Record-breaking Bitcoin even on Friday 13th

4 min readTable of Contents

Today, Friday 13th, BTC challenges superstition by setting a new record. In the last few hours, the prices of Bitcoin have been rising to $16,500, the highest level since January 7th, 2018.

This trend seems to know no stopping and if it were confirmed also in the weekend, it would see Bitcoin achieve the 5th consecutive week on the rise. A better trend over the last year only developed between mid-March and the end of April with 7 consecutive positive weeks. However, it was a much smaller gain than the one that has been developing since the first week of October.

We were at $10,500, today prices are about +$6,000 from those levels.

To find such important gains it is necessary to look back to the unrestrained race at the end of 2017. These are numbers that do justice to Bitcoin and increase the euphoria, but this must be taken with due caution because the rise is starting to become significant. Bullish trends always need in-depth analysis, keeping feet on the ground. An upswing without breaks is not physiologically feasible in the long term.

Bitcoin is being observed with amazement by the rest of the sector, where 75% of the cryptocurrencies are in positive today.

When looking at the balance of weekly earnings, over 70% of the top 20 are above parity. Bitcoin and Ethereum have been earning more than 5% since last Friday. Chainlink (LINK) does better than the two of them, which with the increase of the last few days sees a performance on a weekly basis that goes over 11%. This is the only double-digit sign among the top 20.

The tokens of the DeFi universe are still among the best upturns of the day. The best one is SushiSwap (SUSHI) and Decred (DCR), both going over 15%. Followed by Uniswap (UNI), Decentraland (MANA), Yearn Finance (YFI) and Aave (AAVE) all up 6%.

Among the best of the day, there is also Litecoin (LTC) with a gain of 8% in the last 24 hours.

Record volumes not only for Bitcoin

The week also saw a record volume in the spot market.

Yesterday Bitcoin traded 4.3 billion in dollars. This is the third time in a week that it has recorded such high trades, which are also confirmed for units of bitcoin traded, more than 250.000, which remain below the highs of the year, but are the highest since mid-October.

In addition to the spot market, derivatives volumes are also flying. Yesterday, with more than 6.1 billion in dollars, a new record was set for open interest in aggregate future volumes. Derivatives in options also updated the record yesterday with around 3.8 billion dollars.

Volumes in general see total trade over $145 billion, slightly up from yesterday’s levels.

The crypto market cap

The rise in the last few hours continues to strengthen Bitcoin’s dominance, at 65% with a total market cap of $463 billion. This is the highest level since February 2018, thanks to Bitcoin’s capitalization which, with today’s increases, brings it to over $300 billion, which Bitcoin had not recorded since December 2017. This also drives the total capitalization upwards.

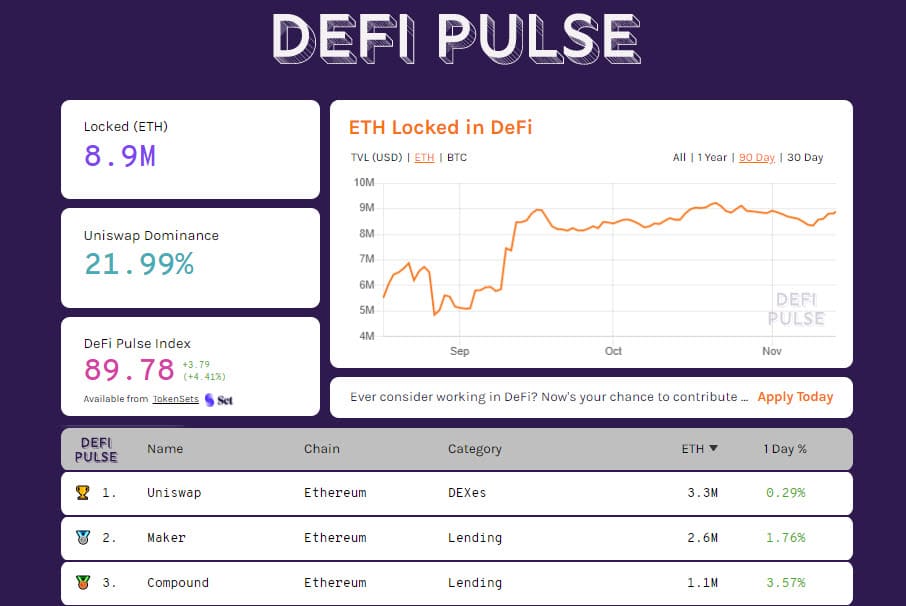

DeFi sets a new record for TVL at $13.8 billion. The number of locked Ether rises to 8.8 million. Uniswap strengthens its dominant position with over 3.8 billion locked on its protocol. Maker drops below 3 billion again.

Bitcoin (BTC) aims for $20,000

Bitcoin continues to rise, increasingly separating itself from the correlation with both gold and the US S&P 500 stock index. Both continue to show signs of weakness in recent days while BTC continues to strengthen with a rise that in these hours activates new records at $16,500.

This also attracts speculation and the fear of short-term reversals, which must be taken into account: these are likely to occur after rises that have not been halted so far. This can also be seen from the activity of the last 48 hours of operators in options that increase the sale of calls, even if the strength of the calls has decreased again.

There is a strong attraction of coverage as purchased put positions, which definitely affects important levels in the event of a turnaround, levels that would give signals of support between $15,100 and 13,800.

These are the protected areas in the event of possible falls over the weekend.

Upwards, an overcoming of the 16,600 dollars would project prices to the next level of 17,200 dollars, where there’s the last barrier of resistance, after which there’s room for what is identified as the next target, the absolute historical maximum of 20,000 dollars in December 2017.

Ethereum (ETH)

The recovery of the 470 dollars occurred in the last hours finds again the action of the coverings that rejects the prices of Ethereum at 460 dollars.

It will be important for ETH over the weekend to confirm the support of the $455, a former resistance area that in the first week of November had repeatedly rejected attempts to increase. This area has also become valuable support for options hedging. Put options hedges are confirmed, with operators maintaining a bullish view.

It would be important to break the $470 and $490, which in any case coincide with the record annual highs reached at the beginning of September.

The post Record-breaking Bitcoin even on Friday 13th appeared first on The Cryptonomist.

![Decentraland: Review & Beginner's Guide [current_date format=Y] 31 Decentraland: Review & Beginner's Guide](https://cryptheory.org/wp-content/uploads/2020/11/decentraland-02-gID_7-300x150.jpg)