions to billions of dollars a day. Hedge fund officials also said they were ready to take advantage of “mistakes and arbitrage opportunities” as exchanges offer increasingly sophisticated products to meet growing demand.

The published results also show that two-thirds of hedge funds (which responded) are exposed to digital assets through either futures or options trading.

Other interesting results show that 57 percent of respondents appreciate that digital assets offer them the diversification of their portfolios. Nearly a third (29%) said that the main attraction for their investment was “exposure to a new value-creating ecosystem”, while 14% believe that investing in digital assets is a good hedge against inflation.

Conclusion

We leave the conclusion to the creators of this report. According to him, the exponential growth of cryptocurrency hedge funds can be expected to continue.

“We expect this number to grow as individuals continue to gain more experience in this specialized area and the funds increasingly seek to hire individuals with deep experience in cryptocurrency and blockchain. […] This is likely to give funds a competitive advantage and a better understanding of a rapidly changing and complex market. “

So maybe we have something to look forward to.

Top alternative exchanges for Binance without KYC verification