Disproving the myth of BTC concentration in the hands of several large holders

2 min readDue to the fact that the price of BTC is around the historical maximum, today almost all holders of cryptocurrencies are in plus. As a result, public intrigue is growing around the largest holders and who will benefit from further price increases.

Is BTC really concentrated in the hands of several holders?

BTC and most cryptocurrencies in general differ from traditional financial assets in transparency. The transparency of BTC data greatly facilitates their control, and it can be seen that BTC are concentrated in the hands of a small group of early adopters or wealthy individuals. A quick look at the data shows that 18.7 million of the 18.9 million BTCs in total own 10% of BTC addresses, while 17.3 million belong to 1% of addresses. But it is very misleading, because many of the largest addresses are entities that own BTC on behalf of thousands, if not millions of individuals.

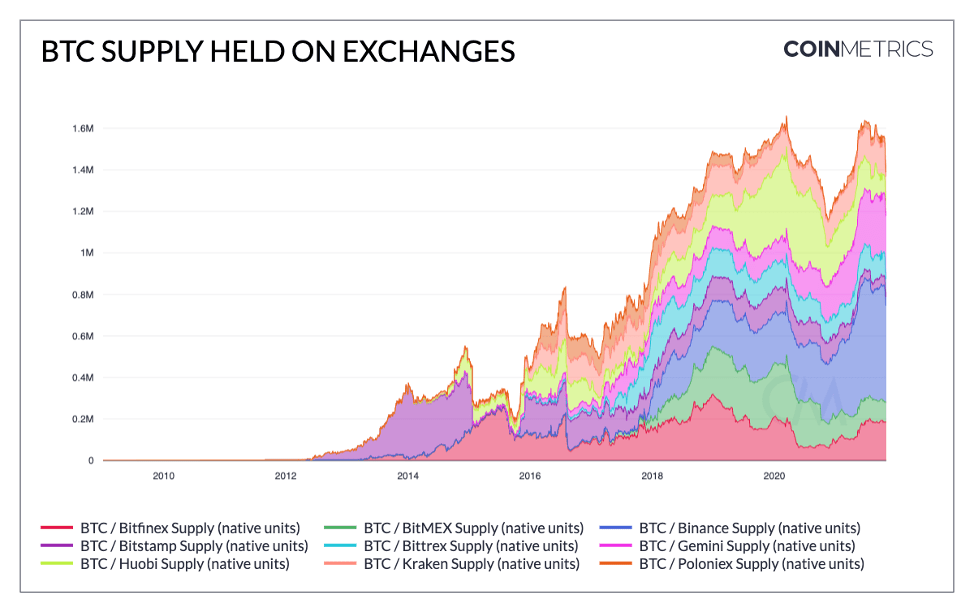

One of these entities are exchanges. Centralized exchanges maintain BTC for trading on behalf of individuals.

Currently, the major exchanges monitored hold about 1.4 million BTC, or about 7.7% of BTC’s total offering. This number is probably underestimated because services such as Coin Metrics identify addresses belonging to major exchanges. However, these exchanges control 4 of the 10 largest BTC addresses, including the two largest addresses owned by Binance, which hold a total of 465,000 BTCs in their wallets.

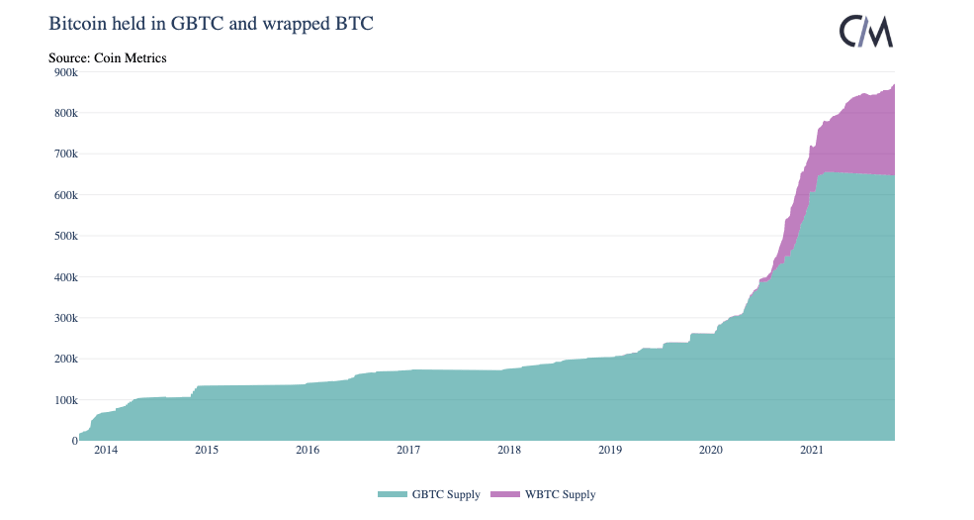

In addition to exchanges, there are other institutional entities that store large amounts of BTC and can also look like ordinary whales. BTC trusts are funds held and managed by BTC on behalf of other individuals. The largest trust in terms of assets under management to date is the Greyscale BTC Trust (GBTC), which holds 647,000 BTC (3.5% of the total supply).

source: coinmetrics

source: coinmetricsIn addition to trusts, there are at least 225,000 BTC in the smart contract (WBTC) that can be used in the ETH ecosystem. WBTC owns 41k ETH addresses. Other custody solutions include sidechains such as Liquid and entities operating custody services on the Lightning Network.

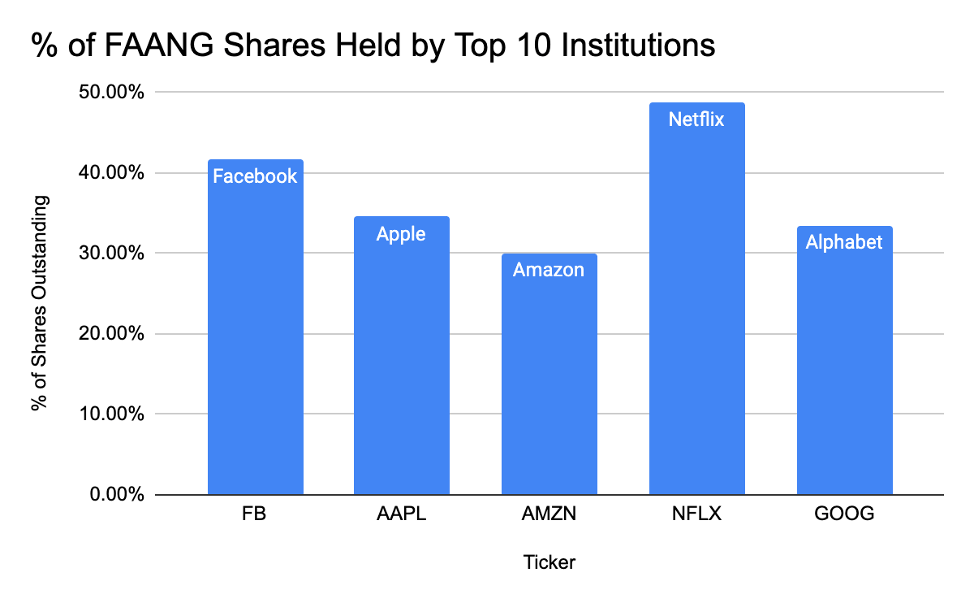

It is worth noting that BTC is far from the only financial asset that seems to be concentrated because of the trustees. Although the data is updated less frequently and contains less detail, US stocks look similar. The institution holds a significant portion of the shares on behalf of others.

For example, the 10 largest financial institutions have a 30-50% share of the total volume of FAANG stocks outstanding as of Q2 2021. But millions of investors can invest in these institutions through investment vehicles such as ETFs.

source: Nasdaq

source: NasdaqIn addition to large holders and network entities, 2.3 million BTCs (12% of supply) are held by inactive market veterans who have been inactive since 2012 or earlier.