Swipe (SXP) Moves Back to Trade at Range Lows

3 min readTable of Contents

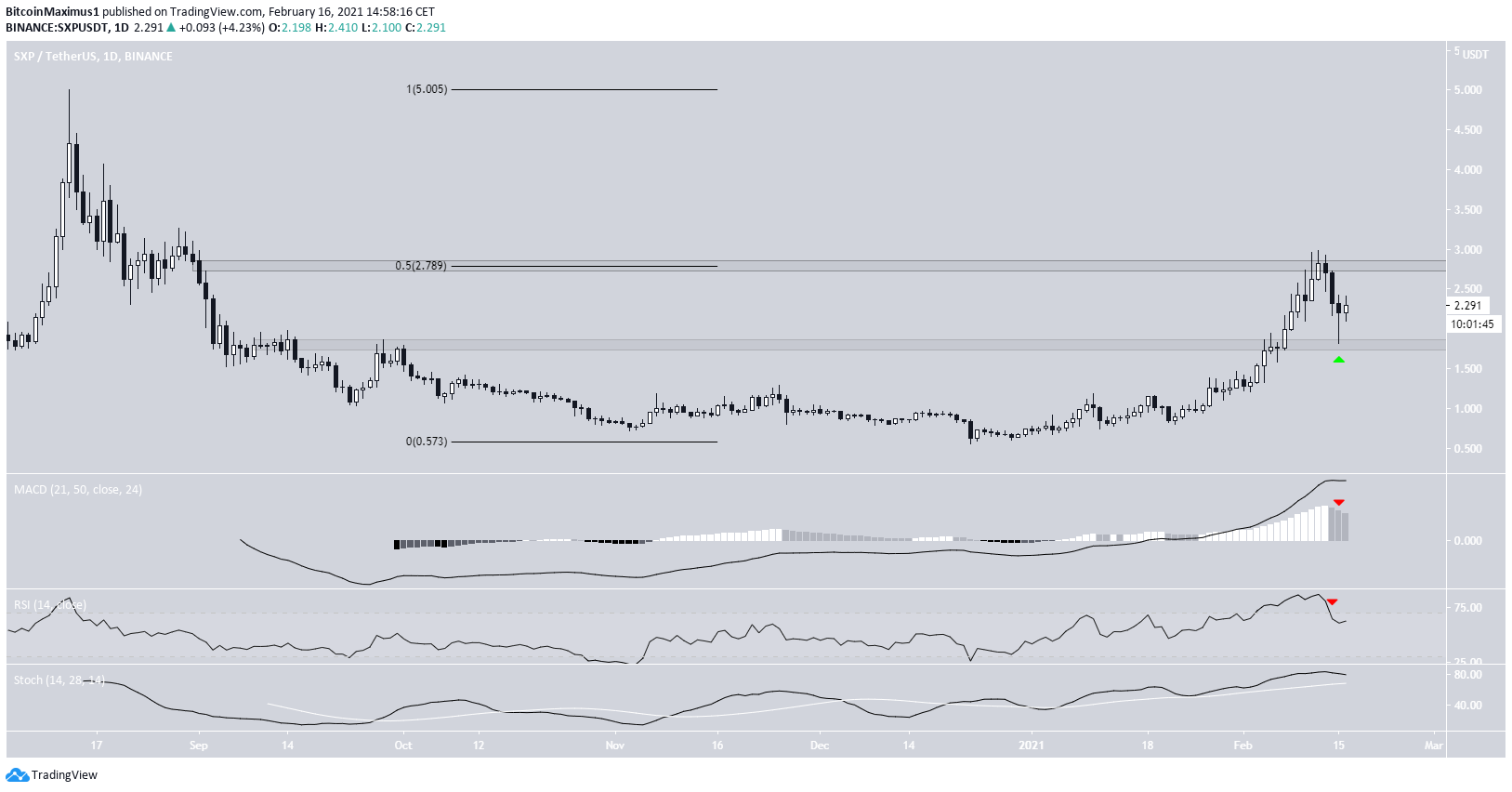

Swipe (SXP) has been decreasing since Feb. 12 and is currently trading inside a range between $1.80 and $2.80.

Swipe is expected to continue consolidating in this range before potentially breaking out.

Swipe Trading Range

SXP has been moving upwards with strength since Jan. 27, when it initially broke out above the $1.20 resistance area. SXP proceeded to reach a high of $2.98 on Feb. 12 but has been decreasing since.

The failure to continue moving higher is important since the $2.80 area is the 0.5 Fib retracement level of the entire downward move. This is a level that is now validated as resistance.

The ongoing decrease has also taken SXP all the way down to $1.80, validating the previous breakout level as support.

SXP is now trading in a range between these two levels.

Technical indicators are neutral but leaning bearish. The Stochastic oscillator has made a bullish cross and both the RSI and MACD are moving downwards.

Cryptocurrency trader @CryptoNewton outlined an SXP chart, stating that an ensuing breakout would likely take SXP to $3.83 and eventually $5.

While a breakout above the $2.80 resistance area would most likely trigger an upward movement towards the targets provided in a tweet, the daily chart does not provide sufficient confirmation that SXP will break out.

Future Movement

The wave count suggests that SXP has completed wave three (shown in white below) of a bullish impulse that began in December 2020.

If correct, SXP is now correcting inside wave four. The corrective structure has just begun, thus its final form cannot be determined at the current time. It’s possible that the structure will eventually develop into a fourth wave triangle.

The sub-wave count is shown in orange.

The two-hour chart shows that SXP is still trading below both the 0.5 and 0.618 Fib retracement levels, thus indicating that the short-term trend is bearish. Despite this, both the RSI and MACD suggest that a breakout is likely.

If the aforementioned fourth wave triangle develops, SXP would be expected to consolidate throughout the week before eventually breaking out.

However, the pattern is not yet confirmed, thus SXP could develop into some other type of corrective structure.

SXP/BTC

SXP/BTC has been moving upwards since breaking out from a descending resistance line on Jan. 18. So far, SXP has reached a high of 6,599 satoshis on Feb. 11.

However, SXP has been decreasing since and has validated the 4,000 satoshi area as support. Similar to the SXP/USD pair, SXP/BTC is trading in a range between 4,000 and 6,600 satoshis.

Technical indicators provide a mixed outlook. While the RSI is above 50, it has been decreasing and the Stochastic oscillator is very close to making a bearish cross.

Therefore, it would make sense for SXP to trade between these two levels in the short-term until the direction of the trend is decided.

Conclusion

Swipe is likely in a corrective wave and is expected to consolidate before breaking out. This stands true for both the SXP/USD and the SXP/BTC pair.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here

The post Swipe (SXP) Moves Back to Trade at Range Lows appeared first on BeInCrypto.

![Decentraland: Review & Beginner's Guide [current_date format=Y] 32 Decentraland: Review & Beginner's Guide](https://cryptheory.org/wp-content/uploads/2020/11/decentraland-02-gID_7-300x150.jpg)