Some crypto exchanges only serve risky entities on the darknet

2 min readDarknet transactions are natural for the bitcoin ecosystem, unfortunately. To think about banning such transactions, however, would be a violation of the basic features of what makes the cryptocurrency truly decentralized. Although it has been many years since the famous Silk Road, the first major use of BTC in illegal e-shops, transactions using this cryptocurrency are constantly growing.

Shift in the use of exchanges by entities on the darknet

According to a report by Bitfury’s Crystal Blockchain, the amount of BTC sent and received by entities on the darknet increased in 2020. For example, in the first quarter of 2017, the value of Bitcoins sent to these entities was $ 85 million, and in the first quarter of 2020 it was $ 411 million, a jump of 380 percent. BTCs received from darknet entities saw a similar increase of 340 percent over the same period.

However, the intermediary services used for these transactions have changed significantly. Both-way transactions on the darknet saw a large decline in the use of exchanges without verification requirements this calendar year from 76 percent in 2017 to 46 percent in 2020. On the other hand, exchanges with verification requests, only on Bitcoins accepted from such entities, increased from 14 percent in 2017 to 29 percent in 2020.

The reason for this trend is that “new exchanges are conducting verification procedures due to FATF requirements,” the report concluded.

Although this is a significant shift away from exchanges without verification requirements, it seems that most of these exchanges still have enough customers who operate within the darknet.

John Jefferies, chief financial analyst at CipherTrace, said many poorly listed exchanges “tend to accept more illegal and riskier funds.” Jefferies spoke not only of a handful of stock exchanges, but of a third of all stock exchanges. According to Cipher Trace, 38 percent of exchanges interacted with “high-risk entities”. For some, this is more than a quarter of all their transactions.

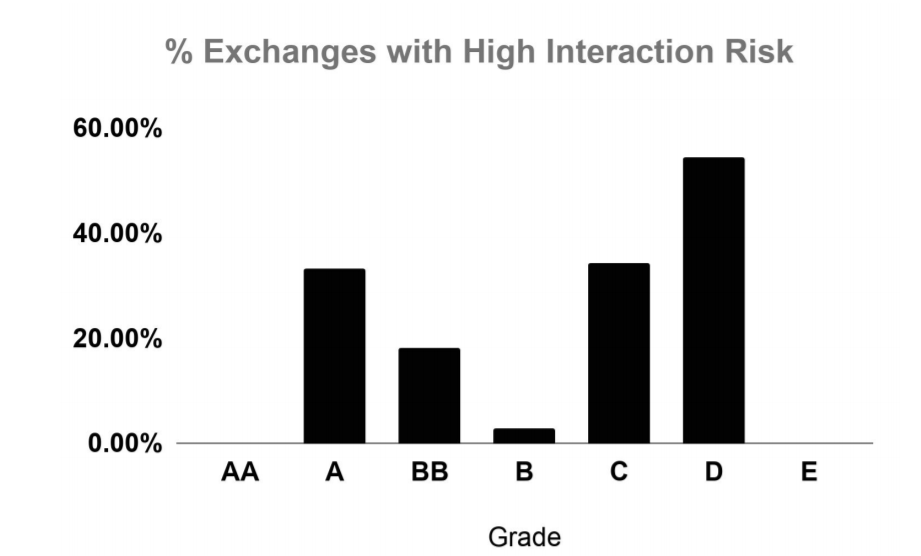

The report ranks exchanges in an alphabetical system similar to ratings from A to E. Exchanges classified in category “D” recorded the highest share of interaction with high-risk funds, more than 40 percent of all exchanges. Some of the exchanges in category “D” are DECOIN, BTC-Exchange, Coinhub, RightBTC and CoinTiger. The metrics used for the rating include, but are not limited to – KYC / AML procedures, security, risk interaction scores, trade and team quality. And who got into the top 20?

Ranking can be found here.

Darknet markets are not just a small part of the deep web and work financially thanks to such high-risk exchanges that are barely suitable.

You might also like: Best Crypto Lending Platforms: Top Crypto Loans Programs

![Decentraland: Review & Beginner's Guide [current_date format=Y] 28 Decentraland: Review & Beginner's Guide](https://cryptheory.org/wp-content/uploads/2020/11/decentraland-02-gID_7-300x150.jpg)