Differences Between Cryptocurrency Coins and Tokens

4 min readTable of Contents

Cryptocurrencies can be extremely hard to wrap our heads around, especially since their underlying technology – the Blockchain – is shrouded in computing language and terminology that is technical in nature.

This is a huge barrier to many who are interested to learn more about cryptocurrencies and blockchain technology.

But do not worry! We’ll guide you in understanding key cryptocurrency concepts that is great for you to know.

What Are Cryptocurrencies?

Let’s start with understanding the definition of cryptocurrencies. Cryptocurrencies are digital or virtual currencies that are encrypted (secured) using cryptography.

Cryptography refers to the use of encryption techniques to secure and verify the transfer of transactions.

Bitcoin represents the first decentralized cryptocurrency, which is powered by a public ledger that records and validates all transactions chronologically, called the Blockchain.

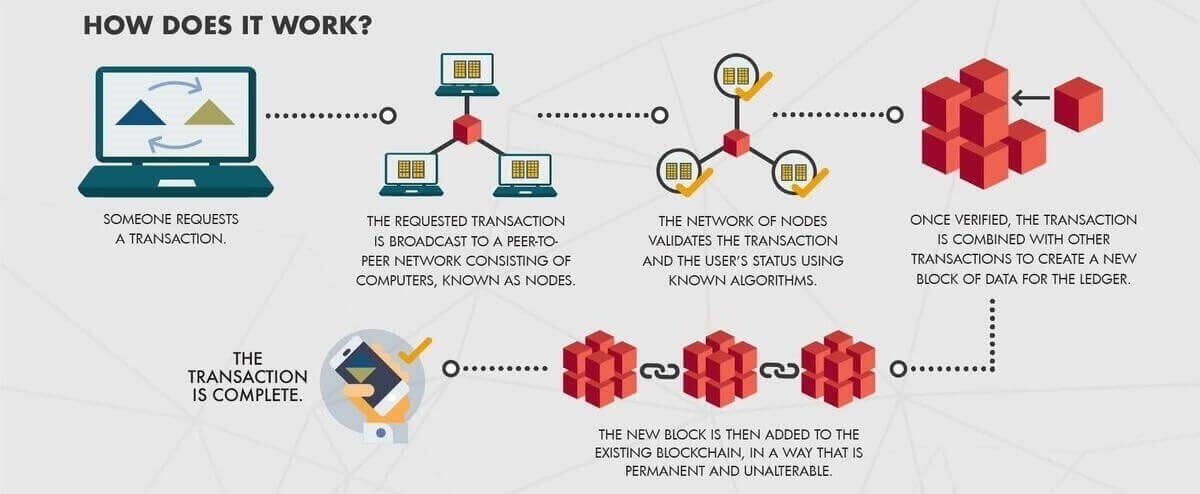

Here’s an overview of how the blockchain works:

Source: The Bernie Group

Although many cryptocurrencies have existed prior to Bitcoin, it’s creation marks an important milestone in the realm of digital currencies, due to its distributed and decentralized nature.

The creation of Bitcoin precipitated the expansion of a lush and more diverse ecosystem of other coins and tokens, that are often regarded as cryptocurrencies in general, even when most of them do not fall under the definition of a “currency”.

Coins vs Tokens: Categorization Of Cryptocurrencies

It is important to note that all coins or tokens are regarded as cryptocurrencies, even if most of the coins do not function as a currency or medium of exchange.

All these characteristics are inherent within Bitcoin, and since the cryptocurrency space was kickstarted by Bitcoin’s creation, any other coins conceived after Bitcoin is generally considered as a cryptocurrency, though most do not fulfill the aforementioned characteristics of an actual currency.

The most common categorization of cryptocurrencies are:

- Alternative Cryptocurrency Coins (Altcoins)

- Tokens

Altcoins

Alternative cryptocurrency coins are also called altcoins or simply “coins”. They’re often used interchangeably. Altcoins simply refers to coins that are an alternative to Bitcoin.

The majority of altcoins are a variant (fork) of Bitcoin, built using Bitcoin’s open-sourced, original protocol with changes to it’s underlying codes, therefore conceiving an entirely new coin with a different set of features.

A central concept of modifying open source codes to create new coins is called hardforks.

Some examples of altcoins that are variants of Bitcoin’s codes are Namecoin, Peercoin, Litecoin, Dogecoin and Auroracoin.

There are other altcoins that aren’t derived from Bitcoin’s open-source protocol. Rather, they have created their own Blockchain and protocol that supports their native currency.

Examples of these coins include Ethereum, Ripple, Omni, Bitshares, NEO, Waves and Counterparty.

A commonality of all altcoins is that they each possess their own independent blockchain, where transactions relating to their native coins occur in.

Fun fact: The first Altcoin was Namecoin, which was created in April 2011. It is a decentralized open source information registration and transfer system

Tokens

Tokens are a representation of a particular asset or utility, that usually resides on top of another blockchain.

Tokens can represent basically any assets that are fungible and tradable, from commodities to loyalty points to even other cryptocurrencies!

Creating tokens is a much easier process as you do not have to modify the codes from a particular protocol or create a blockchain from scratch.

All you have to do is follow a standard template on the blockchain – such as on the Ethereum or Waves platform – that allows you to create your own tokens.

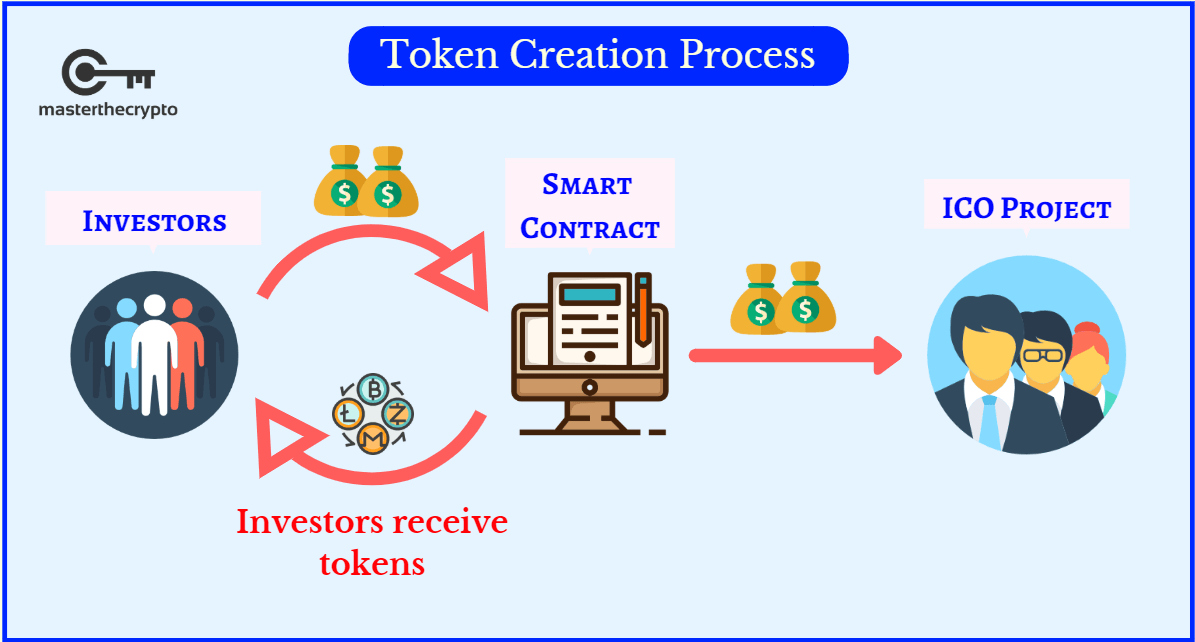

This functionality of creating your own tokens is made possible through the use of smart contracts; programmable computer codes that are self-executing and do not need any third-parties to operate.

It really is super cool! Here’s a look at the process:

Tokens are created and distributed to the public through an Initial Coin Offering (ICO), which is a means of crowdfunding, through the release of a new cryptocurrency or token to fund project development.

It is similar to an Initial Public Offering (IPO) for stocks. Many are crazy over ICOs as they represent a great way of identifying interesting projects that can provide great financial returns.

Fun Fact: A template for token creation is wonderful since it provides a standard interface for interoperability between tokens. This make it so much easier for you to store different type of coins within a single wallet. An example is the ERC-20 standard on the Ethereum blockchain, which has is used by over 40 tokens

Final Thoughts

The main difference between altcoins and tokens is in their structure; altcoins are separate currencies with their own separate blockchain while tokens operate on top of a blockchain that facilitates the creation of decentralized applications.

The majority of coins in existence (close to 80%) are tokens, since they’re much more easier to create.