Solana represents up to 86.6% of the weekly inflow into crypto investment products

1 min read

Institutional traders currently Solana is mainly interested, while demand for ETH and BTC is leveling off. SOL investment products accounted for a huge 86.6% of the total inflow into crypto investment products last week.

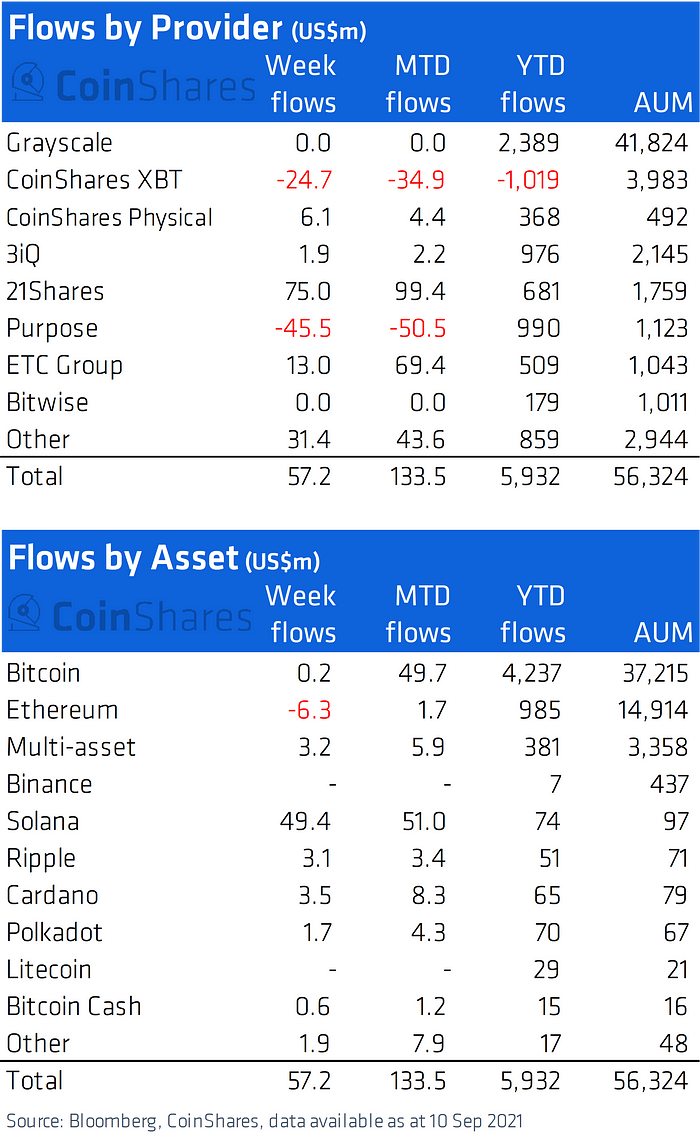

According to CoinShares Digital Asset Fund Flows Weekly recorded Solana’s investment products between September 6 and 10 an inflow of $ 49.4 million. The combined total inflow of cryptoinvestment products was $ 57 million per week. SOL noted year-on-year increase by 275%, which represents 86.6% of the total inflow.

The growing interest in Solana products coincided with that SOL price increased by 36% in the same period. Digital asset products have been growing for the fourth week in a row, with demand for altcoins significantly outweighing BTC products. They recorded a minimal influx, only $ 200,000.

Solana leads the altcoins

The inflow was also partially offset by institutional investors. They reduced their exposure to ETH worth $ 6.3 million as the price of the asset fell 10% during the week.

Cardano expected the introduction of smart contracts on 13 September. Nevertheless, the institutional flows following the ADA decreased by 46% compared to the previous week.

According to CoinShares estimates, institutional asset managers currently represent a total AUM of $ 56.3 billion combined. This represents a decrease of 9% compared to the previous week. Grayscale remained dominant, accounting for 74% of AUM at $ 41.8 billion.

Top alternative exchanges for Binance without KYC verification