Europe is the largest crypto economy in the world

3 min read

Europe is now the largest crypto economy in the world. This is the result of a new report by the analysis company Chainalysis.

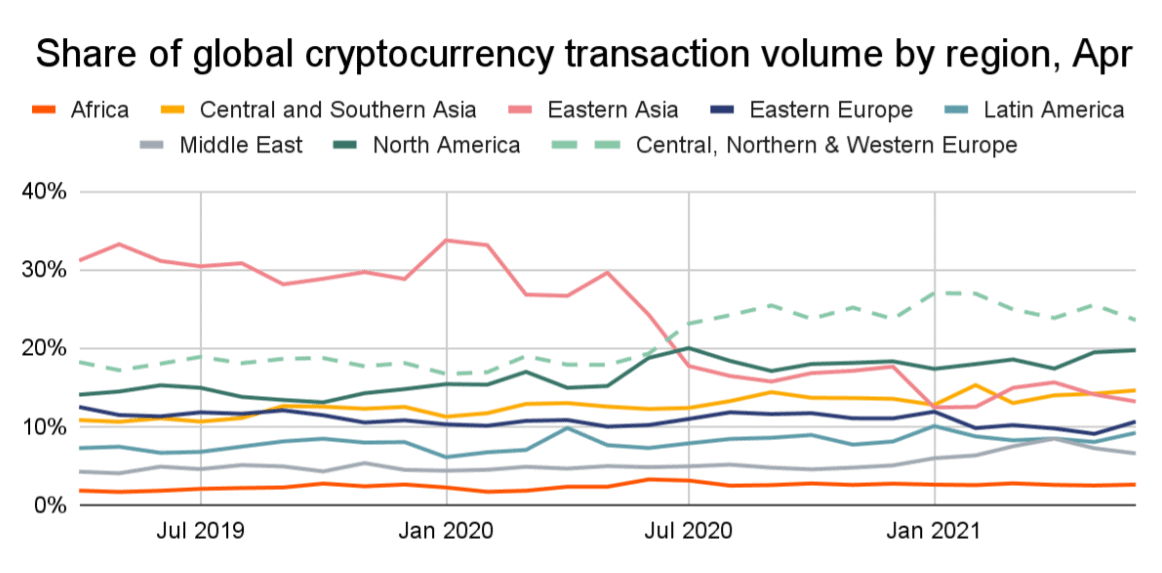

The global adoption of cryptocurrencies continues. Driven by growing interest, more and more institutional investors are entering the field of BTC and Co. and helping the prosperous economic sector to grow more. One region in particular benefits from this development – Europe. Like the US analysis company Chainalysis in a current report notes, Central, Northern and Western Europe (CNWE) have now risen to become the largest crypto economy in the world. The development was mainly driven by institutional investors and other “whales” with the entry into the DeFi sector. According to this, the sector has received over $ 1 trillion in transactions since July 2020 and now accounts for around 25 percent of global activity. The CNWE countries are thus able to displace the previous leader in East Asia from pole position.

From this, Chainalysis concluded that the CNWE region now had “a unique status as an international hub in the global crypto economy”.

“DeFi is a crypto driver”

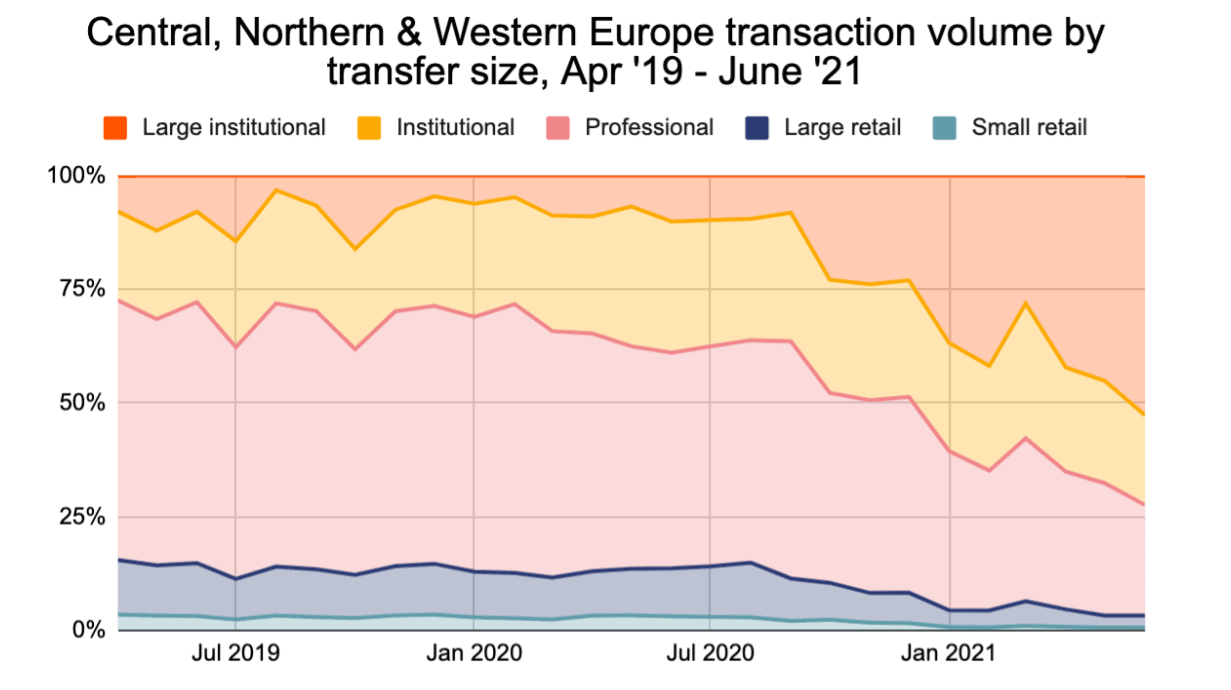

Chainalysis sees the increase in “large institutional crypto transactions” with a volume of at least 10 million US dollars as the reason for the prospering economic performance of the CNWE states. These transfers have grown since July last year from 1.4 billion to 46.3 billion US dollars. They thus accounted for more than half of the transaction activity among large investors in the CNWE region.

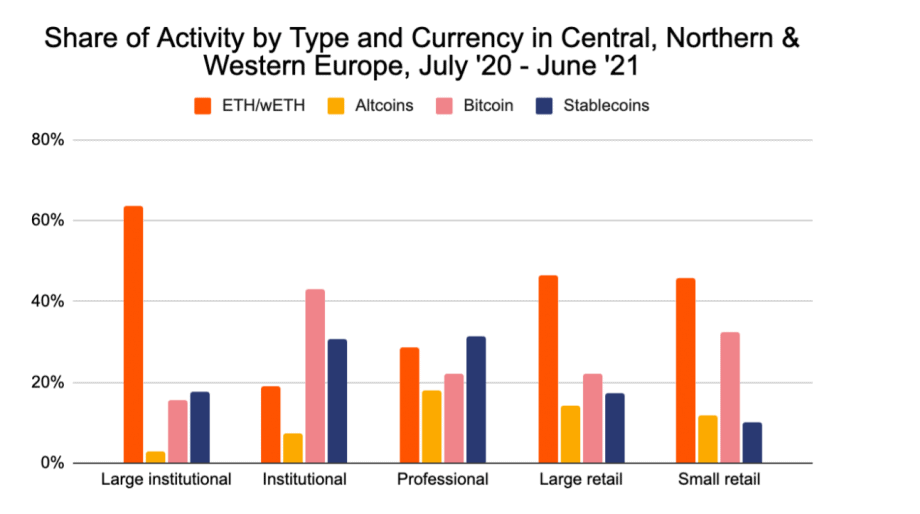

Although the US company saw an increase in the volume of transactions in practically all cryptocurrencies and services, one area stood out in particular – the DeFi sector. The majority of these transactions went into decentralized financial services, says Chainalysis. The analysis company cites the access of large institutional investors to the staking services of various DeFi platforms as the main reason. ETH (ETH) and Wrapped ETH (WETH) were primarily used for this. The latter is a replica of the “Digital Gas”, which is compatible with ERC-20 tokens and is therefore often used in DeFi protocols. For example, if you want to exchange Ether for other ERC-20 tokens, you first have to convert your ETH to WETH.

Highest activity in UK, France and Germany

The pioneering role in terms of crypto activity in Europe fell on the continent’s three largest economies – the United Kingdom, France and Germany. For example, the front runner Great Britain traded $ 170 billion over the last year. The Federal Republic landed in third place behind its French neighbor with a trading volume of 114.4 billion US dollars. Followed by the Netherlands and Switzerland.

So it is above all DeFi Space that made the CNWE region the leading crypto market, summarizes Chainalysis. It is hardly surprising that this development was primarily driven by institutional investors. In a report at the end of August, the analysis company noted an increase in adoption in the entire crypto market.

The report from Blockdata also points to the enormous potential. If the world’s 100 largest banks invested just one percent of their assets under management in DeFi, that would be a cash injection of nearly $ 1 trillion. Around 55 of the 100 largest banks are currently invested in cryptocurrencies or blockchain-based companies. As a result, the leap from crypto to DeFi space would not be far, says CEO Jonathan Knegtel. The entry of “one or two big banks” could already trigger a chain reaction.

The famous picture of 2-year-old Chloe was sold as the NFT for almost $ 75,000