Sentiment on the crypto market is declining, no coins are in the positive zone

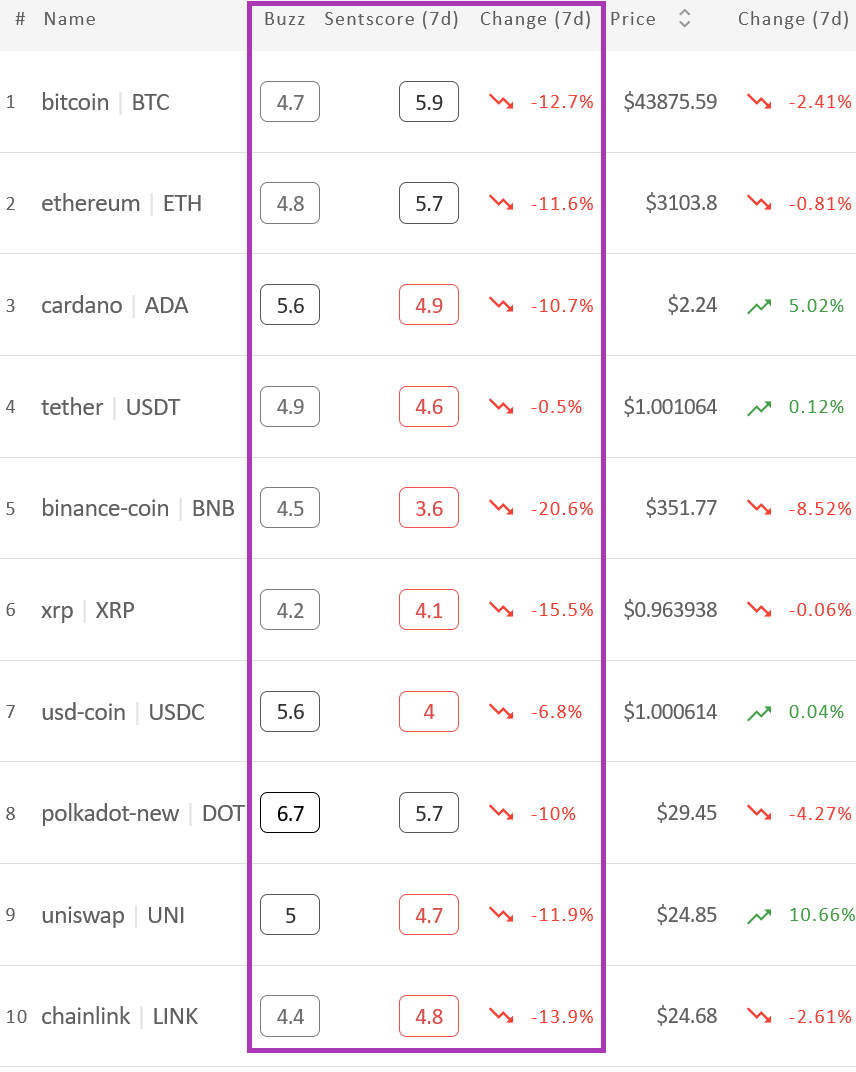

1 min readThe fifth red week in a row pulled sentiment on the crypto market below the score of 5. According to the analyst firm, the average seven-day value of crypto market sentiment (sentscore) for the ten main crypto assets Omenics decreased to 4.8 from 5.43 a week ago.

Sentiment on the crypto market is declining

All coins have been red for the past week, with most of them experiencing significant double-digit declines. At the very top of this list is the Binance coin (BNB) with almost -21%. Next in line is the XRP with -15.5%, while Chainlink (LINK), Bitcoin (BTC), Uniswap (UNI) and Ethereum (ETH) recorded a decrease in metrics between 14% and 12%.

In addition, all coins this week left the positive zone. BTC is now closest to it with 5.9, while ETH and Polkadot have 5.7 each. And these are also the only three coins that now score above 5.

Not only are the other coins on the list now at 4-4.9, but one has fallen into the negative zone: the BNB now has a 3.6 sentscore.

Interpretation of the sentscore scale:

- 0 to 2.5: very negative

- 2 to 3.9: quite negative zone

- 4 to 5.9: neutral zone

- 6 to 7.49: quite positive zone

- 7.5 to 10: very positive zone.

ATOM is the only coin among the top 25, located in the positive zone with a score of 6.2. Eight others have scores above 5 and four coins are now in the negative zone: QTUM, ZRX, NEO and nem (XEM), all with sentscore ranging from 3.8 to 3.9.

Top alternative exchanges for Binance without KYC verification