HSBC reportedly bans customers from trading this BTC-linked stock

2 min readUK-based Hongkong and Shanghai Banking Corporation (HSBC), one of the world’s biggest banks by assets under management, has reportedly banned customers from trading the stock of business analytics firm MicroStrategy due to its links to BTC, as per a leaked email circulating on social media.

HSBC FUD

HSBC’s new “policies” on virtual currencies say that clients won’t be allowed to trade stocks that mimic the price movements of those assets.

“HIDC (HSBC InvestDirect) will not participate in facilitating (buy and/or exchange) products related to virtual currencies, or products related to or referencing to the performance of virtual currency,” a leaked screenshot of the email read.

It added, “ Records show your (HDIC) is holding MICROSTRATEGY INC-A — MSTR-US, a virtual currency product…new purchases or transfers-in will not be allowed.”

HSBC Bank preventing their customers from holding an equity because it has BTC on it's balance sheet!

Scared much @HSBC? You look pathetic. https://t.co/euOmteqUvt

— Preston Pysh (@PrestonPysh) April 8, 2021

The bank has, in recent times, come down hard on cryptocurrencies and their usage, with one such announcement from January stating it would no longer cater to clients engaging with crypto exchanges in the UK.

The BTC-Equity game

MicroStrategy has accumulated over 90,000 BTC in the past year, with CEO Michael Saylor intent on purchasing even more BTC each week. This has led to an increase in the stock prices of MicroStrategy, leading to some even referring to it as a pseudo-BTC ETF.

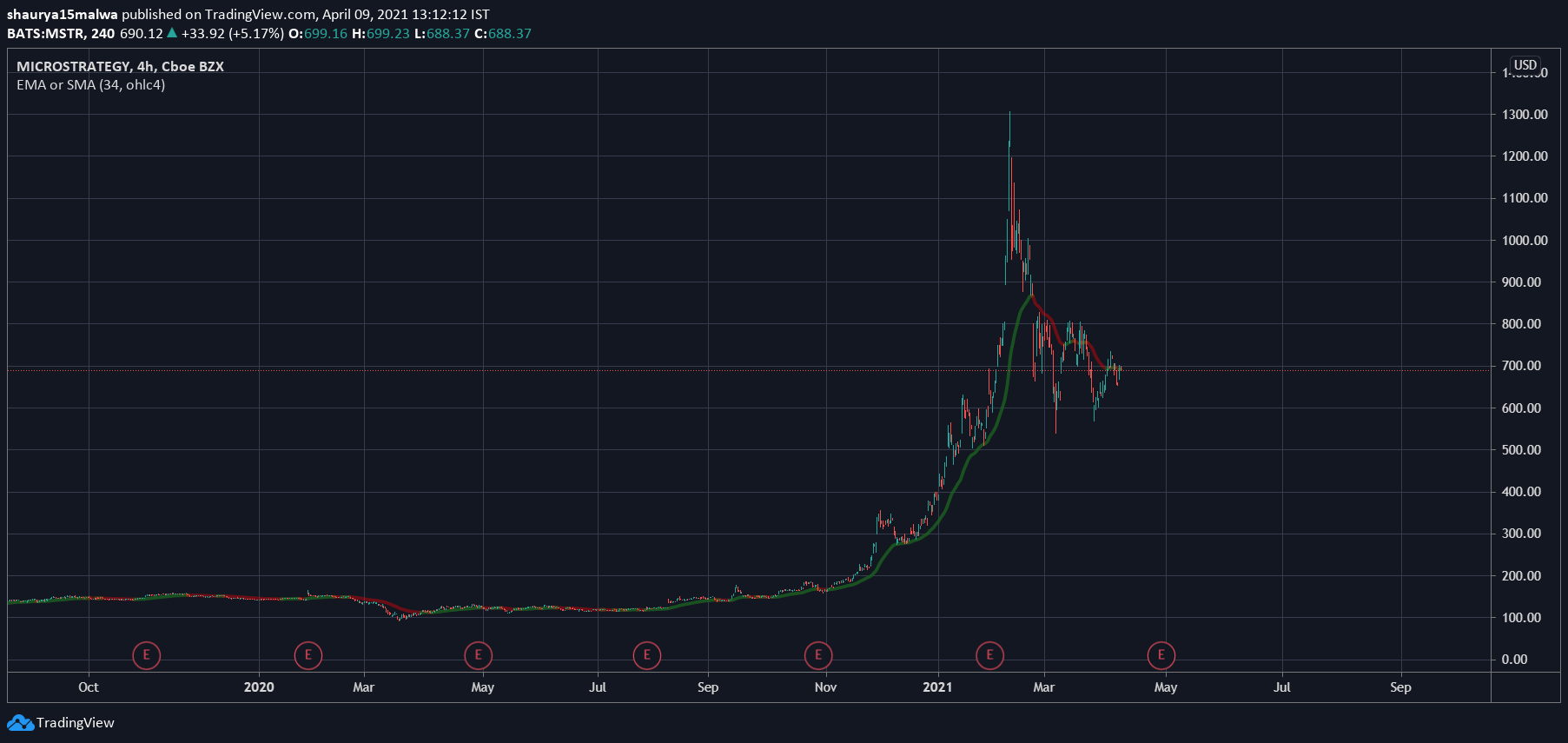

As the below image shows, MSTR has risen from under $142 in August 2020 (when it announced its first purchase) to over $1,100 in February 2021—a near ‘10x trade.’ BTC, on the other hand, went from under $10,000 to over $61,000 in the same period—displaying a trade with remarkable similarity.

Similar price movements have been seen in publicly listed companies with either hold or operate in BTC-related fields. The stock of Riot Blockchain (NYE: RIOT), for example, rose from a tiny $0.64 in March 2020 to over $77 in February 2021—a mammoth 11931.25% increase.

Meanwhile, the HSBC email is ironic considering the bank’s ties with an $880 million money laundering case in 2019.

The FinCEN Files probe revealed that HSBC aided a massive Ponzi scheme *while on probation* for laundering almost $1B for the Sinaloa cartel and other Mexican drug gangs.

But allowing their customers to own a BTC-related equity?

Too risky.https://t.co/RjcZAWemk1 https://t.co/P49keUjrkA

— Alex Gladstein (@gladstein) April 9, 2021

The post HSBC reportedly bans customers from trading this BTC-linked stock appeared first on CryptoSlate.

![Decentraland: Review & Beginner's Guide [current_date format=Y] 19 Decentraland: Review & Beginner's Guide](https://cryptheory.org/wp-content/uploads/2020/11/decentraland-02-gID_7-300x150.jpg)