Bitcoin Adds $2,600 to Close a Massive Bullish Week

2 min readTable of Contents

Bitcoin (BTC) increased considerably during the week of Nov 15-22, nearly reaching a new all-time high price.

As long as the current support structure holds, BTC is expected to make another attempt at overtaking its all-time high levels.

Bitcoin Nears All-Time High

During the week of Nov 15-22, the BTC price increased considerably, creating a bullish candlestick with an open and close of $15,935 and $18,575 respectively. This made for an increase of slightly more than $2,600.

The price is approaching the primary resistance area of $19,645, near the all-time high price reached in December 2017.

Technical indicators in the weekly time-frame suggest that the rally is overbought, but do not yet show any clear signs of weakness due to the lack of a bearish divergence.

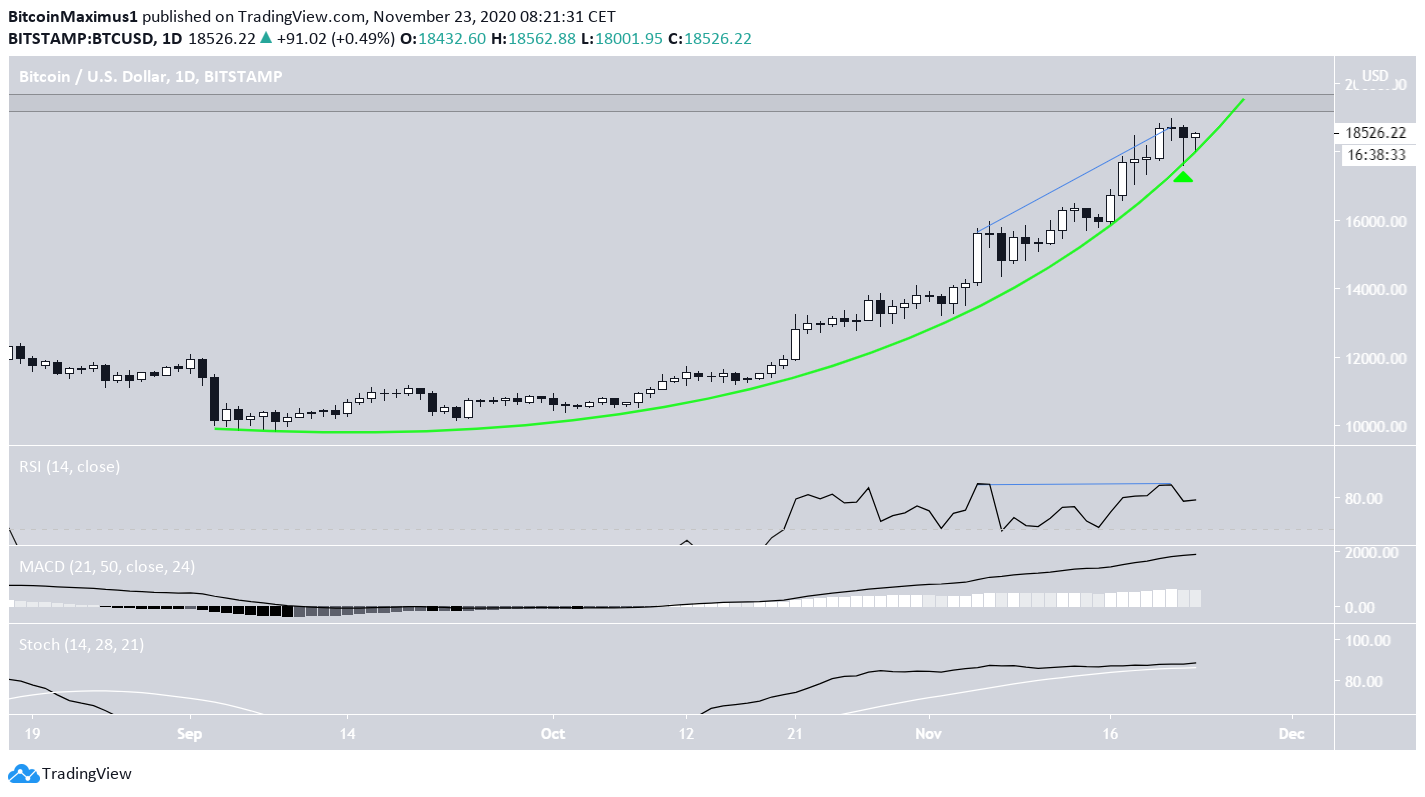

Parabolic Support

The daily time-frame shows that BTC has been following a parabolic ascending support line since September.

Yesterday, the price created a hammer candlestick that served to validate the line as support before moving higher. The long lower wick is a sign of buying pressure.

Technical indicators show a similarly overbought trend and the RSI has even generated a considerable bearish divergence. However, the MACD has not yet done so and the Stochastic oscillator has yet to make a bearish cross, suggesting that the upward move could continue as long as the support line holds.

Short-Term Range

The two-hour chart shows a trading range between $17,600-$18,600. While the price was initially rejected by the resistance area, it created a very long lower wick once it reached support, and followed that with the creation of a higher low (shown in black arrows below).

In addition, the price appears to be stuck under a descending resistance line.

A breakout and retest of this resistance area would likely indicate that the trend is bullish and that BTC is indeed heading towards the all-time high resistance area at $19,450.

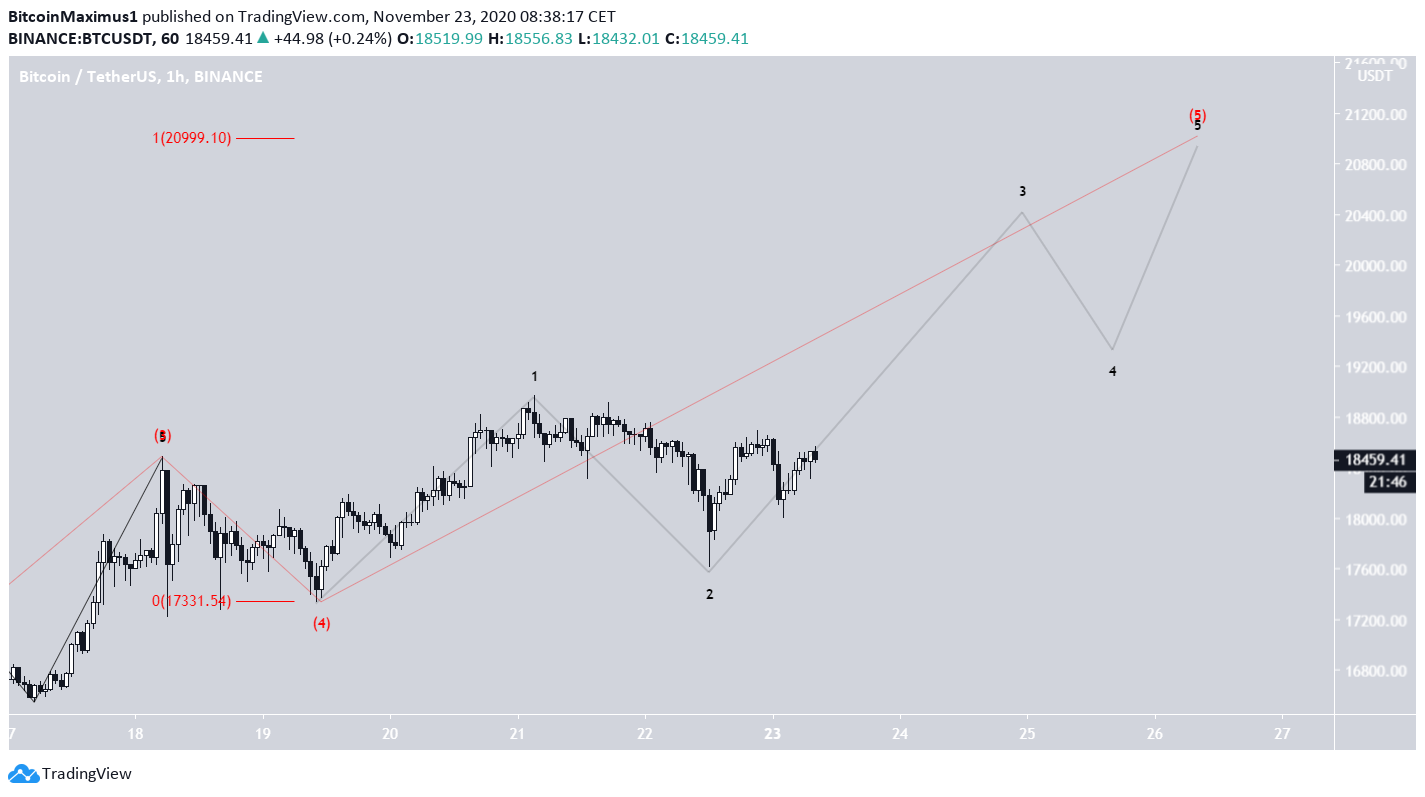

Wave Count

The most likely wave count for BTC suggests that the price is in the fifth-and-final minor sub-wave (red) of the fifth sub-wave (orange) of a long-term bullish impulse that began in March.

A possible target for the upward move to end would be between $20,859-$20,999, the 3.61 Fib extension level of minor sub-wave 1 and the projection of the lengths of minor sub-waves 1-3.

If the move transpires as expected, the even shorter-term count would likely resemble the one presented in the chart below:

Conclusion

The BTC price is expected to continue increasing until it reached the all-time high resistance area of $19,450, and could possibly go a little higher.

For BeInCrypto’s previous Bitcoin analysis, click here!

Disclaimer: Cryptocurrency trading carries a high level of risk and may not be suitable for all investors. The views expressed in this article do not reflect those of BeInCrypto

The post Bitcoin Adds $2,600 to Close a Massive Bullish Week appeared first on BeInCrypto.

![Decentraland: Review & Beginner's Guide [current_date format=Y] 31 Decentraland: Review & Beginner's Guide](https://cryptheory.org/wp-content/uploads/2020/11/decentraland-02-gID_7-300x150.jpg)