ADA and BCH Maintain Bullish Structures While LTC Breaks Down

3 min readCardano (ADA) has bounced at the long-term $1.05 support area, which acted as resistance in Dec. 2017.

BTC Cash (BCH) has decreased considerably since the beginning of May but has bounced at the $450 horizontal support area.

Litecoin (LTC) is decreasing towards a long-term an ascending support line.

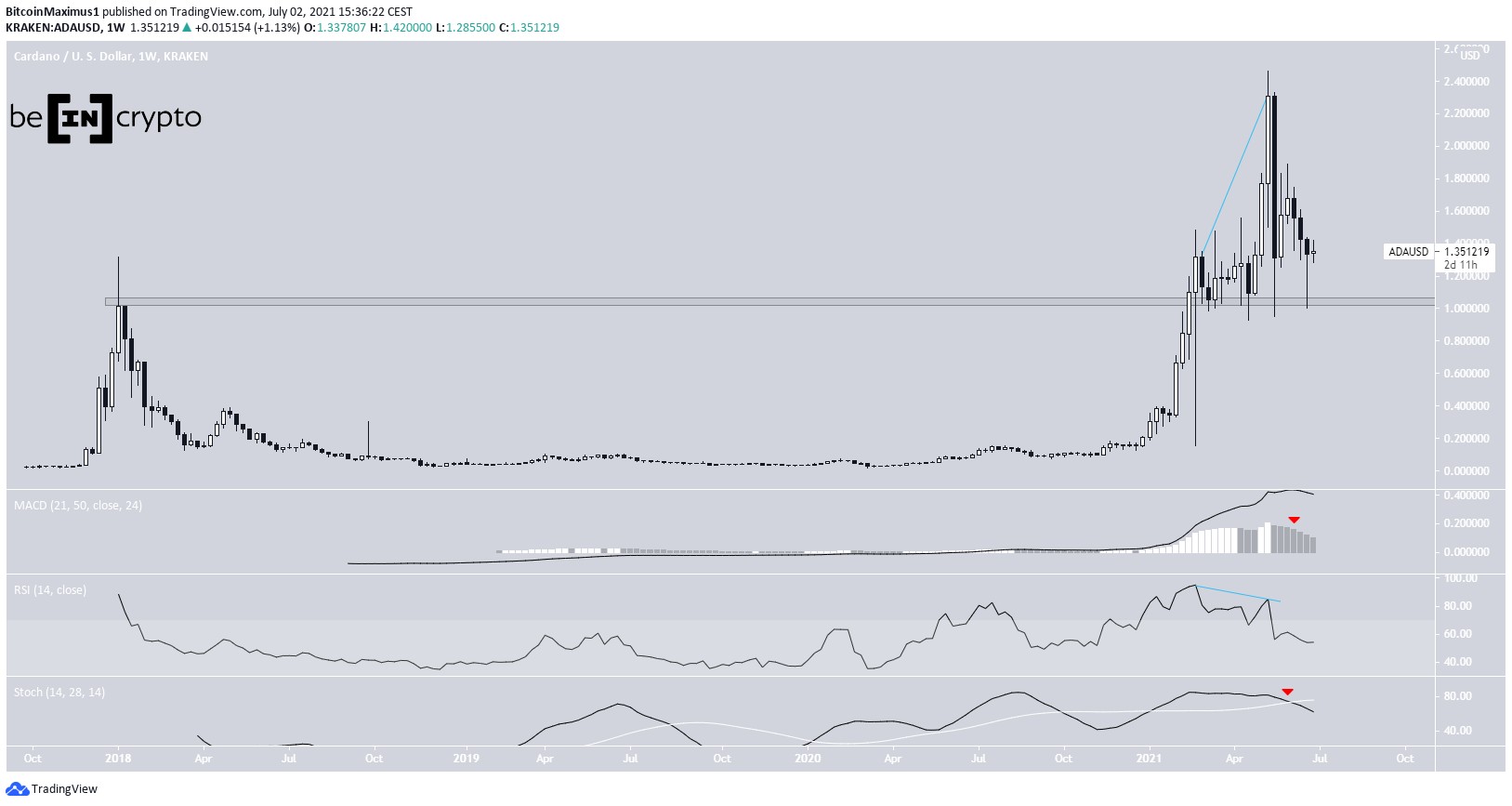

ADA

ADA has been decreasing since May 16, when it reached an all-time high price of $2.46. The decrease was sharp and led to a low of $0.95 three days later. The decrease was preceded by significant bearish divergence in the RSI.

ADA bounced immediately afterwards, validating the $1.05 area as support. The same area has acted as resistance during the previous all-time high on Dec. 2019.

While technical indicators are bearish, as evidenced by the bearish reversal signal in the MACD and bearish cross in the Stochastic oscillator, the bullish structure remains intact as long as the token is trading above the $1.05 horizontal support area.

The ADA/BTC pair is not as bearish as its USD counterpart.

While there is an ongoing downwards movement since May 16, the token seems to be trading inside a symmetrical triangle, which is considered a neutral pattern. In addition to this, the pattern is coming after an upward movement, thus a breakout would be more likely.

Furthermore, technical indicators are giving some bullish signs. The MACD has given a bullish reversal signal, the Stochastic oscillator has made a bullish cross and the RSI is moving above 50.

Highlights

- ADA/USD has bounced at the $1.05 horizontal support area

- ADA/BTC is trading inside a symmetrical triangle.

BCH

BCH has been decreasing since reaching a high of $1,644 on May 12. The decrease was sharp, and a low of $378 was reached seven days later.

The low and ensuing bounce validated the $450 horizontal area as support. Previously, BCH had accumulated below this level for 581 days.

Similarly to ADA, technical indicators are bearish. However, the bullish structure remains intact as long as BCH is trading above this horizontal level.

Unlike ADA, the BCH/BTC pair looks more bearish than the USD one.

While the token has been increasing since an all-time low of ₿0.0085 in March, the ensuing bounce failed to clear the ₿0.026 resistance area, which previously acted as support.

Despite technical indicators being relatively bullish, the trend is considered bearish as long as the token is trading below this level.

Highlights

- BCH/USD is trading above support at $450.

- BCH/BTC is trading below the ₿0.026 resistance area.

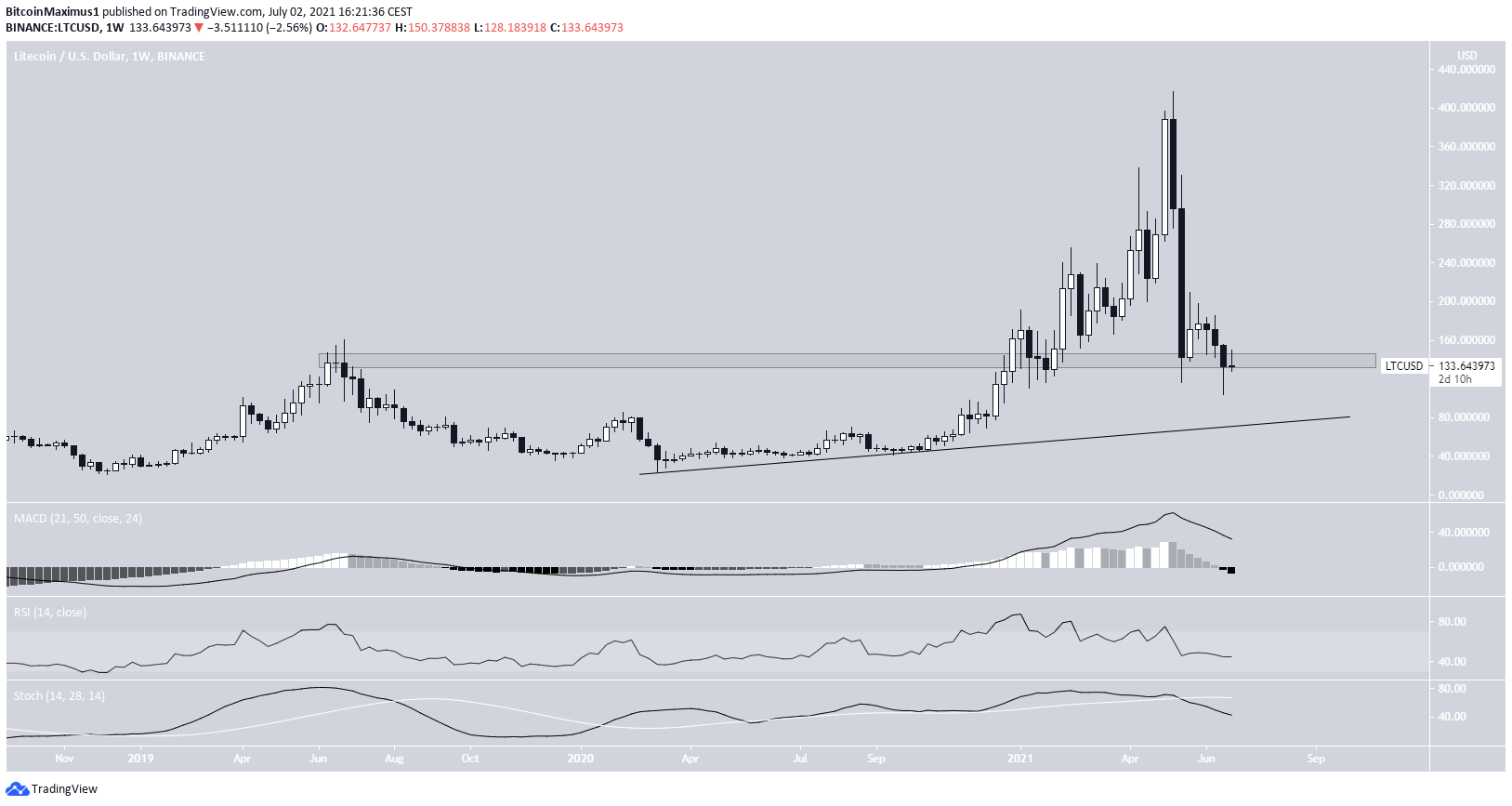

LTC

LTC reached an all-time high price of $417 on. However, it dropped immediately afterwards and has failed to find support since.

It is currently in the process of breaking down from the $140 horizontal support area.

Technical indicators are bearish, and a breakdown could take LTC to the long-term ascending support line at $80.

LTC/BTC has been following a descending resistance line since April 2019.

Most recently, it made an unsuccessful attempt at breaking out (red icon) in May 2019.

Technical indicators are relatively neutral.

Until LTC breaks out from this line, the trend cannot be considered bullish.

Highlights

- LTC/USD is breaking down below the $140 horizontal support area.

- LTC/BTC is following a descending resistance line.

For BeInCrypto’s latest BTC (BTC) analysis, click here.

The post ADA and BCH Maintain Bullish Structures While LTC Breaks Down appeared first on BeInCrypto.

![Decentraland: Review & Beginner's Guide [current_date format=Y] 34 Decentraland: Review & Beginner's Guide](https://cryptheory.org/wp-content/uploads/2020/11/decentraland-02-gID_7-300x150.jpg)