Countries representing more than 90% of global GDP are exploring the central bank’s digital currency

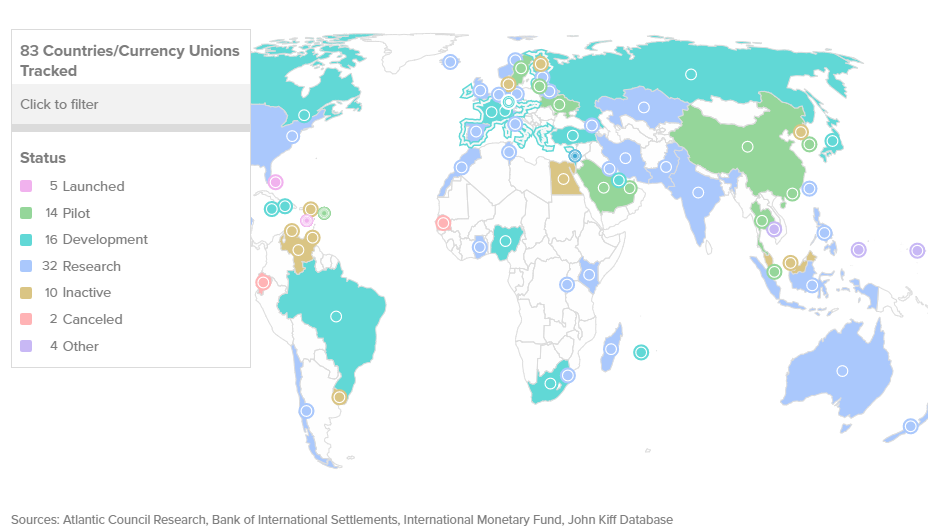

2 min readEfforts to understand the opportunities, challenges and challenges for the central bank’s digital currency are under way in 81 countries, with five countries fully implementing the digital version of their currency, according to a new tracker on the Atlantic Council website.

81 countries are involved in the development of the central bank’s digital currency

The Caribbean is home to all five CBDCs currently in use, with the Bahamas, Saint Kitts and Nevis, Antigua and Barbuda, Saint Lucia and Grenada already implementing their digital cash systems.

CBDCs are in a pilot phase in 14 other countries, including South Korea and Sweden, the tracker shows.

The Atlantic Council, founded in 1961, is called an independent organization. The CBDC tracker, launched on July 22, currently tracks 83 countries and monetary unions.

Of the countries with the four largest central banks – the United States Federal Reserve, the European Central Bank, the Bank of Japan and the Bank of England – the United States is the most remote in terms of CBDC development.

The Federal Reserve has been researching the CBDC for several years, and President Jerome Powell said in January that the development of digital dollars was a “very high priority” in the fight against financial crime. Fed President John Williams, meanwhile, believes that the emergence of cryptocurrencies raises challenging questions for central banks.

China recently said that foreign visitors will be able to use digital yuan during the 2022 Winter Olympics – provided they share information about their passports with the central bank. A group of U.S. senators that includes a supporter BTC Cynthia Lummis, called on American Olympians to boycott the digital yuan. According to the South China Morning Post, Beijing responded by telling US senators to “stop making trouble.”

The People’s Bank of China claims that almost 21 million people have already opened a virtual wallet to use the digital yuan.