REEF, LUNA, and BTS Technical Analysis for February 22, 2021

3 min readThe Reef (REEF) price has reached a confluence of support levels and should initiate a bounce soon, breaking out from its current pattern.

BitShares (BTS) is currently in the process of validating the previous all-time high resistance area as support. As long as it’s trading above, the trend is bullish.

Terra (LUNA) has potentially reached the top of its parabolic move and should correct in the near term.

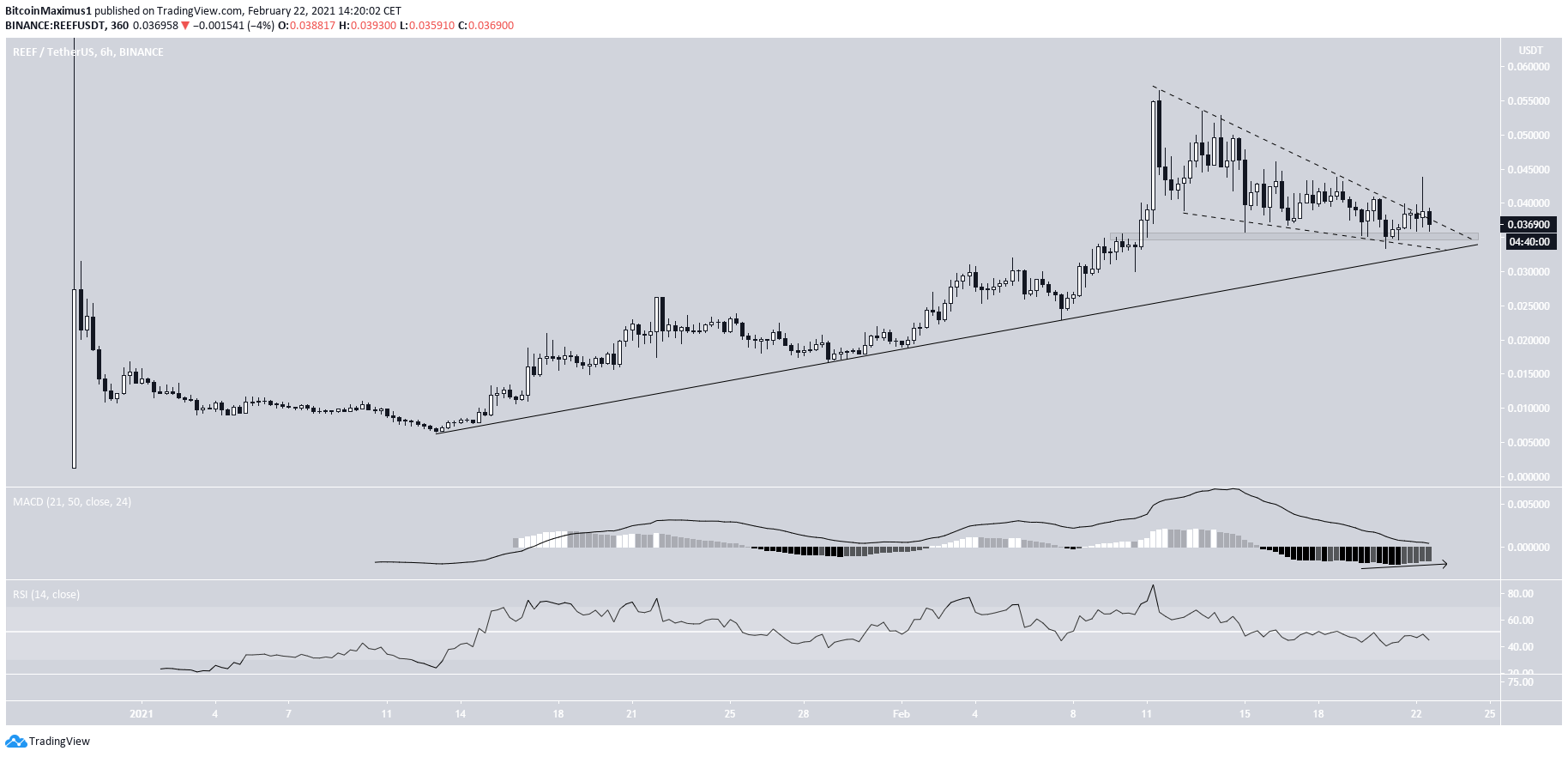

Reef (REEF)

REEF has been following an ascending support line since reaching a low on Jan. 11. So far, it has validated it three times and is close to doing so for the fourth time.

The ascending support line also coincides with the minor $0.036 support area and the support line of a potential descending wedge, which is a bullish pattern.

While the RSI is neutral, the MACD supports the possibility of a breakout and the continuation of the upward movement afterward. Therefore, REEF should break out from its current pattern and continue moving higher.

The wave count suggests that REEF is in an extended third wave (orange), currently trading in its fifth sub-wave (black).

The most likely target for the top of the current move is between $0.071-$0.073, found by using a combination of external retracements and fib projections.

Highlights

- REEF is in the process of breaking out from a descending wedge.

- It is likely in the final sub-wave of the third wave.

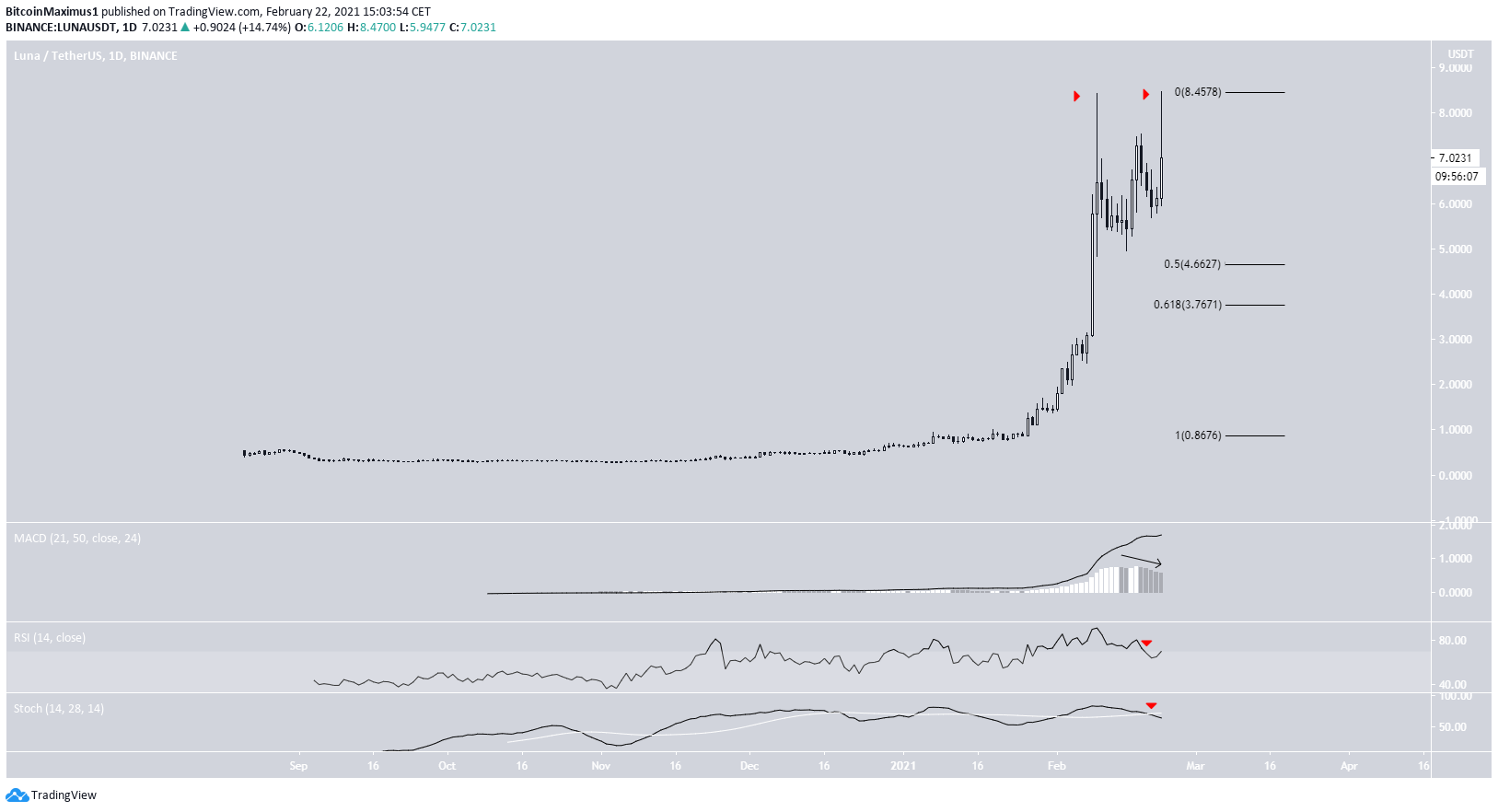

Terra (Luna)

LUNA has increased rapidly since the beginning of Feb. when it was trading close to $1. So far, it has reached an all-time high price of $8.45, doing so on Feb. 9 and 21. However, both times it left a long upper wick in its wake and was rejected.

Technical indicators are bearish, since the MACD is decreasing, the RSI has crossed below 70, and the Stochastic Oscillator has made a bearish cross. Therefore, LUNA is likely to fall towards the 0.5-0.618 Fib retracement levels at $4.66 and $3.76, respectively.

Highlights

- LUNA has twice been rejected from the $8.45 resistance area.

- Technical indicators are bearish.

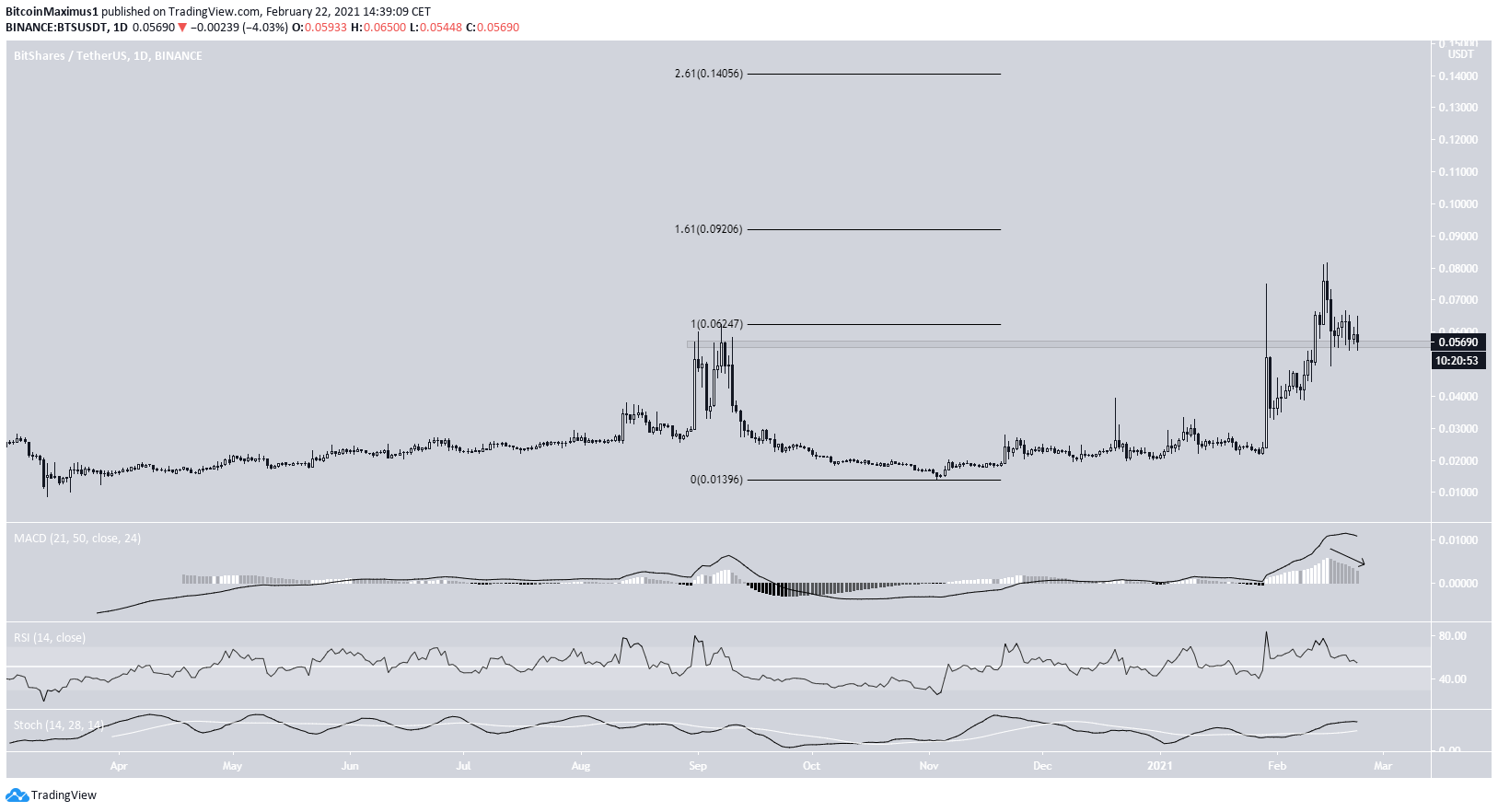

BitShares (BTS)

On Feb. 10, BTS broke out above the $0.056 resistance area, which had previously been in place since the all-time high price of Aug. 2020.

BTS reached a high of $0.081 on Feb. 14, but has been moving downwards since, and is currently in the process of validating the $0.056 area as support.

Despite the falling MACD, the RSI and the Stochastic Oscillator are still bullish. If BTS manages to bounce, the next closest resistance areas would be at $0.092 and $0.14, respectively.

The shorter-term six-hour chart shows that BTS has been trading inside a symmetrical triangle, and is approaching the point of convergence between resistance and support. Therefore, a rapid move in one direction is likely.

If BTS manages to break out and then clear the $0.065 minor resistance area, it would confirm the bullish trend. While there are no short-term signs that would suggest this will occur, the daily time-frame supports the possibility of a breakout.

Highlights

- BTS is in the process of validating the $0.056 area as support.

- It is trading inside a symmetrical triangle

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

The post REEF, LUNA, and BTS Technical Analysis for February 22, 2021 appeared first on BeInCrypto.

![Decentraland: Review & Beginner's Guide [current_date format=Y] 31 Decentraland: Review & Beginner's Guide](https://cryptheory.org/wp-content/uploads/2020/11/decentraland-02-gID_7-300x150.jpg)