ADA, YFI, XMR – Technical Analysis for February 17, 2021

3 min readTable of Contents

The Yearn.Finance (YFI) price has bounced at a crucial support area and is on its way towards a new all-time high price.

Both Cardano (ADA) and Monero (XMR) are facing crucial long-term resistance levels. The price action for the latter seems more bullish, making a breakout more likely.

Cardano (ADA)

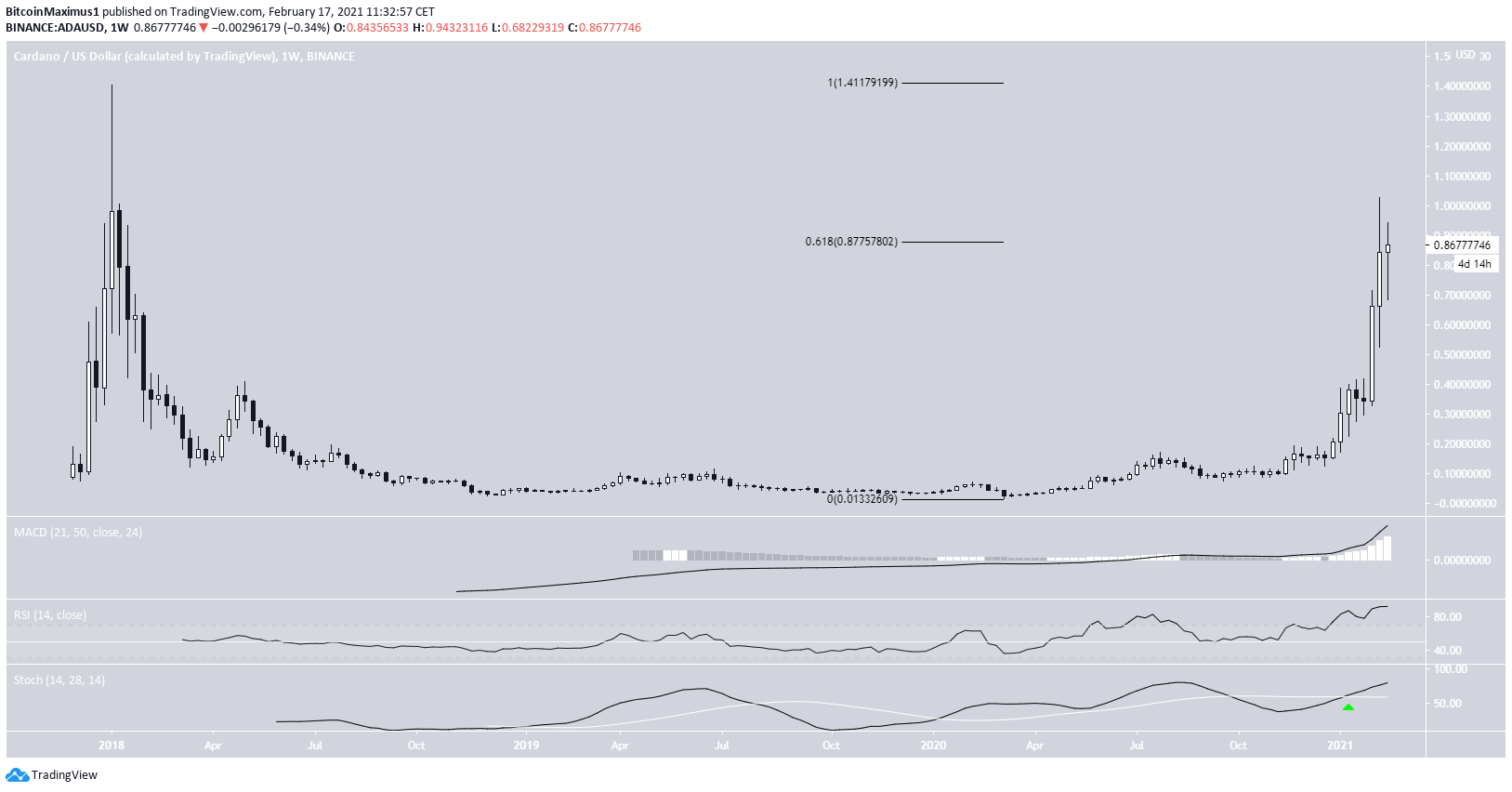

ADA has been increasing rapidly since the beginning of February when it was trading at $0.33. Currently, it’s trading at $0.86 after reaching a high of $1.02 on Feb. 10.

The failure to move above $0.87 is especially important since the area is the 0.618 Fib retracement level measuring from the all-time high price of $1.41.

If ADA is successful in moving above it, there is virtually no resistance until the aforementioned all-time high price.

The MACD, RSI, and Stochastic oscillator are increasing. The latter has just made a bullish cross.

Therefore, it’s likely that ADA eventually breaks out above this level and continues towards a new all-time high price.

The two-hour chart shows that ADA is following a descending resistance line, and has bene doing so since reaching the aforementioned $1.02 high.

While technical indicators are bullish, as evidenced by the positive MACD and the RSI cross above 50, we cannot consider the trend bullish until ADA breaks out above this resistance line.

Highlights

- Cardano is following a short-term descending resistance line.

- There is long-term resistance at $0.87.

Yearn Finance (YFI)

YFI reached an all-time high price of $52,880 on Feb. 12 but has been decreasing since.

After the high, YFI returned to the previous breakout level at $39,500, validated it as support, and has been moving upwards since.

Despite showing a loss of momentum, technical indicators are still bullish. They suggest that YFI is likely to increase, as long as it is trading above the $39,500 support area.

The wave count suggests that YFI is in an extended wave three (white) of a bullish impulse that began on November 2020.

It’s likely that YFI has completed a 1-2/1-2 wave formation, hence the extended wave three.

A possible target for the top of the current upward move is located at $66,185, found using the 1.61 external Fib retracement of the previous downward movement.

The sub-wave count is shown in orange.

Highlights

- YFI has bounced at the $39,500 support area.

- There is resistance at $66,150.

Monero (XMR)

The weekly chart shows that XMR has been increasing rapidly over the past two weeks. However, it is currently struggling to move above the $250 resistance area. This is the 0.5 Fib retracement level of the entire downward move, measuring from the all-time high price of $477.

If successful in moving above this area, XMR would likely find resistance at $380 (0.786 Fib retracement and horizontal resistance area).

Despite the lack of a bullish cross in the Stochastic oscillator, technical indicators are still bullish, supporting the breakout possibility.

The two-hour chart supports this possibility. The chart shows a breakout from a symmetrical triangle reclaiming the previous minor resistance area at $244.

Therefore, XMR is expected to move above the long-term $250 area and gradually increase towards $380.

Highlights

- XMR has broken out from a short-term symmetrical triangle.

- It’s facing resistance at $250.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here

The post ADA, YFI, XMR – Technical Analysis for February 17, 2021 appeared first on BeInCrypto.

![Decentraland: Review & Beginner's Guide [current_date format=Y] 34 Decentraland: Review & Beginner's Guide](https://cryptheory.org/wp-content/uploads/2020/11/decentraland-02-gID_7-300x150.jpg)