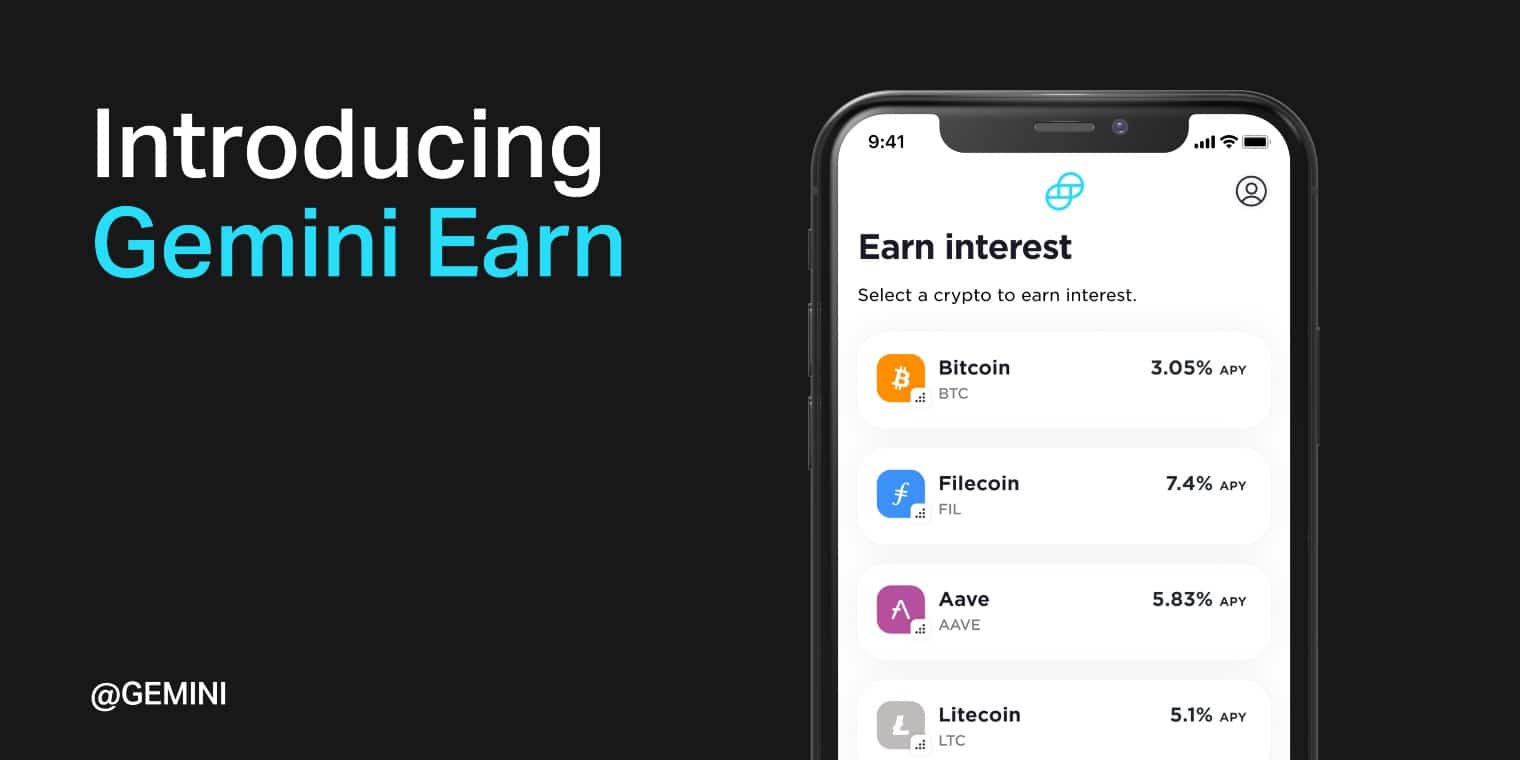

Gemini launches ‘Earn’ program

2 min read

Gemini, the exchange owned by the Winklevoss twins, today announced a program called “Earn” for its US customers from 50 different states.

Tyler Winklevoss explained:

“We designed a program that allows our customers the ability to generate a real return on their crypto holdings without having to sell one of the best performing asset classes of the decade.”

How does Gemini Earn work

Basically, the program will allow Gemini’s customers to earn up to 7.4% annual interest starting next Friday, even though for a select number of users, Earn is already available.

The COO of Gemini, Noah Perlman, said that the interest rates will be calculated based on supply and demand for crypto loans. Interest will be paid daily. He explained:

“Our vetted institutional lending partners, such as Genesis Global Capital, find these borrowers and lend crypto funds in exchange for an interest payment.”

Gemini’s upcoming IPO

Gemini had also recently announced the launch of its debit card to spend various cryptocurrencies. Moreover, the exchange may soon launch an IPO and thus land on the stock exchange.

As early as last December, Coinbase had also submitted documentation to the SEC in order to start the IPO process.

Gemini and the NFT platform

Not so long ago, the US exchange launched its own sales platform for Non Fungible Tokens called Nifty Gateway.

This platform allows NFTs to be created, bought and sold. Here you can find the NFT Yachty Coin of the famous rapper. Lil Yachty entered the crypto sector back in November 2020 when he announced he was working on his own crypto using Swiss company Fyooz‘s platform, which connects fans with artists through the use of ad hoc tokens.

The post Gemini launches ‘Earn’ program appeared first on The Cryptonomist.

![Decentraland: Review & Beginner's Guide [current_date format=Y] 20 Decentraland: Review & Beginner's Guide](https://cryptheory.org/wp-content/uploads/2020/11/decentraland-02-gID_7-300x150.jpg)