BTC, ETH, XRP, WAVES, EOS, TRX, ANT: Price Analysis February 23

4 min readTable of Contents

Bitcoin (BTC), Ethereum (ETH), and Waves (WAVES) have dropped considerably since their all-time highs but have found temporary support and could potentially be in the process of bouncing.

XRP (XRP), EOS (EOS), and Tron (TRX) are in the process of bouncing after validating the previous breakout level.

Aragon (ANT) has bounced at a minor support area, but technical indicators have turned bearish.

Bitcoin (BTC)

BTC has been decreasing since reaching an all-time high price of $58,352 on Feb. 21. The decline has been swift, and so far, BTC has reached a low of $44,892, doing so on Feb. 23.

Since the low, BTC has created a bullish engulfing candlestick and bounced near the $45,400 support level, which is both a horizontal support area and the 0.5 Fib retracement level of the most recent decline.

While technical indicators do not yet confirm the trend reversal, the RSI is extremely oversold, increasing the possibility of a bounce.

A breakdown below the $45,400 support area could be the catalyst for a considerable price decline due to the lack of support until the mid $30,000s.

Ethereum (ETH)

Like BTC, ETH has also been falling since its all-time high price of $2,042 on Feb. 20.

Currently, ETH is in the process of retesting the $1,400 support area, a level that previously acted as the all-time high resistance back in 2018. This is a bullish retest, and the current candlestick is in the process of creating a long lower wick, a sign of buying pressure.

However, technical indicators are decisively bearish since the MACD histogram has crossed into negative territory, the RSI has crossed below 50, and the Stochastic Oscillator is forming a bearish cross.

Therefore, due to conflicting signs, more information is required to determine its future trend.

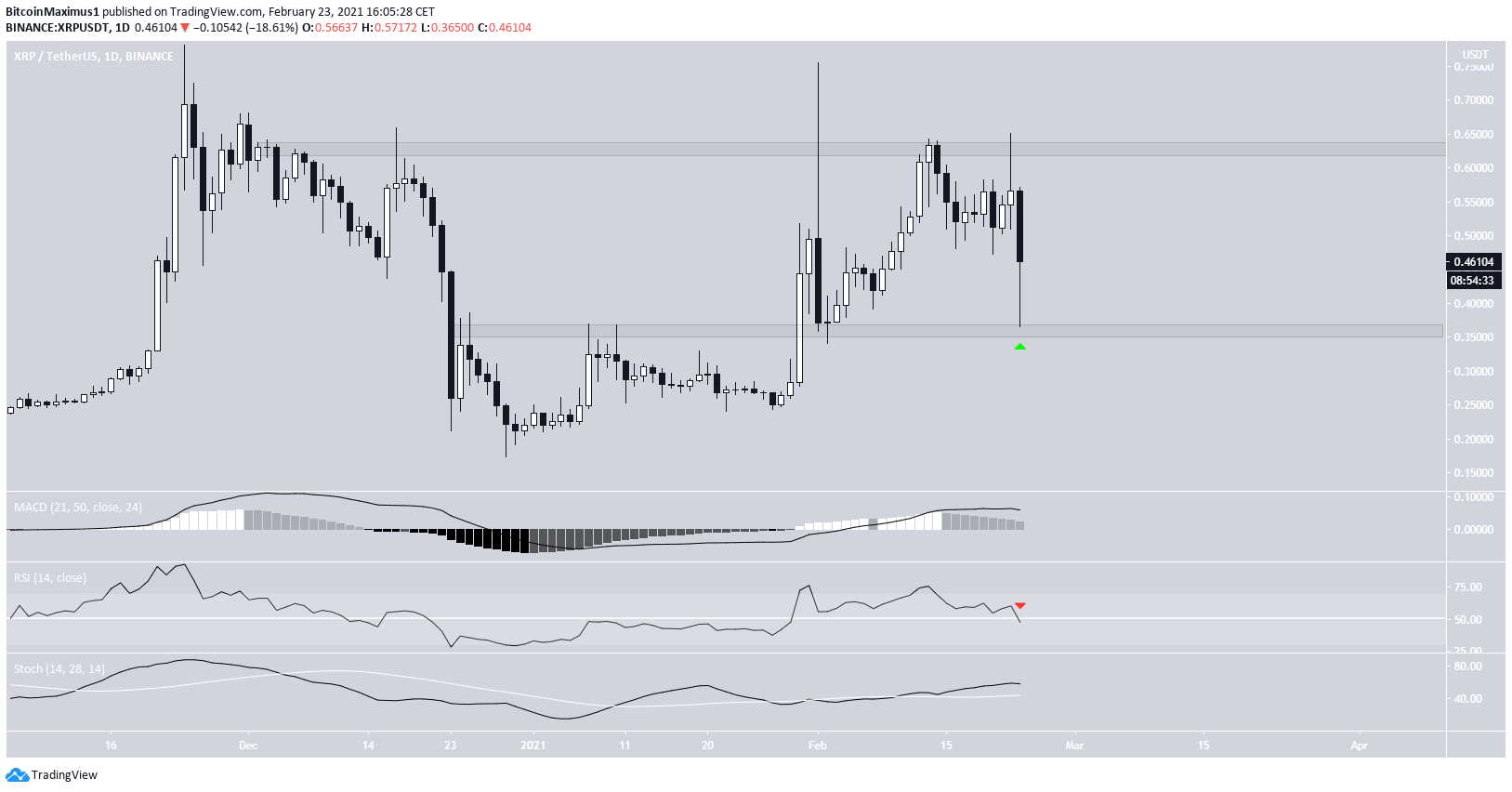

XRP (XRP)

Unlike BTC and ETH, XRP is nowhere close to its all-time high price. However, it has also been declining since Feb. 1, when it reached a high of $0.755.

On Feb. 23, the descent took it to a low of $0.365. The drop served to validate the $0.36 support area, and since then, XRP has been moving upwards, creating a long lower wick.

Technical indicators provide mixed signs. The RSI is right at 50, the MACD is decreasing, and the Stochastic oscillator has made a bullish cross and is moving upwards.

As long as XRP is trading above the $0.36 support area, it should gradually move towards the $0.64 resistance area.

Waves (WAVES)

WAVES has also decreased considerably since it reached the all-time high price of $14.1 on Feb. 18. The fall has taken it to the $8.80 area, which previously acted as the all-time high resistance.

Therefore, the price movement looks very similar to that of ETH, except that the bounce on WAVES has been much stronger.

Technical indicators show a loss of momentum, as evidenced by the RSI and MACD decline. But they are still bullish since the RSI is above 50, the MACD is above 0, and the Stochastic oscillator has yet to make a bearish cross.

When combining this with the long lower wick, which could be significant, it provides a bullish outlook for WAVES.

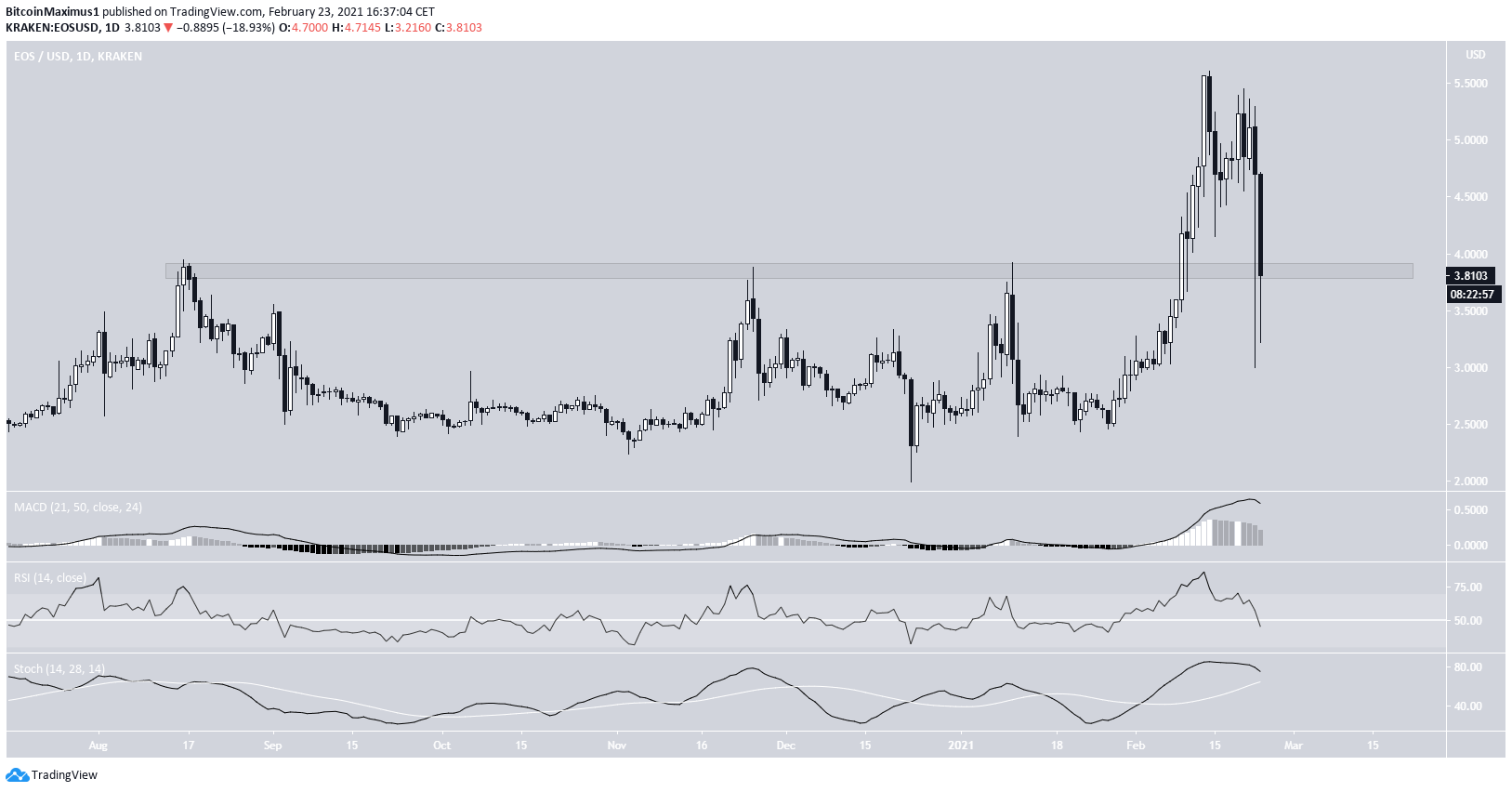

EOS (EOS)

EOS has been moving downwards since Feb. 14, when it was trading at a high of $5.60. The ensuing decrease has been swift, further accelerating on Feb. 22, taking EOS to a low of $3.00.

While technical indicators have started to show bearish signs, as evidenced by the RSI cross below 50, the fact that the MACD is still positive and the Stochastic oscillator has not yet made a bearish cross suggests that the trend is still bullish.

EOS has since bounced and is currently trading at the $3.70 area, which previously acted as resistance for the latter half of 2020. Whether EOS manages to hold above this level or drop below will have a crucial effect in determining the future direction of its trend.

Tron (TRX)

TRX has been falling since it reached a high of $0.064 on Feb. 19. The decrease has taken it to the $0.039 area, which previously acted as resistance since Sept. 2020, before TRX finally broke out. Therefore, the current drop may be just a retest of that resistance level, validating it as support.

The readings from technical indicators are nearly identical to those of EOS. While the RSI is bearish, crossing below 50, both the MACD and the Stochastic oscillator are bullish.

Therefore, as long as TRX is trading above $0.039, the trend is bullish.

Aragon (ANT)

ANT has been decreasing since Feb. 14, when it reached a high of $8. So far, ANT has dropped to a low of $3.82, doing so on Feb. 23.

While ANT has bounced, it is currently trading right at the 0.618 Fib retracement level at $4.46, an area that could act as support. If ANT manages to close above this level, it will go a long way in confirming a new upward trend.

However, technical indicators on the daily time-frame are bearish, casting doubt on this possibility.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

The post BTC, ETH, XRP, WAVES, EOS, TRX, ANT: Price Analysis February 23 appeared first on BeInCrypto.

![Decentraland: Review & Beginner's Guide [current_date format=Y] 37 Decentraland: Review & Beginner's Guide](https://cryptheory.org/wp-content/uploads/2020/11/decentraland-02-gID_7-300x150.jpg)