$7 million ‘liquidated’ after BTC drops $1,000 in 30 minutes

2 min readBTC fell $1,000 this morning in a sudden drop, taking along with the rest of the crypto and racking up $7 million in ‘liquidations,’ data from several sources shows.

‘Liquidations,’ for the uninitiated, occur when leveraged positions are automatically closed out by exchanges/brokerages as a “safety mechanism.” Futures and margin traders—who borrow capital from exchanges (usually in multiples) to place bigger bets—put up a small collateral amount before placing a trade.

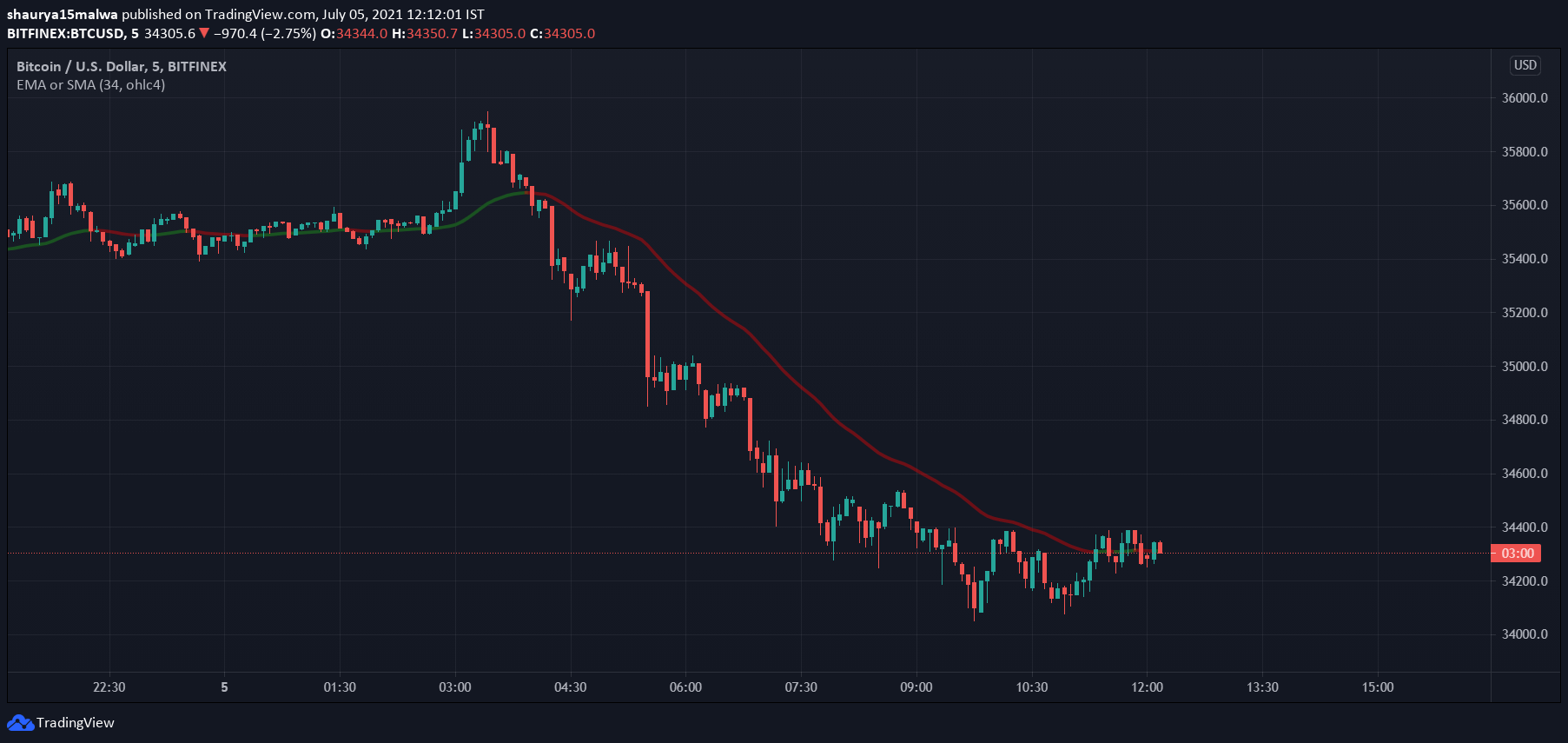

The move followed a choppy weekend market, which saw the asset range between the $33,000 and $35,500 price zones. This morning, however, BTC saw clear rejection at the $35,500 zone, dropping over $1,000 in just 30 minutes.

As the below chart shows, buyers stepped in at the $34,000 level, causing the plunge to temporarily pause. Still, BTC trades under its 34 period moving average—a tool used by traders to determine market trends using historic prices—at press time, indicating further downside for the next few hours.

Long traders pay the crypto price

As such, the downward move saw other cryptocurrencies fall alongside BTC, costing ‘long’ traders over $7 million. As per data analytics tool Bybt, over 89% of all futures traders were in ‘long’ positions (or betting on higher prices), losing over $7.69 million in all.

$3.6 million of long liquidations happened on futures powerhouse Bybit. OKEx and Binance followed with $1.45 million and $1.28 million in liquidations respectively.

BTC recorded the highest amount in liquidations with $4.2 million, followed by ETH liquidations at $2.5 million and XRP liquidations at $614,000.

11% of ‘short’ traders were liquidated as well, with $914,000 lost to the move (while short traders bet on falling prices, they may have used higher leverage that resulted in even them getting liquidated).

Meanwhile, the plunge further shows that while BTC’s recent adoption (or consideration) as money in some nations provides for a shifting narrative, it remains a highly volatile asset class that’s still in its nascency.

The post $7 million ‘liquidated’ after BTC drops $1,000 in 30 minutes appeared first on CryptoSlate.

![Decentraland: Review & Beginner's Guide [current_date format=Y] 19 Decentraland: Review & Beginner's Guide](https://cryptheory.org/wp-content/uploads/2020/11/decentraland-02-gID_7-300x150.jpg)