Greenidge To Be First Public BTC Mining Firm With Own Power Plant

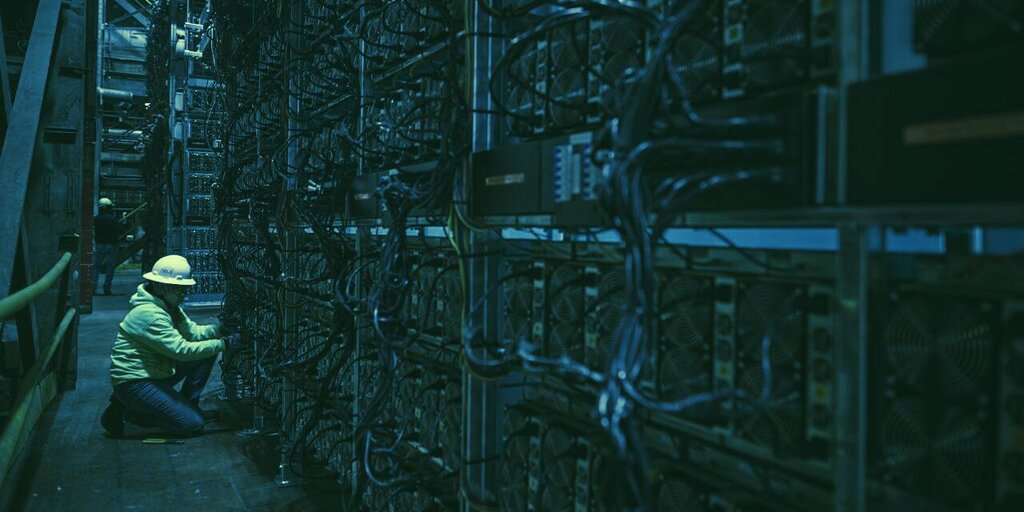

2 min readGreenidge Generation Holdings (Greenidge) is expecting to be the first publicly traded BTC mining company with a wholly-owned power plant, according to an announcement made today.

Greenidge is a holding company that includes Greenidge Generation LLC, a mining and power generation facility in Upstate New York. The company expects to be listed on Nasdaq, through a merger with Support.com, subject to certain conditions including Support.com shareholder approval. Upon closure of the merger, Support.com will become a wholly-owned subsidiary of Greenidge.

“This merger is an important next step for Greenidge as we build upon our existing, integrated and proven platform for BTC mining and generation of lower carbon affordable power,” said Greenidge CEO Jeff Kirt. According to Lance Rosenzweig, president and CEO of Support.com, this transaction will “build upon Greenidge’s successful business by providing them with additional cash funding and a public currency to fund their growth plans.”

Greenidge’s natural gas plant currently powers 19 megawatts of mining capacity, which, by the end of Q2 2021, is expected to more than double to 41 megawatts. By the end of next year, this figure is anticipated to reach 85 megawatts, and by 2025, Greenidge plans to achieve at least 500 megawatts of mining capacity.

A lucrative business

BTC mining has proven to be a successful business for Greenidge.

As of March 2020, Greenidge Generation’s power plan generated $50,000 through mining BTC. The company also claimed to have access to the cheapest natural gas in the United States.

The company’s aim is to tap the profitability of the growing BTC market—and judging by the fact that BTC’s price has increased from approximately $5,000 to over $60,000 in the last 12 months, it’s safe to say the decision has been a beneficial one so far.

However, the environmental impact of BTC mining remains controversial. The network uses a proof of work consensus mechanism that consumes large amounts of energy by design; critics point to figures estimating that BTC’s energy consumption is greater than that of many countries.

![Decentraland: Review & Beginner's Guide [current_date format=Y] 19 Decentraland: Review & Beginner's Guide](https://cryptheory.org/wp-content/uploads/2020/11/decentraland-02-gID_7-300x150.jpg)