Bitcoin Continues Ascent, Invalidating Numerous Divergences

2 min readTable of Contents

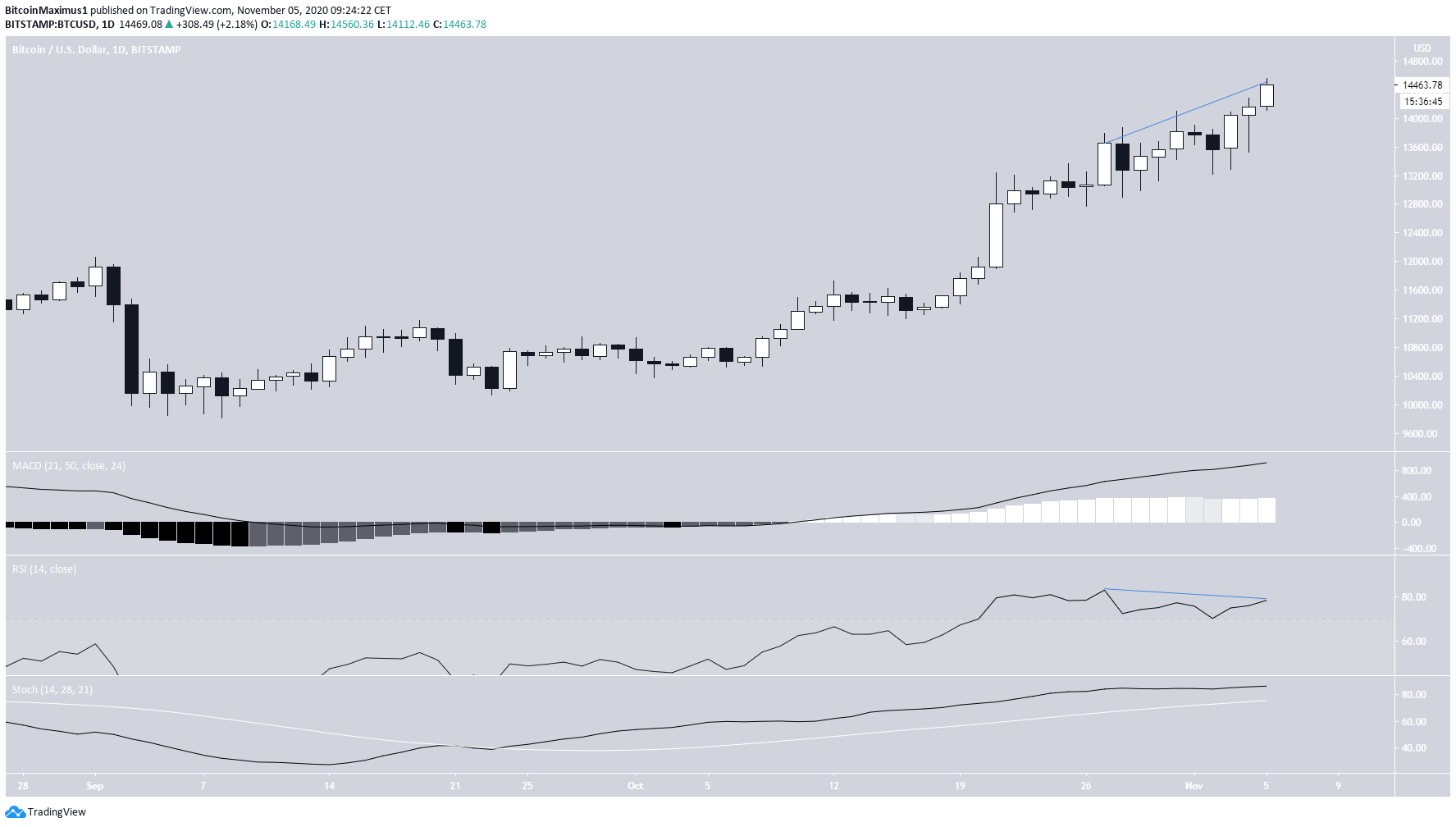

The Bitcoin (BTC) price has continued its ascent by creating yet another bullish candlestick on Nov 4.

The movement has invalidated numerous bearish divergences, and the price seems to be targeting a long-term resistance level.

Bitcoin’s Ongoing Increase

Yesterday, the BTC price created another bullish candlestick and resumed its upward movement, thus far reaching a local top at $14,560.

Despite the developing bearish divergence in the RSI, which is in overbought territory, neither the MACD nor the Stochastic Oscillator are showing signs of weakness. This indicates that the bullish momentum is expected to continue.

The closest resistance level is found near $16,120, which is the 0.786 Fib level of the entire previous downward move (from the Dec 2017 high).

Weekly technical indicators do not give any clear signs of weakness, therefore the price is expected to continue moving upwards in the medium and long-term.

Current Movement

Despite the ongoing increase, the price has still failed to break out above the parallel ascending channel that has been in place since Oct 28. If BTC manages to break out above this channel, the upward move would likely be steep.

Similar to the weekly and daily time-frames, there is no clear weakness visible. Despite this, a rejection from the resistance line of the channel could cause a short-term dip towards the middle of the channel near $14,000.

Wave Count

As for the wave count, it is likely that BTC just completed wave 4 (shown in orange below) of an impulse that began on Sept 7. If this is correct, then Bitcoin appears to have begun wave 5 yesterday.

The most likely target for the top of wave 5 is found between $16,000 and $16,300. This range was found by using fib extensions of waves 1 and 3 and projecting the length of waves 1-3 to the bottom of wave 4. This also fits with the previously outlined long-term resistance area.

Invalidation of this scenario would occur if BTC drops below the wave 4 low of $13,520. This would not invalidate the entire bullish formation per se, but would rather suggest that wave 4 has not yet ended. The targets for wave 5 would still remain the same.

Conclusion

To conclude, while short-term decreases could occur, the Bitcoin price is expected to eventually reach the next resistance area near $16,100.

For BeInCrypto’s previous Bitcoin analysis, click here!

Disclaimer: Cryptocurrency trading carries a high level of risk and may not be suitable for all investors. The views expressed in this article do not reflect those of BeInCrypto.

The post Bitcoin Continues Ascent, Invalidating Numerous Divergences appeared first on BeInCrypto.

![Decentraland: Review & Beginner's Guide [current_date format=Y] 28 Decentraland: Review & Beginner's Guide](https://cryptheory.org/wp-content/uploads/2020/11/decentraland-02-gID_7-300x150.jpg)