Institutions continue to accumulate BTC. Interest in ETH also increased

2 min read

CoinShares traditionally publishes the results of the most watched cryptocurrency funds at the beginning of the week, which indicate the cryptocurrency sentiment among accredited solvent investors and institutions. Recent figures suggest that their interest in cryptocurrencies persists.

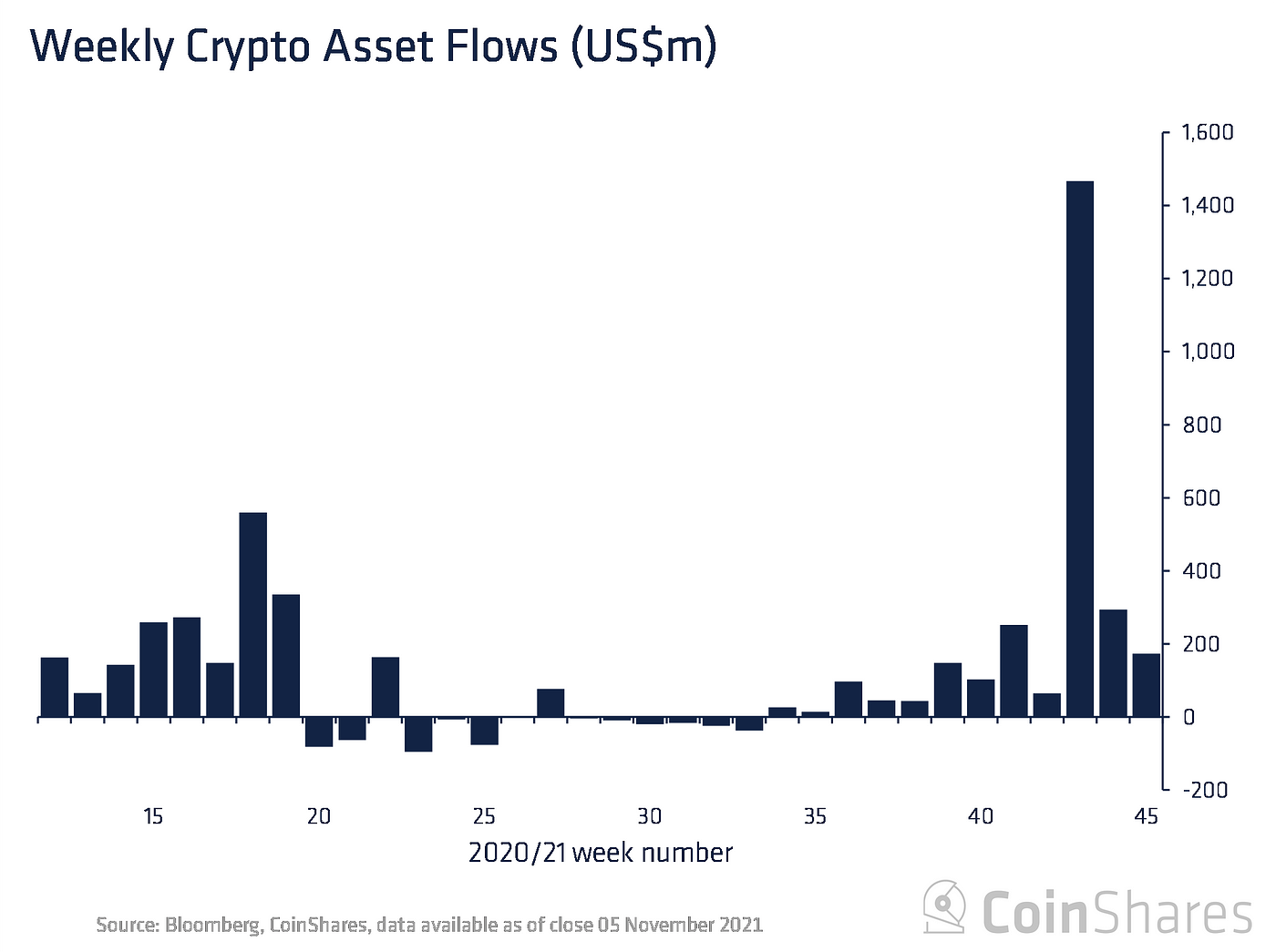

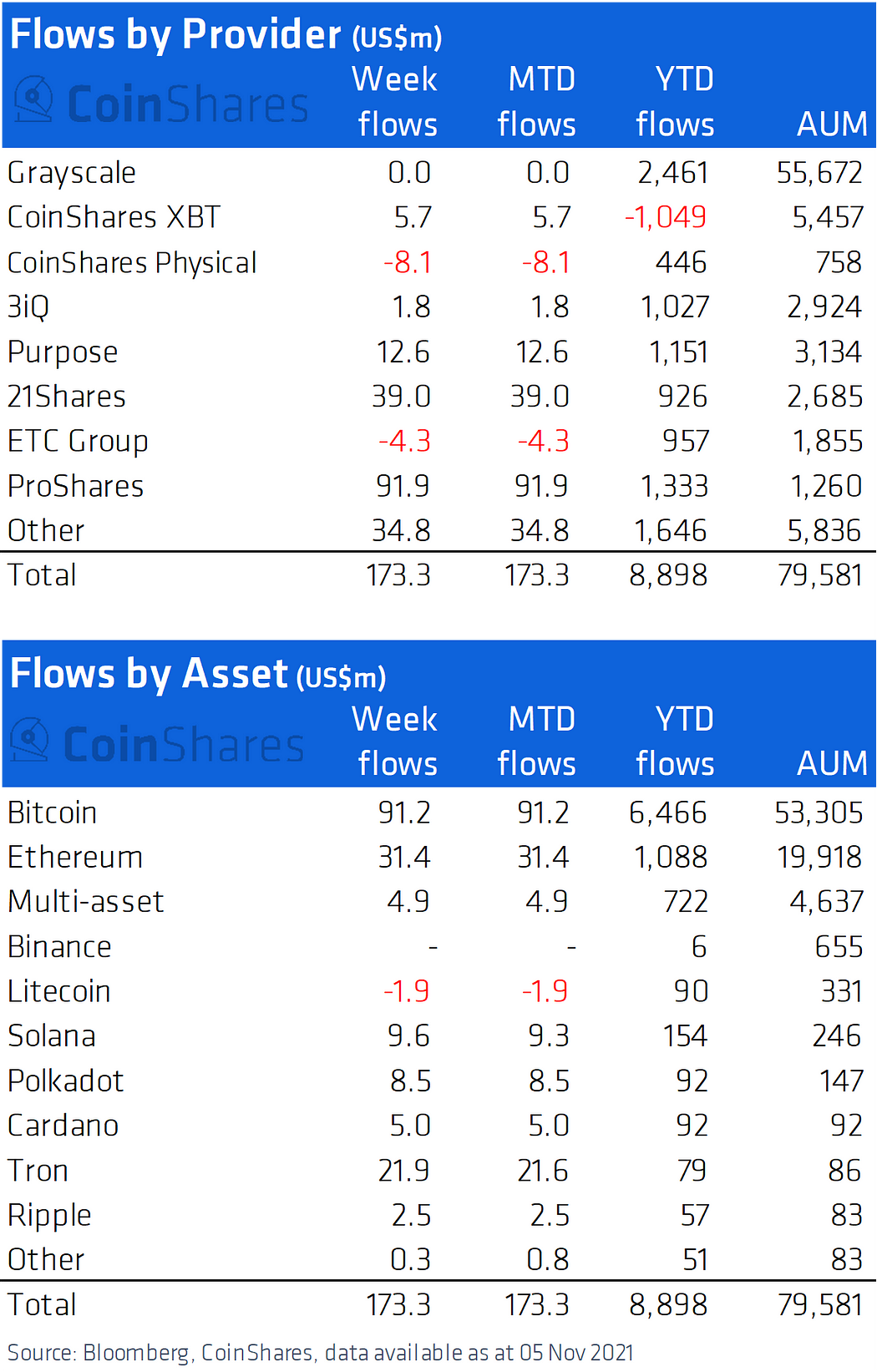

The recent Coinshares report, which reports on the performance of crypto funds in the business week ending November 5, reports that Grayscale, CoinShares, 3iQ, Purpose, 21Shares, ETC Group and ProShares received capital worth $ 173 million. It’s less than $ 287 million the previous week, or a record $ 1.45 billion two weeks ago (affected by the launch of BitShin Futures ETFs from ProShares), but it’s still one of the most significant weekly inflows in the first half of the year.

On the positive side, this is the 12th week in a row in which crypto funds have seen a significant inflow of capital than outflows. Bread broke at the end of the summer, when we witnessed 9 weeks out of ten, in which capital from the funds mostly decreased.

BTC sovereignly at the forefront of interest

As for BTC, which recorded the eighth positive week in a row, the institutions invested $ 91 million in it this time through the mentioned funds. The total value of managed capital tied to BTC for crypto funds is currently over $ 55.6 billion.

After a long period of time, investors also showed greater interest in ETH (ETH), which gained USD 31.4 million last week. Solana (almost 10 million), Polkadot (8.5m), and Cardano (5m) also finished in nice numbers.

The big surprise was the great interest in the cryptocurrency Tron (TRX), in which they invested up to $ 21.9 million. As a result, the total managed value of Tron’s investments in these crypto funds climbed to $ 86 million and significantly reached Cardano (92 million). At the same time, Tron overtook Ripple (XRP) in this indicator.