Does already 11% of people own cryptocurrencies? Do you know where they are most popular?

2 min read

The Australian company Finder conducted a survey of more than 40,000 respondents in 22 different countries to analyze the adoption of cryptocurrencies from a demographic perspective.

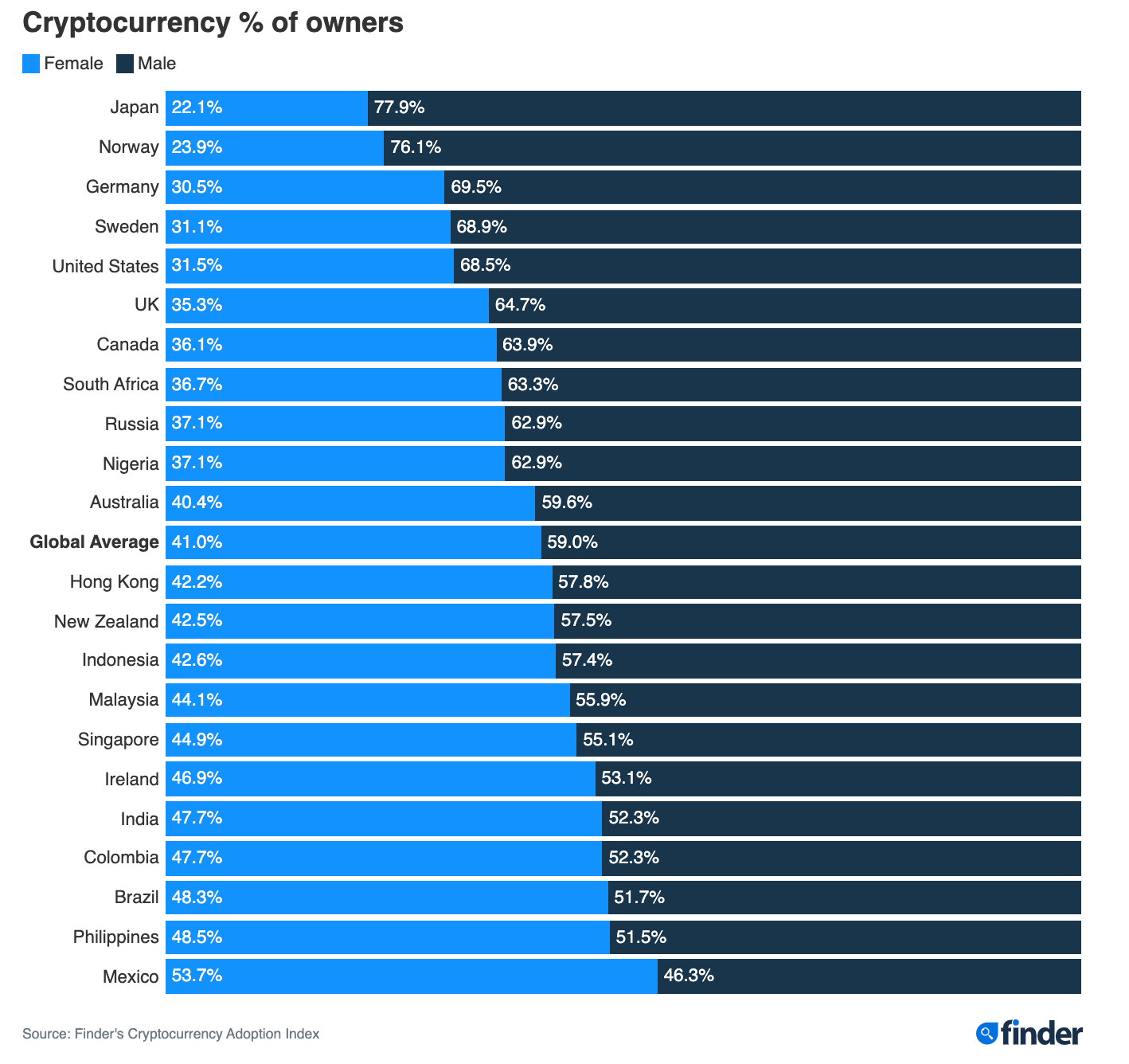

The numbers brought by the Finder revealed several interesting facts. For example, in only one of the monitored countries is the adoption of cryptocurrencies among women higher than among men – it is Mexico, where women have a 53.7% market share. However, women from Philippines, Brazil, Colombia, India, or Ireland are very close to 50%. On the contrary in Japan, Norway, Germany, Sweden or v USA make up only 20 to 30%.

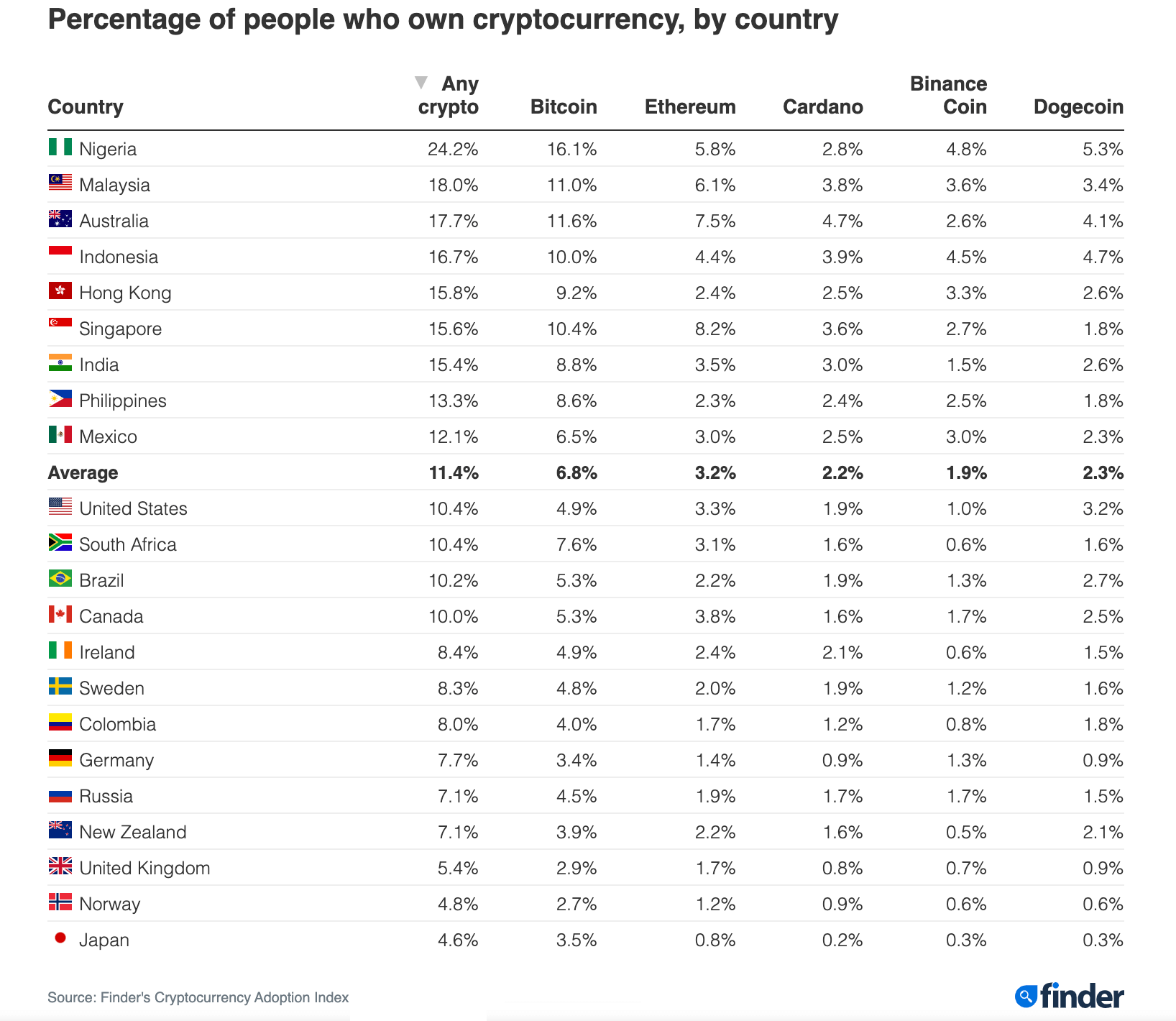

In terms of percentage of the total population, we would find the most holders of cryptocurrencies in Nigeria, where according to the survey own almost every fourth person (24%). It is the most popular among Nigerians BTC which owns 16% of the population. Follows ETH, Dogecoin, Binance Coin a Cardano.

On second place after Nigeria is Malaysia and the third is Australia. In all 22 countries surveyed, BTC is the most dominant cryptocurrency in their portfolio.

In terms of average survey figures, 11.4% of people hold cryptocurrencies. BTC is present in 6.8% of the population, ETH in 3.2%, Cardano in 2.2%, Binance Coin in 1.9% and Dogecoin 2.3%. Dogecoin’s figures show how much influence Elon Musk and the retail frenzy had on investors.

BTC is most popular in Japan, where it is held by 76.7% of people who have some cryptocurrencies in their portfolio. ETH was most successful in Singapore (52.4% of cryptocurrency holders) and Cardano in Australia (26.3%). Binance Coin has the largest fan base in Indonesia (26.9%). Well, as far as Dogecoin is concerned, it is doing best in the US, where it is held by about 30% of cryptocurrency investors.

How many people already own cryptocurrencies?

If we tried to translate the findings of the survey into global figures, we would find that more than 700 million people own cryptocurrencies, a figure that goes beyond current estimates from other surveys. The most common assumption is that about 5% of the world’s population owns or has invested in cryptocurrencies, which can be around 300 to 350 million people.

Cryptocurrency fans rely on the so-called network effect, in which the adoption of a given technology begins to grow parabolically the moment it gains support from a sufficiently large sample of people. In other words, if 10% of people used cryptocurrencies, most likely another 10% would be added at a much faster rate than the first ones – similar to what happened on the Internet or social networks such as Facebook.