Crypto funds celebrate a new record. They manage over $ 72 billion

1 min read

Accredited investors continue to increase the rate of investment in cryptocurrencies, although in the past week, according to a CoinShares report, they have invested less in them through crypto funds than in the week before. This time it was almost $ 80 million.

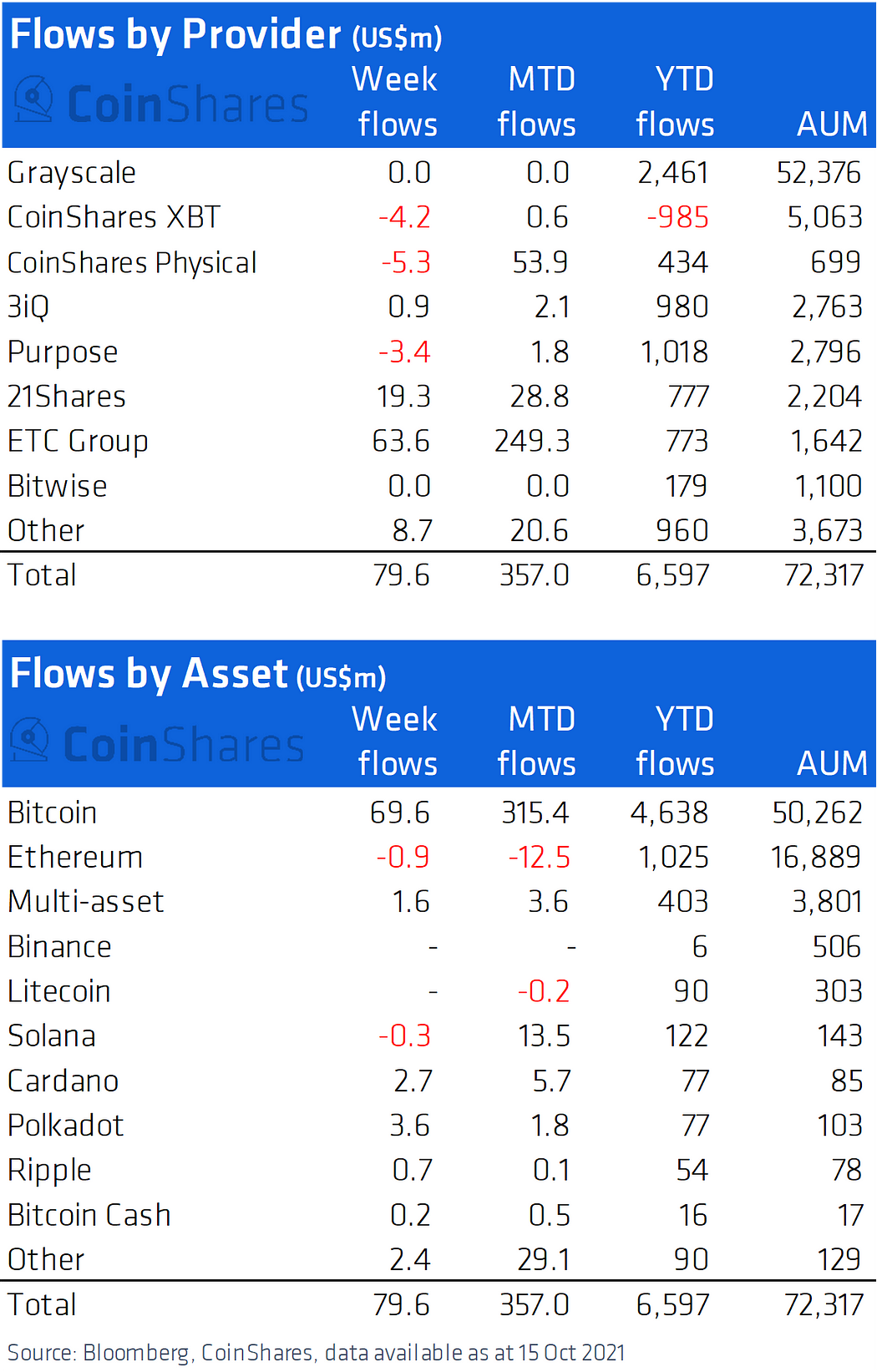

At the beginning of the week, CoinShares publishes the results of the largest cryptocurrency funds Grayscale, CoinShares, 3iQ, Purpose, 21Shares, ETC Group and Bitwise. According to the latest report, another $ 79.6 million was poured into these funds in the week beginning October 11.

Most capital flowed back into BTC – almost 70 million. Polkadot (3.6m), Cardano (2.7m) and a basket of various crypto assets (1.6m) also finished in the black. On the contrary, ETH (-0.9m) and Solana (-0.3m) did not succeed, which ended in red numbers.

This is the ninth week in a row with a plus sign in the final balance sheet. Before that, we followed 10 weeks, in which up to 9 cases the cryptofonds ended up in red numbers. As for BTC, it recorded its fifth week in a row.

In the final balance sheet, the cryptofunds manage capital worth a total of $ 72.3 billion, which is a new record. BTC alone is $ 50.2 billion. In second place is ETH with $ 16 billion.