Institutions’ interest in BTC is not waning. They bought for hundreds of millions more

1 min read

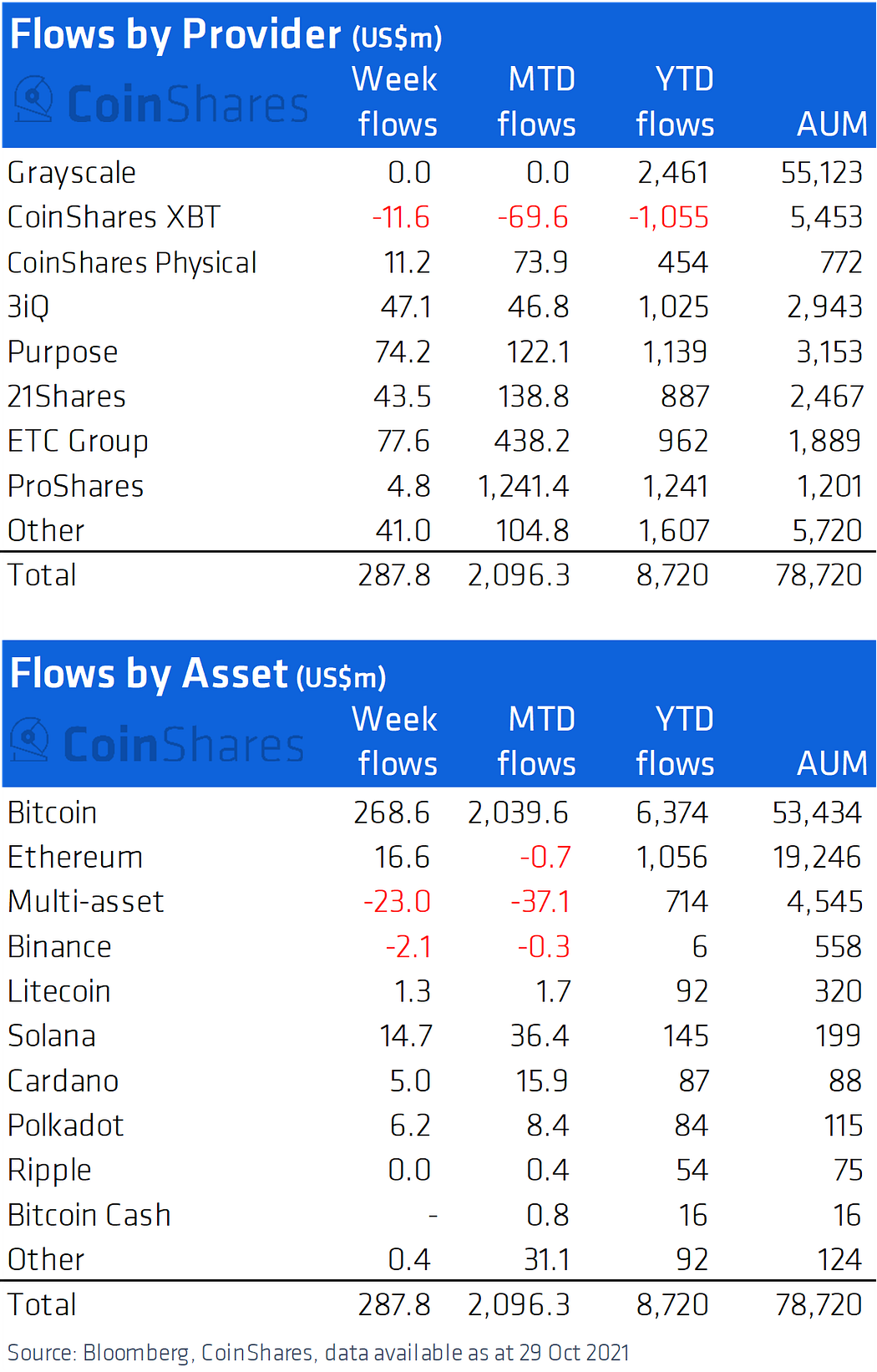

CoinShares traditionally publishes the results of the largest cryptocurrency funds on Monday, through which accredited investors and institutions probably have the easiest opportunity to invest in cryptocurrencies. Also, a recent report on the working week ending October 29 shows that institutions’ interest in cryptocurrencies continues to grow.

A record working week ending October 22, during which he was into funds Grayscale, CoinShares, 3iQ, Purpose, 21Shares, ETC Group and ProShares over $ 1.475 billion was far from over, but 5 working days last week was among the most successful in terms of capital inflows of nearly $ 290 million (the record week was mainly due to the launch of ProShares’ first BTC Futures ETF, which even outperformed the first gold ETF of 2004).

Traditionally, the biggest interest was in BTC, which poured another $ 268 million, bringing the total managed value of BTC-linked funds to $ 53.4 billion. In October 2021, a total of a record $ 2.039 billion flowed into them through these funds.

ETH also did well, gaining $ 16.6 million after three “red weeks” in a row. However, the October balance is slightly down 0.7 million USD.

As much as $ 14.7 million went to Solana, $ 6.2 million to Polkadot, and $ 5 million to Cardano. All of these cryptocurrencies also ended in monthly black balance sheets, with Solana (SOL) recording the largest inflow among altcoins in October, up $ 36.4 million.