Bitcoin Surges Past $50K – Should You Wait to Buy the Dip?

7 min readTable of Contents

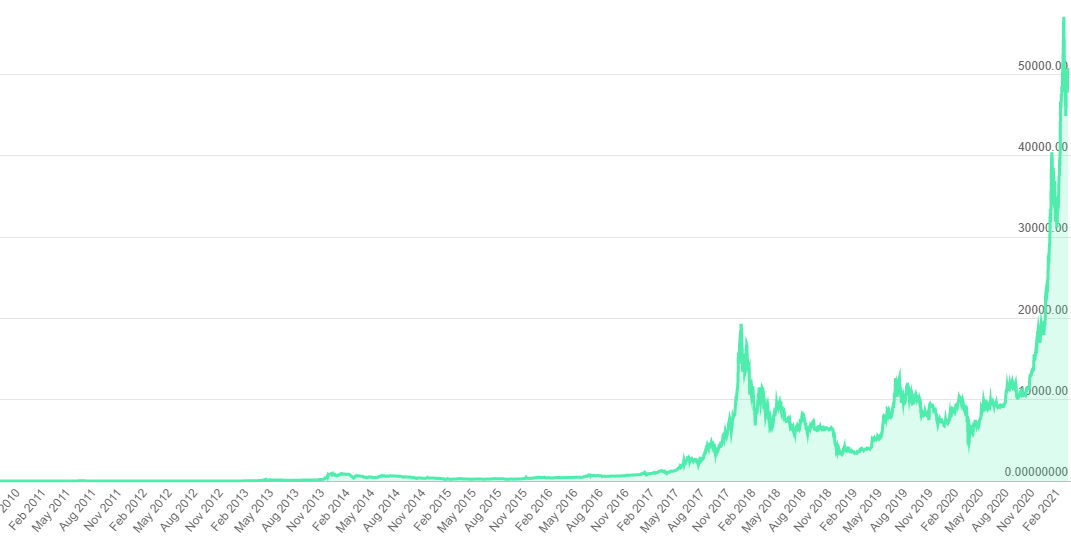

Feb 2021 was indeed big for the Bitcoin community worldwide. For the first time in its decade-long history, the alpha-crypto broke through the landmark figure of $50,000. And not stopping there, it relentlessly smashed through one high after another to score an all-time high of $58,352 on Feb 21.

As of press time, the BTC/USD pair has surged more than 300% over the past three months, and nearly 14x since March 2020. Amid this phenomenal growth, a frequently asked question we are coming across more than ever is – sce

“What price should I buy at?“

This is precisely the question we’ll be trying to address today with this analysis of the various market forces currently at play. While at that, we’ll also quickly discuss how you can buy bitcoin safely using debit and credit cards, among other payment options.

Bitcoin Investment in 2021: Should You Wait for the Dip?

For a relatively volatile asset that has been around for just over a decade, long-term investments are widely considered the safest way to dip your toes in the bitcoin market, or crypto in general. By long-term, we mean 5-10 years into the future — or perhaps even more if you are so inclined.

And that brings us to the key point that timing often means very little while you’re investing long-term in an asset such as bitcoin. Unless of course, there are major macro events such as the COVID-induced dip of March 2020 at play.

That is so because based on historic data, BTC has always delivered lofty returns over the long haul despite sharp dips in the short- to-medium-term.

To be able to perfectly time your purchases to coincide with a major dip is often a matter of pure luck. After all, nobody can predict when a dip is going to happen, or for that matter, if it is going to happen at all near the current price point.

Also, to make sizable profits from buying the dip, you will have to have loads of spare capital at your disposal when the BTC/USD pair drops significantly.

If choosing a particular entry point has been a headache for you, you could always start investing a fixed amount periodically — for example, every alternate week or so. Many investors take this approach to smoothen out the negative impact of drastic price swings.

Note, however, that this approach may not work quite well if bitcoin suddenly embarks on a major rally in the meantime.

Time to Jump in?

Just to be clear upfront, bitcoin investments, just like any other investment, carry a certain degree of risk that you should be aware of before making any big decision. Do your due diligence and consult a professional, if need be.

That said, if you focus on the market even from a neutral standpoint, you will see that there are several factors at play that collectively paint a bullish picture for bitcoin in the medium-to-long run.

Let’s quickly go through some of these factors one by one.

The Stock-to-flow Model Could be at Play

So far, nearly nine months into Halving 2020, Bitcoin is closely following the Stock-to-flow (S2F) model.

Granted, there are some valid criticisms against bitcoin’s S2F model that we have covered from time to time. However, that doesn’t change the fact that so far it has done a neat job explaining the major bull runs that followed all of the previous bitcoin halvings.

For those out of the loop, here is BeinCrypto’s detailed guide to bitcoin halving.

In short, halvings are a native feature in the bitcoin network that, along with bitcoin’s fixed maximum supply of 21 million coins, makes it an inherently deflationary currency.

The S2F model, which is based on the demand and scarcity of a particular asset, taps into that to predict that the demand for the alpha-crypto will keep on increasing at a very steep rate, which in turn, will lead to a massive surge in the asset’s price within a relatively short period.

In fact, if we are to follow the S2F model as it is, the BTC/USD pair is likely to hit six figures by the end of this year. That’s admittedly an ultra-bullish projection, albeit one that’s appearing increasingly plausible to many based on how the BTC price has spiked phenomenally since the start of 2021.

Hodlers Hoarding is a Good Sign

As of Jan 2021, more than 60% of the total BTC supply had not moved in over a year. That, in itself, is a pretty bullish indicator suggesting that a growing number of investors are certain about bitcoin’s long-term prospects.

This also indicates that bitcoin is increasingly being perceived by many investors — retail and institutional alike – as a safe hedge against inflation.

This is particularly true in the COVID-hit global economy where central banks in many major economies including the US adopted questionable policies such as injecting massive amounts of newly minted money into the system — sometimes to the tune of $60 million a minute, as we have seen in the case of the US Federal Reserve.

On a related note, a new report has emerged this week claiming that the amount of Bitcoin held across all exchanges continues to decline. This clearly shows that long-term holders are holding their positions undeterred whereas institutional investors are buying in, further straining supply.

As you would imagine, that’s a dream come true scenario in the making if you are a proponent of the S2F model.

Institutional Investors are the Key Now

Through much of its decade-long history, bitcoin’s rise was primarily driven by retail investors, with little to no contribution coming from their counterparts at Wall Street. That’s changing now in a big way.

Tesla, for example, confirmed in early Feb that it had invested an aggregate of $1.5 billion in BTC. Within 24 hours of that announcement, the BTC/USD pair surged more than 26% and started inching towards the $50k milestone.

That pretty much shows the scale of the impact these big players have on the crypto ecosystem. And Tesla is not the only one. The likes of PayPal, MicroStrategy, Cash App, and Revolut, among others, have played a major role in driving Bitcoin’s high demand over the past few months.

Big money from institutional investors works well for the BTC ecosystem in two ways.

First, the massive purchasing power these investors bring along adds to the overall stability of the market. And then, the growing interest from institutional investors underlines the fact that the market is now a lot more matured.

That, in turn, acts as a feedback loop by bringing in even more awareness, interest, and fresh capital to the market.

With all of the aforementioned factors combined, it is tempting to argue that the odds of the current bitcoin rally continuing deep into 2021 are getting progressively higher at this juncture.

3 Common Ways to Buy Bitcoin in 2021

You can purchase bitcoin from many different sources using a variety of payment methods. In the end, it all depends on your preference. For example,

Bitcoin ATMs

Bitcoin ATMs are one of the safest and most privacy-friendly ways to buy BTC. You need to have a bitcoin wallet to send your newly purchased BTC to. Other than that, it is not much different from using the run-of-the-mill ATM that you go to for withdrawing cash.

You don’t have to submit KYC or any other documents to buy from a Bitcoin ATM. However, the max amount you can purchase is relatively small and the fees can be slightly on the higher side.

Also, there are too few of them outside a select few regions in North America, Europe, and Asia.

Peer-to-peer Purchase

You can also use peer-to-peer (p2p) platforms to buy bitcoin directly from a seller. The fees are usually on the lower side on these platforms and you can use escrow services to secure your transactions. P2P platforms such as LocalBitcoin are a great way to buy or sell BTC with a decent degree of privacy.

On the flip side, you have to be always careful to avoid scammers and unreliable sellers. Also, you may end up paying a bid/offer spread just in case the BTC market is too illiquid in your country.

Crypto Exchanges

Exchanges are by far one of the easiest and most popular avenues to buy Bitcoin. There are hundreds of crypto exchanges around today — each with its own set of advantages and disadvantages.

For example, popular exchanges like Coinbase usually offer enhanced security and a range of services. However, more often than not, these perks come at the cost of your profitability (due to higher fee structures) and privacy.

Ideally, you should look for an exchange that offers the optimum balance of security, privacy, a low fee structure, and quick transaction time. This is where relatively new but fast-growing exchanges like Xcoins make a difference by offering perks such as:

- Quick KYC verification.

- Robust security with a proven track record.

- Quick transaction time (15 mins or less in most cases).

- The ability to buy Bitcoin using debit and credit cards, and several other payment methods.

In conclusion, if you are new to the crypto space with little or no prior investments in the asset class, you might want to get started by buying small amounts of BTC from a trusted exchange like Xcoins.

But as always, don’t forget to do your own research first and evaluate the platforms based on its merits before making a finall call.

The post Bitcoin Surges Past $50K – Should You Wait to Buy the Dip? appeared first on BeInCrypto.

![Decentraland: Review & Beginner's Guide [current_date format=Y] 32 Decentraland: Review & Beginner's Guide](https://cryptheory.org/wp-content/uploads/2020/11/decentraland-02-gID_7-300x150.jpg)