Over 231,000 Bitcoins Sold – Can the Market Absorb the Sell-off?

2 min readLast week, more than 231,000 Bitcoins ($ 2.54 billion) and 3.5 million ethers ($ 1.05 billion) acquiring profit of over 25 percent were sold. BTC prices are more than USD 11,500 (the highest price since August 2019) and higher by more than 70% year-on-year. Since declining to $ 3,800 in March, it has added over 200% of its value. The Etereum also rose sharply to a two-year high. So the question arises – can the market absorb this sale?

Realizing profit is natural. If an asset grows by 25%, investors who are not “typical creditors” usually try to liquidate their shares. Some invest back in the asset that led them to such profits, while others diversify or spend. The report does not mention the direction in which this sale took place, ie either reinvestment, diversification or any other path, but only mentions that the sale took place.

Can the market absorb such a sell-off?

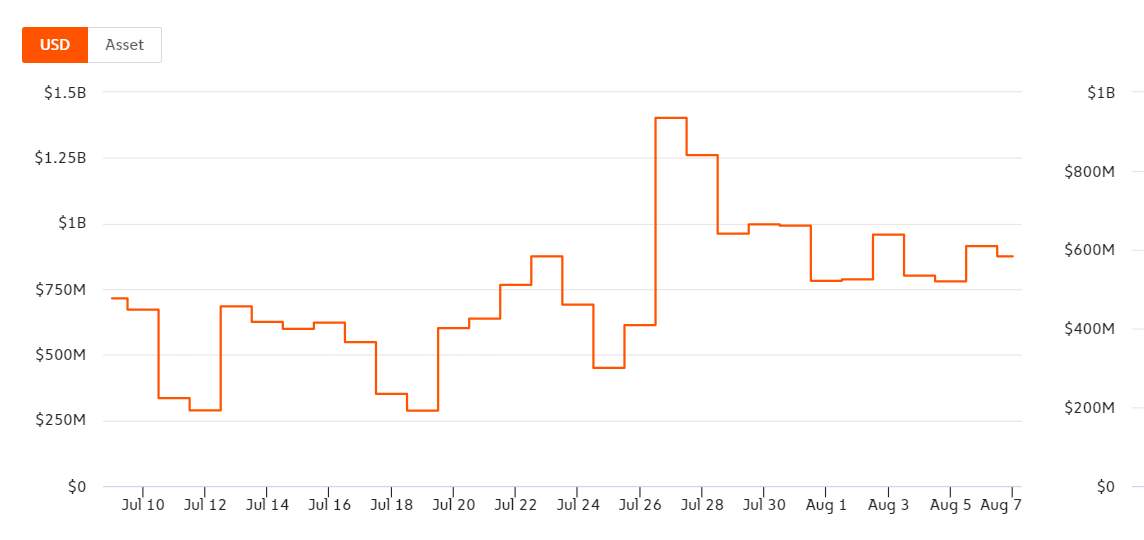

Given that the report states that the aim was to “make profits”, it is likely that cryptocurrencies were sent for disposal, either through exchanges or otherwise. In addition, the report said that the influx of Bitcoins into the crypto exchange was 7.4 million BTC in August.

This increase in liquidation is similar to that of February 2020, at a time when Bitcoins exceeded $ 10,000 for the first time in a calendar year. However, a month after this increase, it fell below $ 4,000. The report added that the decline between the rise and fall in mid-March was due to “market absorption”.

Given these figures and the fact that the price is now above February 2020 levels – can the market absorb such oversupply? Looking back on 2017, the report stated that the amount of profit on the BTC market is “relatively low” due to the price increase.

Compared to the previous increase in BTC, it was possible to sell a larger number of Bitcoins in December 2017 and July 2019. However, the market is not at such a level of demand.

There are people who hodl to expect price increases and there are those who liquidate when the price in their eyes reaches the limit. If the latter outnumbered the former, the rush to liquidate would lower the market price.

That was a week ago, when the price fell just after exceeding $ 12,000. Now that the price has survived this decline and more than $ 11,500 has been traded since then, a new level will need to be discovered that could lower prices. At this level, once the hodlers are surpassed, the rush to liquidate will continue and market absorption will come into play again.

image source: tinyurl

You might also like: These Are the Most Rewarding Bitcoin Faucets in August 2020

![Decentraland: Review & Beginner's Guide [current_date format=Y] 26 Decentraland: Review & Beginner's Guide](https://cryptheory.org/wp-content/uploads/2020/11/decentraland-02-gID_7-300x150.jpg)