How Binance and BitMEX are currently on the market

1 min read

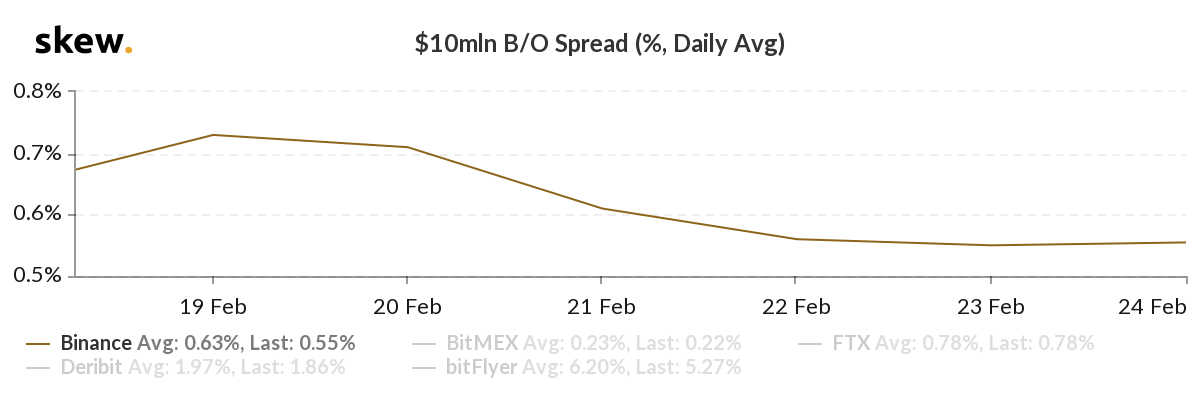

According to data provided by analyst company Skew, the average daily bid of $ 10 million on Binance has been steadily decreasing over the past week. This margin represents the difference in price between assets for immediate purchase and immediate sale.

Binance showed a spread of 0.71% on 19 February and recorded a decline of 0.55% over the week, down by approximately 16 basis points.

Skew also saw a 50 basis point decrease between 6 January and 4 February. This means that Binance’s liquidity is increasing as more buyers are coping with vendors on the cryptocurrency exchange at a larger price range.

How’s Bitmex doing?

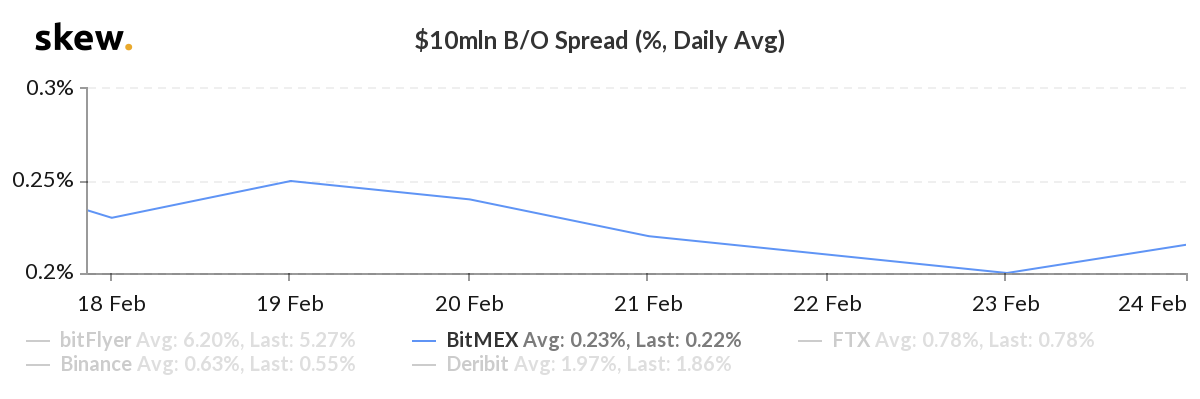

On the other hand, BitMEX could see a slight decline in liquidity, despite a decline of 5 basis points since last week.

On February 19, there was a 0.25% demand-supply spread on BitMEX, which fell to 0.20% over the next four days. However, on February 24, it rose to 0.22%, which could mean fewer users decide to trade on BitMEX.

Summary

Currently, Binance Futures posted a 24-hour volume of $ 1.24 billion, much less than BitMEX of $ 2.7 billion in the same period. However, given the rate of growth in recent months, it may not be long before Binance takes the throne.

![Decentraland: Review & Beginner's Guide [current_date format=Y] 26 Decentraland: Review & Beginner's Guide](https://cryptheory.org/wp-content/uploads/2020/11/decentraland-02-gID_7-300x150.jpg)