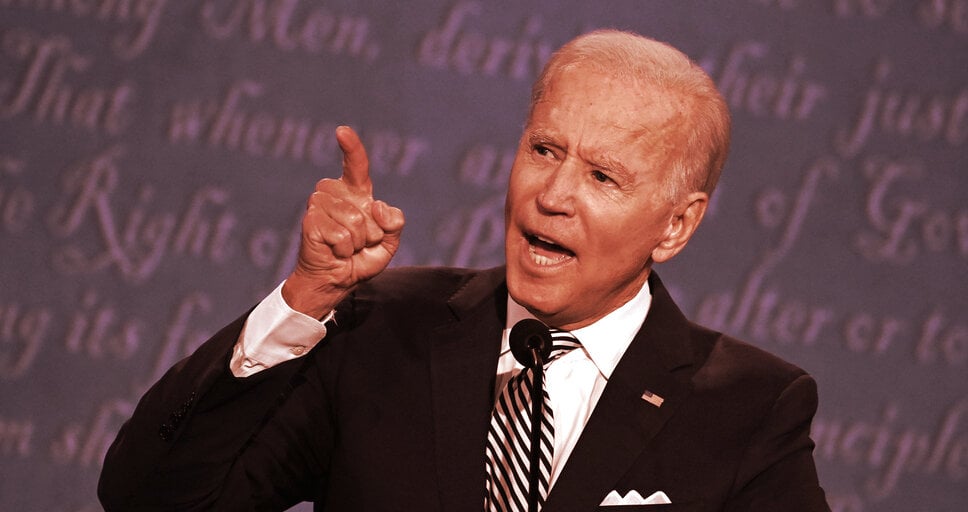

How Joe Biden's Picks for SEC, Treasury Will Impact Crypto

6 min readFollowing Biden’s inauguration, there will be an array of new faces in Washington, including several who will have oversight of the crypto markets, including Gary Gensler and Janet Yellen.

Gary Gensler has been picked to lead the SEC. This regulator steps in when it deems coins are securities, fining crypto projects including Telegram, Kik, Enigma, and BitClave—and, last month, serving a lawsuit against Ripple. And yesterday, Janet Yellen was sworn in as the new Treasury Secretary, where she will have a pivotal role in shaping the economic development of the US.

But what do they think about the crypto industry and how might they seek to impact it? We spoke to a former SEC lawyer and a former US attorney to find out.

Gary Gensler picked for the SEC

While Joe Biden named Commissioner Allison Herren Lee as an Acting Chairman of the SEC last week, this move is expected to be temporary. Gary Gensler, former head of the CFTC and the president’s pick for the role, is likely to be confirmed by the Senate in the near future.

As far as cryptocurrencies are concerned, the overall expectation is that Gensler’s role at the SEC will be similar to his assignment at the CFTC: bringing order to a largely ungoverned ecosystem.

“We need to guard against illicit activity. And yes, we need to protect investors. The crypto exchanges, big exchanges like Coinbase, need to come within the SEC or the CFTC,” he said in an interview with Bloomberg in 2018.

The good news is that the 63-year-old Wall Street veteran is quite familiar with the digital assets space, having taught a course at the Massachusetts Institute of Technology (MIT) about how Bitcoin and blockchain could be used in finance. He also authored an op-ed for Coindesk, describing cryptocurrency as a “catalyst for change,” and discussed the need to bring the Federal Reserve into the modern payments era.

One of the key bodies within the SEC’s structure is the Enforcement Division, which is responsible for conducting investigations into possible violations of the federal securities laws, and prosecuting the Commission’s civil suits in the federal courts as well as its administrative proceedings.

“I would expect Gensler to bring renewed energy to the Enforcement Division. For the last four years, the Enforcement Division has had to navigate a divided commission, with often conflicting priorities on issues that impact the investigation and prosecution of cases,” Philip Moustakis, former senior counsel in the SEC’s Division of Enforcement, told Decrypt.

Moustakis, who currently serves as a Counsel at Seward & Kissel LLP, expects that under the new leadership the Commission will adopt a more aggressive approach not only towards private funds and their managers, but to the crypto industry as well. This fresh approach is likely to result in a marked increase in the number of enforcement actions.

“In the digital assets space, to date, the Enforcement Division of the SEC has brought cases related to offering frauds, ICOs, and their promoters. The next logical step, which I have been expecting for some time and, in my view, is likely to occur under a new, more aggressive chair, would be a greater focus on exchanges and trading platforms for digital assets, broker-dealers, investment advisers, and other traditional market participants,” he added.

Jeff Alberts, former US Attorney and currently a partner at law firm Pryor Cashman, warns of extra scrutiny when it comes to cryptocurrencies being used as a means of raising funds.

“Gensler is not afraid of innovation or change, which is good for those in the digital assets space who are offering genuinely useful financial innovations. However, Gensler is likely to be aggressive in enforcing securities laws and applying those laws to those who are seeking to use cryptocurrency technology to raise funds from investors. Anyone contemplating an ICO while Gensler is at the SEC should expect close scrutiny,” Alberts told Decrypt.

Janet Yellen gets sworn in

Joe Biden’s other high-profile pick is Janet Yellen, who chaired the Federal Reserve from 2014 to 2018, and was officially confirmed as Treasury Secretary on January 25.

Yellen has been critical of Bitcoin in the past, and during her Senate confirmation hearing on January 19 she made waves among Bitcoin proponents, stating that “cryptocurrencies are of particular concern” when it comes to facilitating crime, including terrorist activity.

“I think we really need to examine ways in which we can curtail their use, and make sure that anti-money laundering doesn’t occur through those channels,” she said, at the time.

Yellen later attempted to placate criticism, acknowledging that we need to consider “the benefits of cryptocurrencies and other digital assets, and the potential they have to improve the efficiency of the financial system.”

In Albert’s view, these statements are in line with Yellen’s earlier approach to the crypto space.

“Janet Yellen’s comments on the role of Bitcoin in laundering proceeds of criminal activity are unsurprising. Bitcoin users should not infer that Yellen is likely to change FinCEN’s approach to cryptocurrency based on her comments,” Alberts said.

In December 2020, FinCEN, which is a part of the US Treasury Department, proposed rules that would require banks and money service businesses to keep records and verify the identity of customers transferring over $3,000 per day to their private crypto wallets. Additionally they would force them to file reports for customers transacting in over $10,000 per day.

The deadline for public comments was January 4, well short of the normal 60-day period, but after heavy criticism this period was extended. Moreover, on January 21 president Biden has frozen all agency rulemaking pending further review, including former Secretary Mnuchin’s proposal on “unhosted wallets.”

However, major industry players still fear that FinCEN might not listen to the White House and decide not to pause the existing comment period. Digital assets exchange Coinbase noted that as of Monday, January 25, the comment period still remained open. The company said that this would likely create significant confusion and requested that FinCEN “formally close the open comment period and withdraw the notice of proposed rulemaking in accordance with the new administration’s instructions.”

Privacy advocates are probably able to take a breath of relief for now. But the fight is far from being over, and with Yellen now sworn in, the Treasury is most likely to continue its attempts to regulate crypto transactions.

The departure of Heath Tarbert

CFTC’s Chairman Heath Tarbert, who joined the agency in July 2019 after serving as a senior official in President Donald Trump’s Treasury Department, will shortly be leaving the agency. The CFTC is the US federal regulator of digital assets markets, including derivatives and, to a lesser extent, spot exchanges. Tarbert is expected to stay at the agency as a commissioner for a short period of time and, according to Alberts, his departure from the Chair’s seat will be felt by many in the crypto industry.

“Heath Tarbert displayed an uncommon knowledge and respect for innovations in blockchain technology, and he was widely viewed as a supporter of the cryptocurrency space. Companies in the crypto space will miss his supportive voice in the conversation about how best to regulate cryptocurrency activity,” said Alberts.

Georgetown University academic Chris Brummer is reportedly the leading candidate to chair the CFTC following Tarbert’s departure last week. He founded the DC Fintech Week conference and hosts the Fintech Beat podcast which focuses on the regulations and policies surrounding finance and technology.

![Decentraland: Review & Beginner's Guide [current_date format=Y] 32 Decentraland: Review & Beginner's Guide](https://cryptheory.org/wp-content/uploads/2020/11/decentraland-02-gID_7-300x150.jpg)