Polkadot analysis – When will DOT break out?

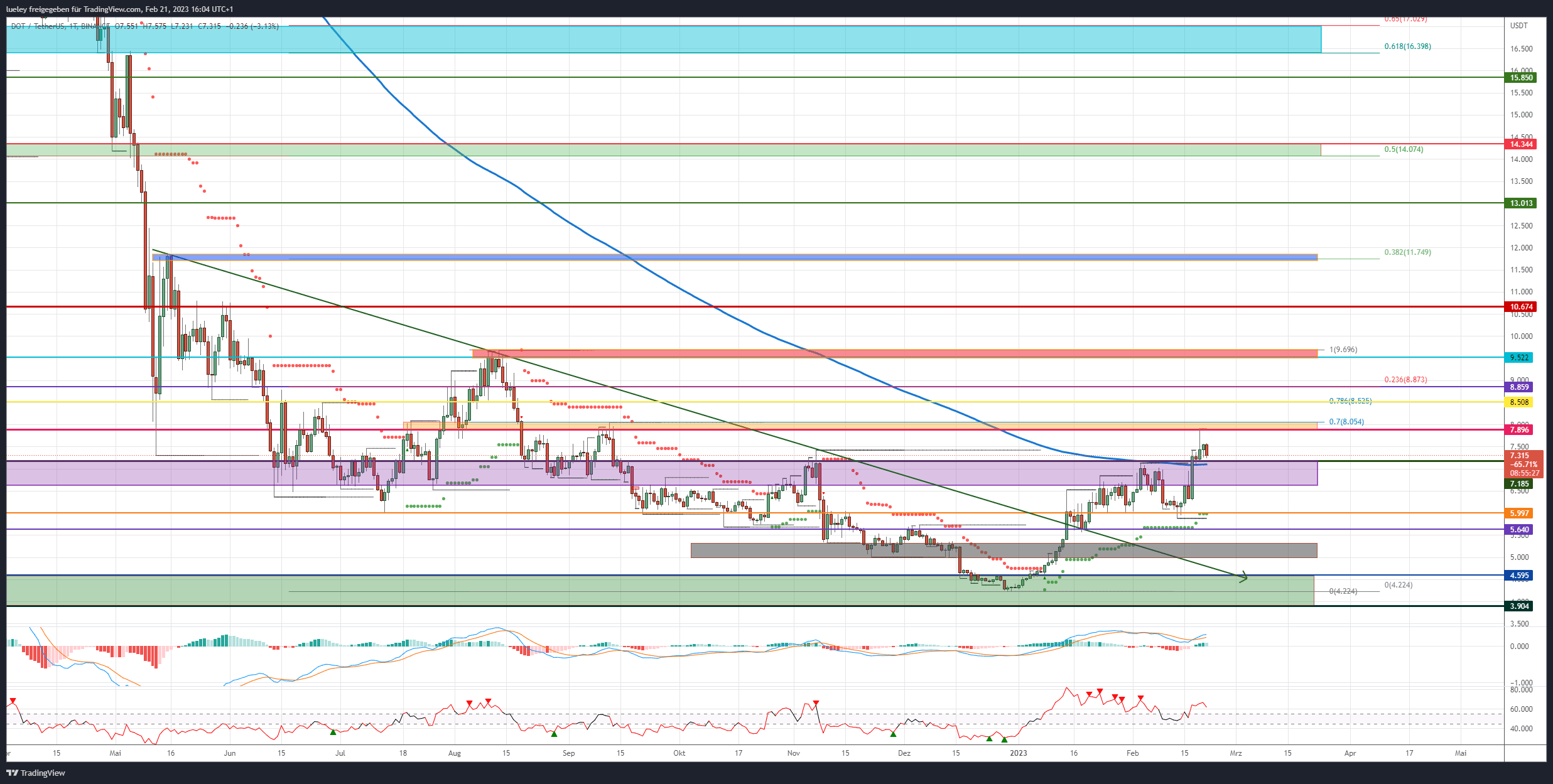

3 min readThe layer 0 blockchain Polkadot (DOT) had recently become quiet. Although the project saw an all-time high in developer activity in the last quarter of last year, this positive development did not affect the DOT price. Increasingly, however, the updated rodmap of the crosschain-enabled Ethereum competitor could bear fruit. Since the beginning of the year, the DOT price has risen by 86 percent to the north and was able to recapture the strong cross-resistance from EMA200 (blue) and the horizontal resist line at US$ 7.20 a few days ago.

While Polkadot initially rebounded south near the September 2022 high of $7.89 last Sunday, February 19, stabilization above the 200-day moving average line would be a key milestone for further gains courses in the coming period. The fact that many other cryptocurrencies from the Polkadot ecosystem, such as Moonriver (MOVR) and Moonbeam (GLMR), have also recorded steady price gains could indicate that the high level of developer activity should increasingly pay off.

Polkadot: The bullish price targets

Bullish price targets: 7.89/8.05 USD, 8.52/8.87 USD, 9.52/9.69 USD, 10.67 USD, 11.75 USD, 13.01 USD, 14.07/14.34 $15.85, $16.40/$17.23

The DOT course has been able to pick itself up significantly in the last few weeks and is currently trying to stabilize around 7.20 US dollars.

If the DOT price stabilizes above USD 7.20 in the coming days and jumps back towards the monthly high of USD 7.89, a first directional decision can be expected.

If the orange zone is breached around US$8.05, a subsequent rise to US$8.52 is to be planned. A direct march through to the higher 23 Fibonacci retracement at $8.86 would also be conceivable.

If Polkadot breaks above this price level as of the daily closing price, an important price decision will occur in the red resistance area between US$9.52 and US$9.69. The price high from August 2022 runs in this zone. The first profit-taking should be planned for here.

If this resist is recaptured, the chart picture will continue to brighten and the next strong resist in the form of the 38 Fibonacci retracement at $11.75 will come into focus. The bulls are likely to struggle here at the first attempt.

Only when the blue resistance area has been broken through sustainably could Polkadot rise to the green resist zone at the higher-level 50 Fibonacci retracement with an intermediate stop at US$ 13.01.

The $14.07 to $14.34 area currently represents the maximum derivable upside area for Polkadot.

Polkadot: The bearish price targets

Bearish target price: 7.18 USD, 6.63 USD, 5.99 USD, 5.32/4.98 USD, $4.59, 4.22 $3.90

If there is a false breakout and Polkadot slips below the EMA200 at $7.28, the consolidation initially expands to $6.63.

If the bottom of the purple zone fails, the sell-off will extend to multiple support at $5.99. This mark has acted as a good support several times in the past. In addition, the super trend in the daily chart runs here. A countermovement is therefore likely.

However, if the bears manage to dynamically break this support, the correction will gather momentum and is likely to retreat above $5.64 towards the gray support zone of $5.32 – $4.98. Here, the buyer side must show their colors in order to prevent a relapse to the area of the previous year’s low.

However, if this support area is also abandoned in the course of an ongoing overall market correction, Polkadot is likely to lose further ground and break away towards the support at USD 4.59. This price mark has acted as resistance several times in the past and later as support.

If the Bitcoin price also falls back below 20,000 US dollars, a renewed test of the annual low at 4.22 US dollars should be planned. Even a fresh low of around $3.90 cannot be ruled out. From the current chart view, this price mark represents the maximum bearish price target for the coming trading months.

Looking at the indicators

From an indicator perspective, the RSI still has a buy-signal in the daily chart after falling back into the neutral zone. As long as the lower edge of the neutral zone at 45 is not breached, all indicators speak for a bullish continuation of the trend. The MACD indicator also has a lot of room to go up and supports the bullish scenario.

If Polkadot can continue its positive trend of the last few weeks, new buy signals should also be planned in the weekly chart. Fresh long signals on a weekly basis should give the DOT price a further boost in the medium term.