Five Biggest Altcoin Gainer Showcase — July 5-12

3 min readTable of Contents

BeInCrypto breaks down the five biggest altcoin movers and shakers from the previous week. Will their momentum continue?

The five altcoins that increased the most last week were:

- Axie Infinity (AXS) – 116.54%

- Kucoin Token (KCS) – 81.78%

- Flow (FLOW) – 74.58%

- Stacks (STX) – 57.46%

- Synthetix (SNX) – 46.99%

AXS

AXS had been following a descending resistance line since April 29. It made three unsuccessful breakout attempts before finally moving above the line on June 15.

It returned to validate the line as support on June 23 and has been moving upwards at an accelerated rate since.

In a span of slightly less than 18 days, AXS increased by 585%, reaching a new all-time high price of $19.60 on July 10.

Despite the sharp increase, there are signs of weakness present. While AXS has created a higher high, there are bearish divergences in both the RSI and MACD. In addition, both highs are combined with long upper wicks.

If a correction were to occur, the $9.20-$11.20 area would be expected to act as support. This range is the 0.5-0.618 Fib retracement support area.

KCS

KCS had been following a descending resistance line since April 10. It broke out from the line on July 3, reaching a high of $14.85 in the process. The high was reached slightly above the 0.618 Fib retracement resistance level of $14.

KCS decreased afterwards, falling all the way to a low of $10.40 on July 8. However, a long lower wick was created almost immediately and the price bounced back.

Technical indicators are bullish, supporting the continuation of the upward movement. The MACD is positive, the RSI is above 70, and the Stochastic oscillator has made a bullish cross.

If KCS manages to reclaim the $14 area, it would be expected to make an attempt at the $20 all-time high price.

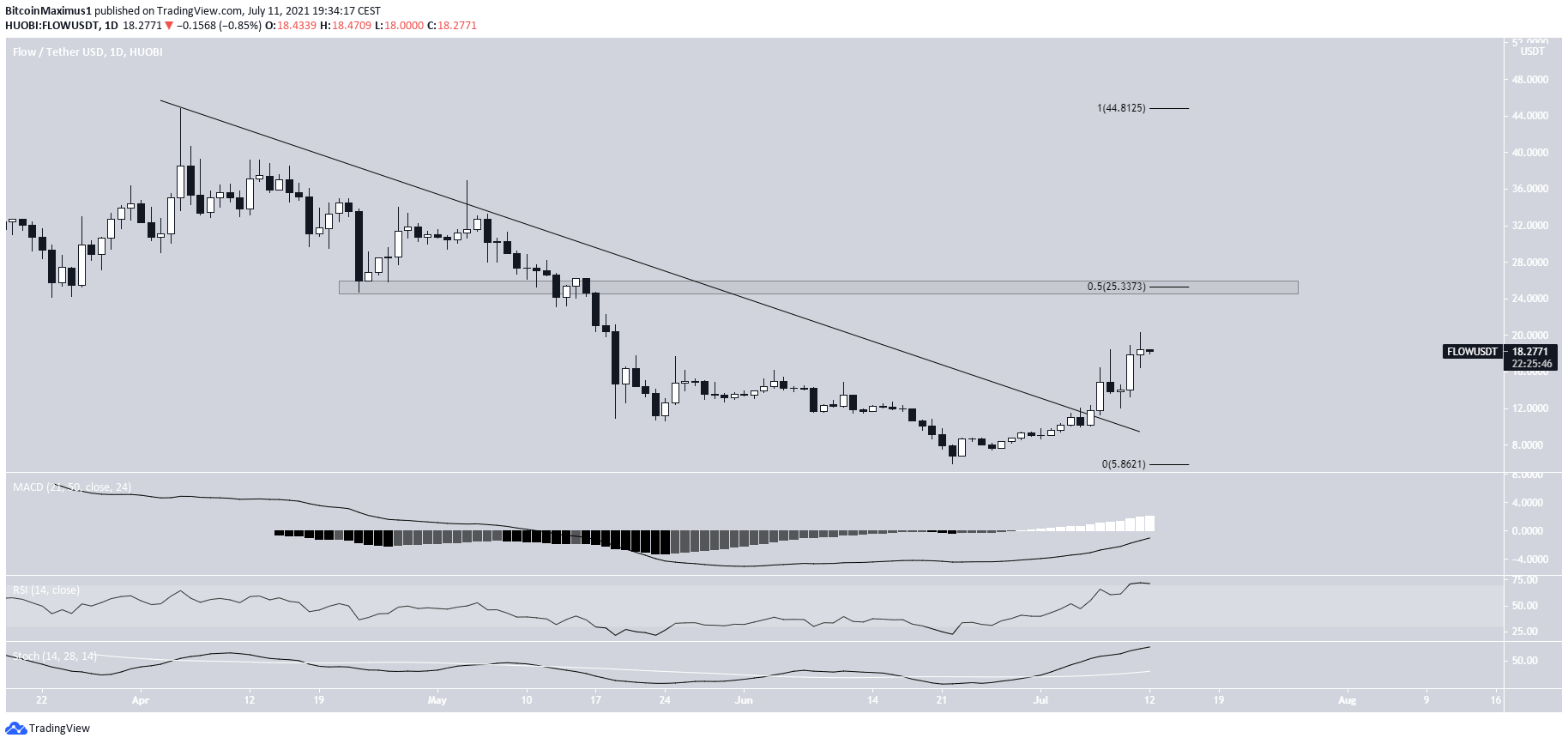

FLOW

FLOW has been moving upwards since reaching a low of $6 on June 22. On July 6, it broke out from a descending resistance line that had been in place since the April 5 high.

Up to this point, FLOW has managed to reach a high of $20.28 on July 11.

Technical indicators in the daily time-frame are bullish. The MACD is nearly positive, the RSI is above 70, and the Stochastic oscillator has made a bullish cross.

The main resistance area is found at $25.30. This is the 0.5 Fib retracement resistance level and a horizontal resistance area. A breakout above this resistance would confirm that the trend is bullish.

STX

STX has been increasing since June 22, after reaching a low of $0.50. The upward move continued until a high of $1.47 was reached on July 11.

This caused a breakout from both a descending resistance line and the $1.20 horizontal resistance area. The latter is now expected to act as support.

The closest resistance area is found at $1.67. This is the 0.5 Fib retracement resistance level and a horizontal resistance area. Technical indicators are bullish, and support the continuation of the upward movement towards this level.

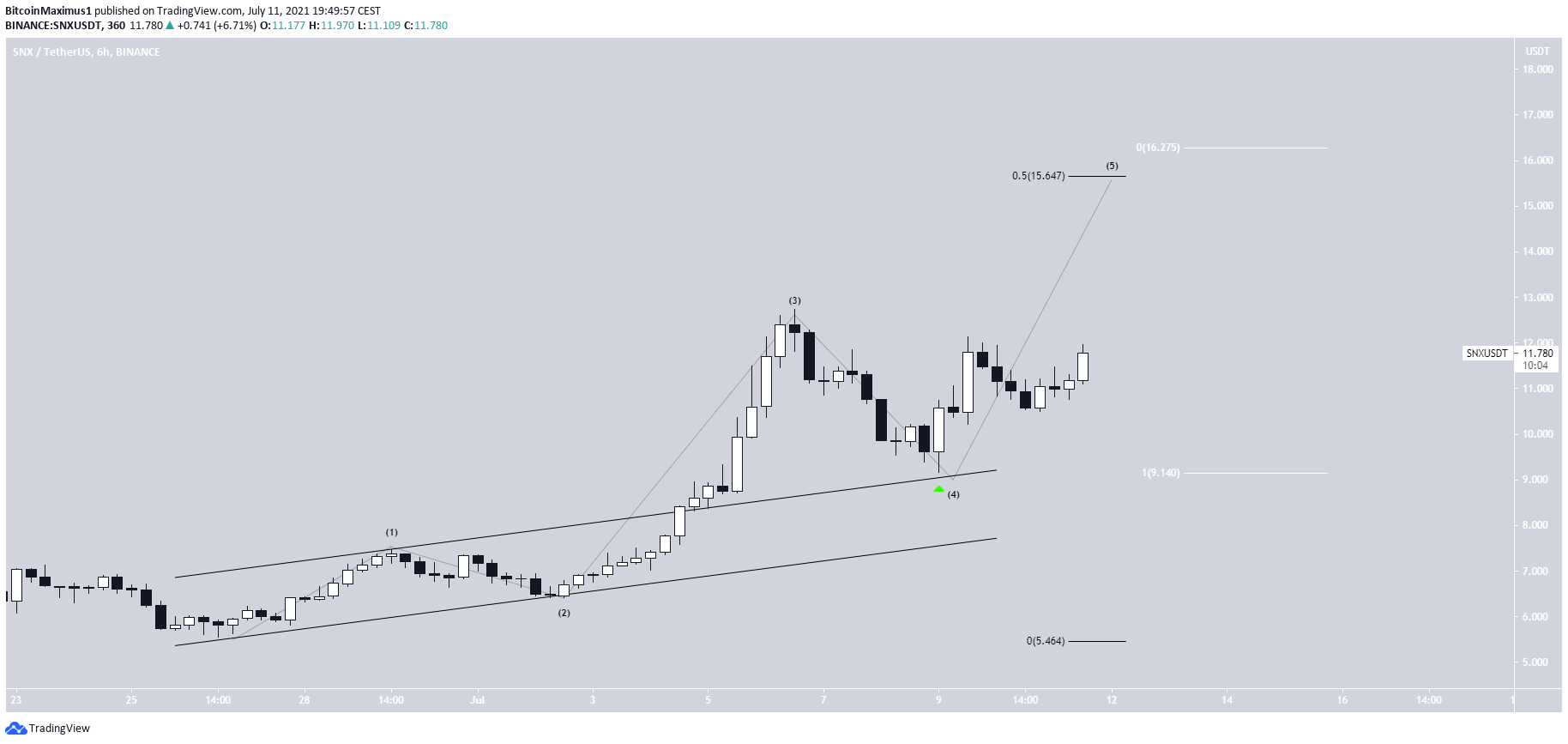

SNX

SNX has been increasing since June 26. It broke out from an ascending parallel channel on July 4 and made a high of $12.74 after two days.

SNX decreased after this, validating the resistance line of the channel as support (green icon). This appears to have been a fourth wave pullback pattern.

A potential target for the top of the upward movement is between $15.64 and $16.28. This range is the 0.5 Fib retracement resistance level (black) and a projection of the length of waves 1-3 (white).

For BeInCrypto’s latest BTC (BTC) analysis, click here.

The post Five Biggest Altcoin Gainer Showcase — July 5-12 appeared first on BeInCrypto.

![Decentraland: Review & Beginner's Guide [current_date format=Y] 31 Decentraland: Review & Beginner's Guide](https://cryptheory.org/wp-content/uploads/2020/11/decentraland-02-gID_7-300x150.jpg)