Shortly from the Cryptoworld

3 min readTable of Contents

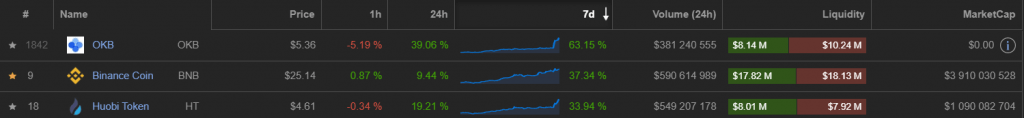

Crypto exchange coin on the rise

Yesterday’s fall of the BTC pulled most coins with it. That is, except the crypto exchange coins headed by Binance. Crypto exchange coins are tokens that have been included by stock exchanges in their ecosystems and provide various benefits to their holders.

Over the past 24 hours, the Okex Token scored 40%. Right behind him is Huobi Token, which gained 18.53%. This is followed by Binance with his BNB, which gained 11% in 24 hours. Smaller exchanges that attributed profits also include the Bibox token. He scored 27 percent last day.

Crypto exchange coins often move together because their function and application is very similar. Especially launching IEO platforms is a great attraction. The IEO (inicial exchange offering) is safer than ICO, which was very popular. The rise of stock coins was last signaled by the bull run.

Tether will now also be on Algorand

Tether is by far the largest stablecoin. This means that its price is directly linked to the dollar. Basically, Bitfinex, behind Tether, has dollars to cover the price of the token. The tether is now upgrading to Algorand (primarily exists on ETH as an ERC 20 token).

Algorand is a new PoS network by Silvio Micali, who transformed modern cryptography and won the most prestigious award (Turing Prize) in computer science. The existence of Tether on the Algo blockchain will enable Algorand to become more competitive.

Stable coins in the form of tokens on smart chains make it possible to overcome one of the biggest problems of today’s cryptocurrency world and that is price volatility. Volatility, for example, prevents businesses from implementing blockchain solutions. It would be problematic for businesses to accept cryptocurrencies on a large scale and their price subsequently dropped.

Institutions should invest some of the capital in Bitcoin, VanEck says

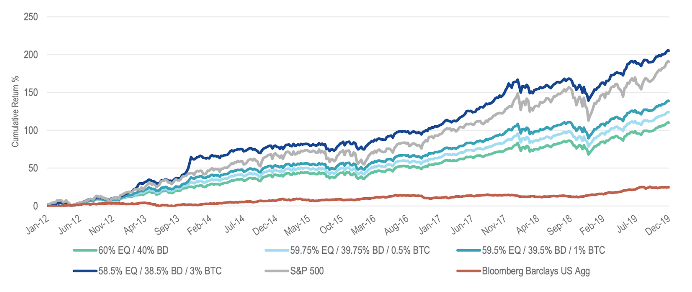

VanEck, which unsuccessfully tried to obtain approval from the US Securities and Exchange Commission (SEC) for Bitcoin ETF last year, published a report according to which institutional investors should transfer part of their investment capital to Bitcoin. They refer to various investment portfolios in which BTC investments were or were not included.

“Small bitcoin allocation has significantly increased the cumulative yield of the various portfolio mixes,” VanEck points out. From the graph below, it is possible to compare how the investment portfolios developed (since 2012), which included a small investment in Bitcoin and in which it did not. While 60% in equities and 40% in bonds fell worst (green line), the portfolio holding 58.5% of equity in shares, 38.5% in bonds and 3% in Bitcoin (blue line) was the most profitable. In the second place was the portfolio with an investment exclusively in S & P 500 shares.

Coronavirus slows China’s economy, analysts say

According to several analysts, the Chinese economy is likely to slow down, which may aim to push the price of Bitcoin up. Analysts are lowering the forecast for the coming months of this year.

Some services are suspended in many parts of the country because it is recommended that Chinese citizens stay safe at home.

[coinlib-widget type=1 coinid=859 prefcoinid=1505 dark=0]

![Decentraland: Review & Beginner's Guide [current_date format=Y] 25 Decentraland: Review & Beginner's Guide](https://cryptheory.org/wp-content/uploads/2020/11/decentraland-02-gID_7-300x150.jpg)