Bitcoin analysis – Where the BTC correction must end

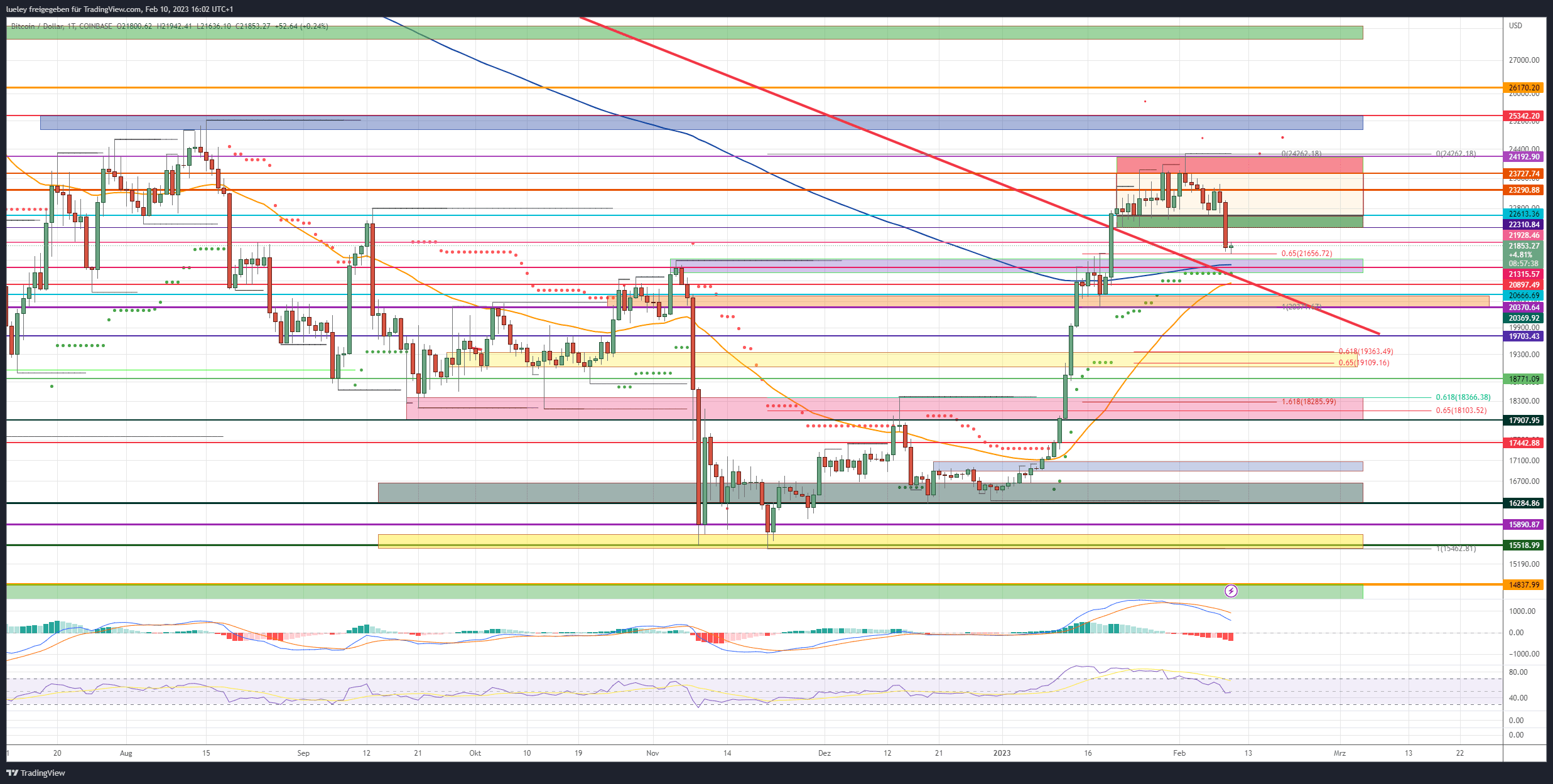

3 min readAfter the Bitcoin price increased by around 40 percent in the last five trading weeks, the bulls ran out of breath for the time being. At its peak, the crypto key currency rose to the resistance of $24,192, but was unable to overcome this price mark and fell back into the trading range between $22,613 and $23,727. In the last few trading days, Bitcoin finally followed the corrective movement of the US stock indices again. Continued strength in the US Dollar Index (DXY) also gave bulls headwinds this week.

Yesterday, Thursday, February 9, crypto exchange Kraken’s staking service announcement caused a bang in the market. As a result, the BTC price slipped dynamically below the prominent support at $22,310. As mentioned in the previous price analysis, the bearish divergence in the daily chart that has existed for weeks unfolded its power and additionally increased the selling pressure on Bitcoin.

Despite the ongoing course correction, the overarching Bitcoin targets remain unchanged.

- Bullish price targets: $21,928. 22,310/22,499 $22,755, $23,290, 23,727 $24,192, $24,925, $25,170/$25,342, $26,170

Bitcoin: Bullish price targets for the coming trading weeks

After the dynamic drop below the green support zone in the last three trading weeks, the BTC price slipped right down to the golden pocket of the current trend movement at $21,734. Bitcoin can currently stabilize here.

For the time being, Bitcoin is still trading above the multiple support area from EMA200 (blue), the historical high of November 5, 2022, the overarching red downtrend line and the supertrend. This set of support in the purple zone area of the chart represents the key support level for the bulls in the near-term. If the buy side manages to defend this area and push Bitcoin back above the green chart area between $22,310 and $22,613, this would be an important partial success. If this price reversal succeeds north, the horizontal resistance at 23,290 US dollars will come into focus.

Only when the BTC price breaks through this resist as well will the bulls make another attempt at the red resistance area between $23,727 and $24.291. In order to break through this recently insurmountable resist zone, Bitcoin must dynamically break out to the north at the daily closing price. Only then can the bulls hope for a march through towards the relevant resistance area between USD 24,925 and USD 25,342. This is where the high from August of the previous year runs. If the breakout above the highs from the summer of 2022 is successful, a direct subsequent increase up to the 161 Fibonacci extension in the area of 26,200 US dollars is to be planned.

- Bearish Targets: $21,656, $21,315, $20,897, 20,666 $20,370, $19,703, $19,363/$19,015. $18,343

Bearish bitcoin price targets

In the short term, the bearish scenario of a top formation that has been outlined several times seems to be coming true. If the BTC price dips into the purple support area in a timely manner, a directional decision can be expected in the coming weeks. If this zone is abandoned by the bull camp and Bitcoin falls back below the EMA200 and the underlying red downtrend line, the bears will do everything in their power to push Bitcoin price below the EMA50 (orange) at $20,897 towards the orange support area.

The next relevant support area lies between $20,666 and $20,370. It would be conceivable to briefly fall below this area to trigger stop-loss orders from the bulls and tap into liquidity there before a new move north is initiated.

Correction threatens to widen

However, if the bears stay in charge and Bitcoin slips below the orange zone by the end of the day, the next price target is $19,703. However, this support should only last for a short time. A dip to the yellow support area between $19,363 and $19,015 is more likely. With the golden pocket of the correction movement starting from the high for the year in combination with a so-called high-volume node, the bulls will start a countermovement here again. This zone therefore represents the next relevant price target for the bears.

The maximum price target for the coming weeks is found around the January 12 breakout level. With the 61 Fibonacci retracement of the entire route from the low to the annual high as well as the 161 Fibonacci extension of the current price movement, this zone represents the optimal area for new, higher-level long entries. However, the BTC price should rise after dipping into the pink Zone quickly recover back above $18,366 to the north. Otherwise, the bullish market momentum threatens to topple. This would most likely result in a relapse to the low of 2022 or even below.