BTC potential path – Overview

2 min readThe $ 40,000 level remained intact, and at the time of writing, BTC is trading at $ 43,000. The Fed’s statement was made (and processed by the market), the US CPI was updated. What is the potential path of BTC? Let’s check the metrics.

BTC potential path

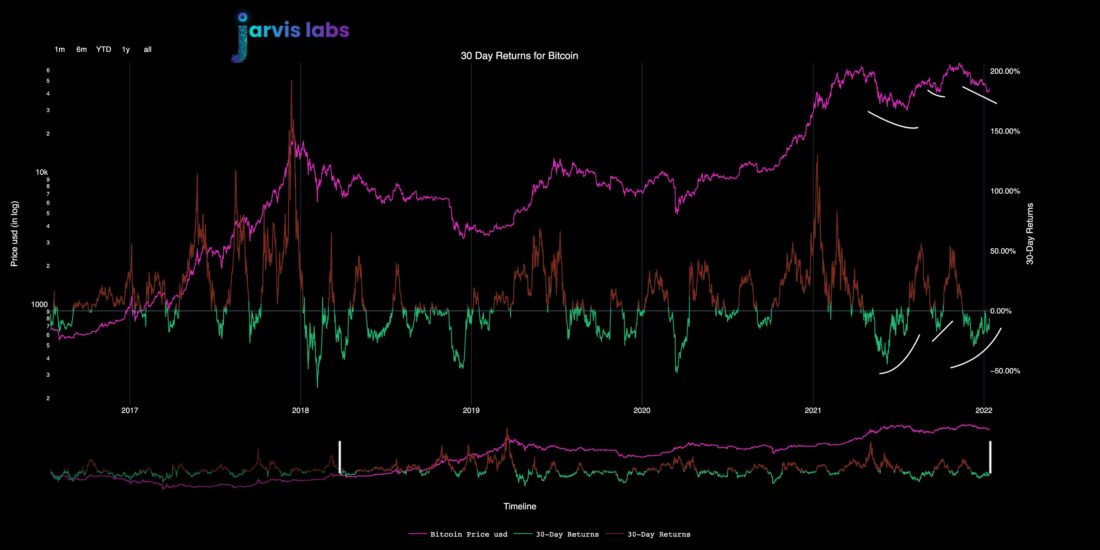

The 30-day yield has been declining in the last month. After declining in December, this indicator rose steadily against the background of a continuing fall in prices, creating a strong bullish divergence. Now it has returned to the threshold level and is approaching zero. If overcome, we expect several weeks of upward movement.

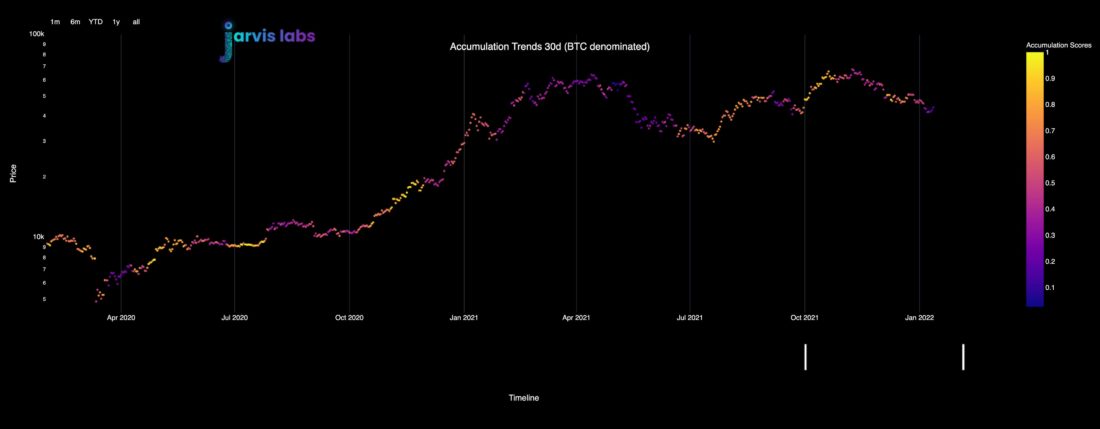

The 30-day accumulation trend indicator shows that retail players are relatively confident in BTC accumulation.

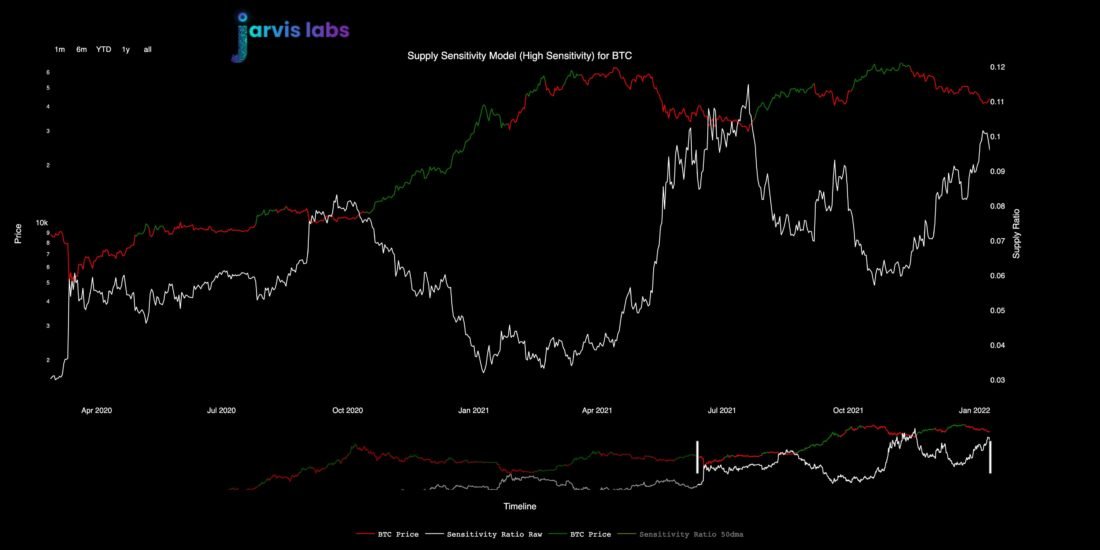

The supply sensitivity ratio is based on the dominance of the supply of stablecoins and BTC. This is an indicator of a medium-term trend that is still in the red and should return to the green values for several weeks of growth, which can be hoped for.

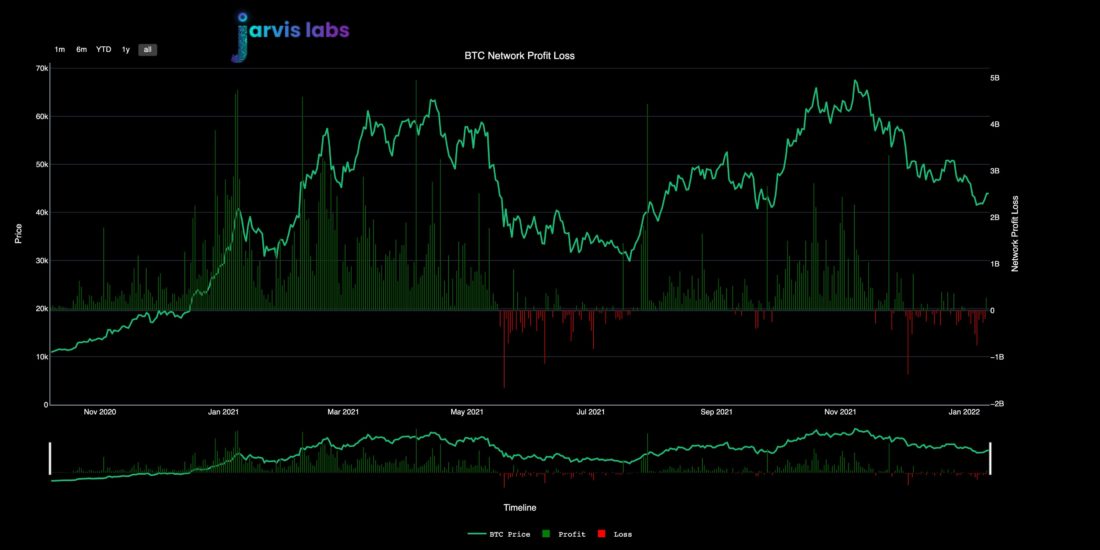

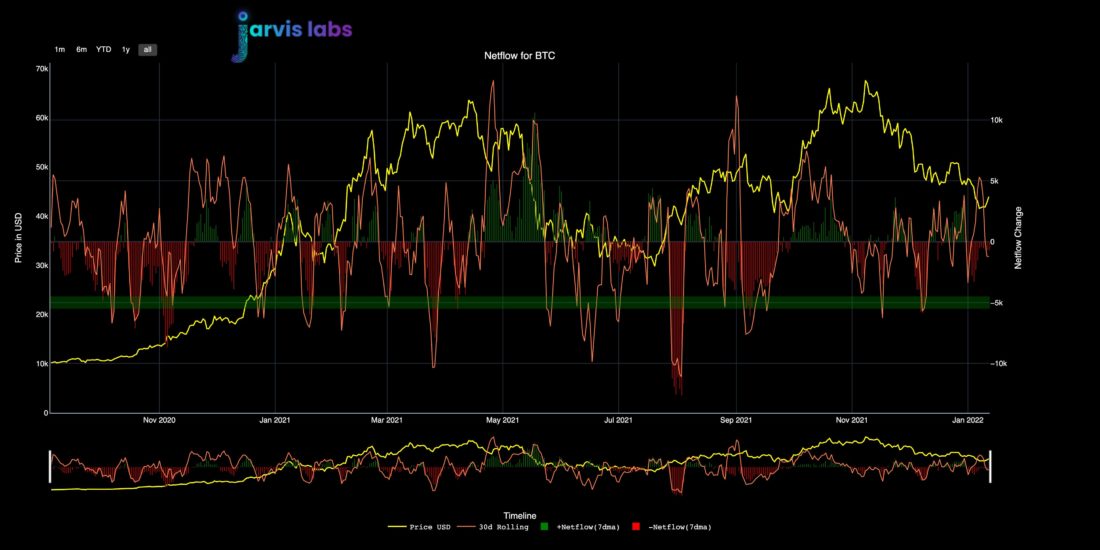

BTC’s net profit figures have signaled losses for almost 3 weeks, mainly due to the fixation of losses on the part of short-term holders. In recent days, several green bars have been seen, which also indicate a small collection of profits at $ 44,000.

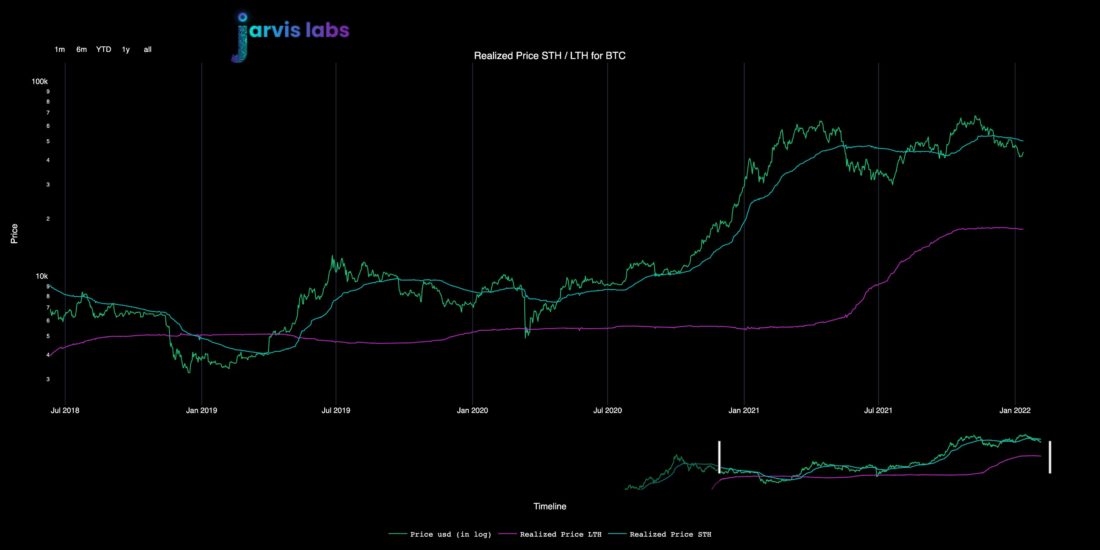

The realized price for short-term holders fell to $ 50.9 thousand and the market price remains below the realized level. As long as this is the case, the threat of further market correction (not necessarily immediate) remains relevant.The funding rate for perpetual futures turned negative on both Binance and FTX. If the price continues to rise and funding remains negative, it will be a strong bullish signal that the market is ready for healthy growth, suggesting that the initiative is on the side of spot buyers.

More than 20 trading pairs are negatively funded at Binance. This is another great signal for bulls.

The net inflow of BTC on the stock exchange is negative, even if the values are small.

Summary:

- Funding rates on Binance and most other exchanges are negative. This is a bull signal.

- BTC’s net inflow is negative.

- The bears have a certain advantage until the market recovers above the average purchase price for short-term holders, $ 50.9 thousand.

- Expected volatility is still declining despite recent price movements, which is a reason for greater caution in trading.

- Long-term holders do not sell their coins.

- We expect some consolidation before the nearest resistance levels ($ 46-48,000) are tested.

- Growth in the first quarter will be a period of profit-taking for most investors, as a large amount of venture capital unblocking and Fed measures are expected in the second quarter.