JPMorgan Does an About Face, Turns Bullish on Bitcoin

2 min readWall Street bank JPMorgan has surprisingly turned bullish on bitcoin’s medium to long-term growth potential.

In its latest Flows & Liquidity report, JPMorgan reportedly stated that bitcoin will compete favorably with gold as an alternative currency in the coming years, as millennials take up a larger share of the total investment picture.

The contents were publicly revealed by Dan Tapiero, co-founder of 10-T Holdings, which is an investment fund focused on digital assets. Writing on his Twitter account, Tapiero expressed surprise at the bank’s uncharacteristically positive assessment of bitcoin.

Holy Cow

Most bullish commentary for #bitcoin that I have read from JP Morgan

"Even modest crowding out of #GOLD takes #bitcoin up multiples."

Widespread research piece reaches all clients of the bank.

Paypal announcement "cover" for other traditional players to get involved. pic.twitter.com/lUd8oYQ77h

— Dan Tapiero (@DTAPCAP) October 23, 2020

“Bitcoin Will Rival Gold”

Flows and Liquidity, which is edited by J.P. Morgan global market strategist Nikolaos Panigirtzoglou, previously expressed similar thoughts about bitcoin’s long-term growth potential. This time, however, the assessment went into great detail to analyze why the bank believes bitcoin has such vast upside potential.

According to the excerpt published by Tapiero, the comparison between bitcoin’s $240 billion total market cap and gold’s $2.6 trillion total stored value presents a massive growth opportunity for bitcoin. This is because as millennials take a bigger share in the total investment picture, they are likely to favor bitcoin over gold, at least to a modest extent. This leaves at least $2.2 trillion worth of value currently stored in gold bars potentially open for bitcoin investors to gobble up.

A quote from the excerpt provided by Tapiero reads:

“Even a modest crowding out of gold as an ‘alternative’ currency over the longer term would imply doubling or tripling of the bitcoin price from here. In other words the potential long term upside for bitcoin is considerable as it competes more intensely with gold as an ‘alternative’ currency we believe, given millennials would become over time a more important component of the investors’ universe.”

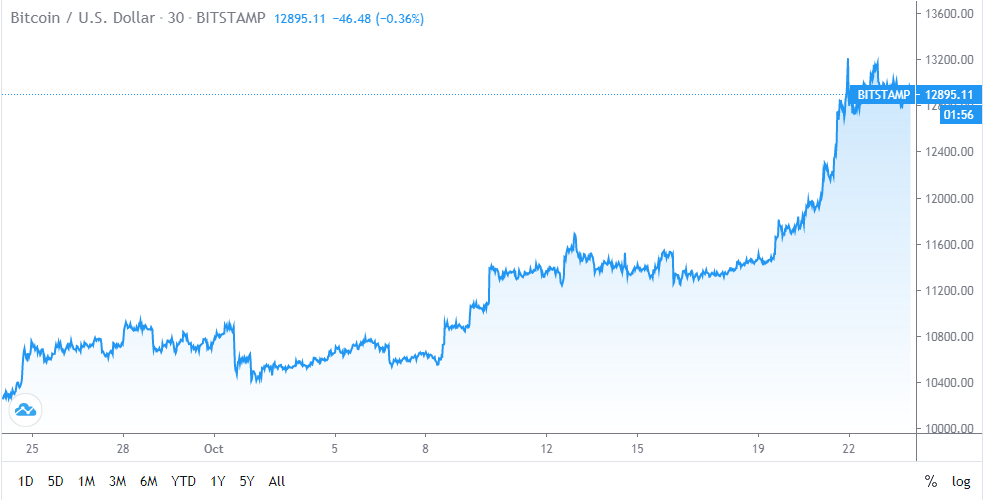

Bitcoin Bullishness Matches JPMorgan’s Assessment

According to the Flows and Liquidity excerpt, corporate trends including PayPal’s recent announcement are already having a significant positive net effect on bitcoin’s price. This is expected to continue. BeinCrypto recently reported that bitcoin jumped 7% after PayPal decided to permit users to buy, sell and hold crypto from January 2021.

The bank’s overall assessment is that while bitcoin remains susceptible to price shocks due to profit-taking in the short term, its long-term prognosis remains very positive due to the expected millennial shift from gold to bitcoin.

The post JPMorgan Does an About Face, Turns Bullish on Bitcoin appeared first on BeInCrypto.

![Decentraland: Review & Beginner's Guide [current_date format=Y] 19 Decentraland: Review & Beginner's Guide](https://cryptheory.org/wp-content/uploads/2020/11/decentraland-02-gID_7-300x150.jpg)