The cryptofunds ended the fifth week in green, the biggest interest was in BTC

1 min read

Cryptocurrency funds after the “bloody summer”, during which they experienced an outflow of capital in the vast majority of weeks, indicate a renewed interest of institutions in investing in digital assets.

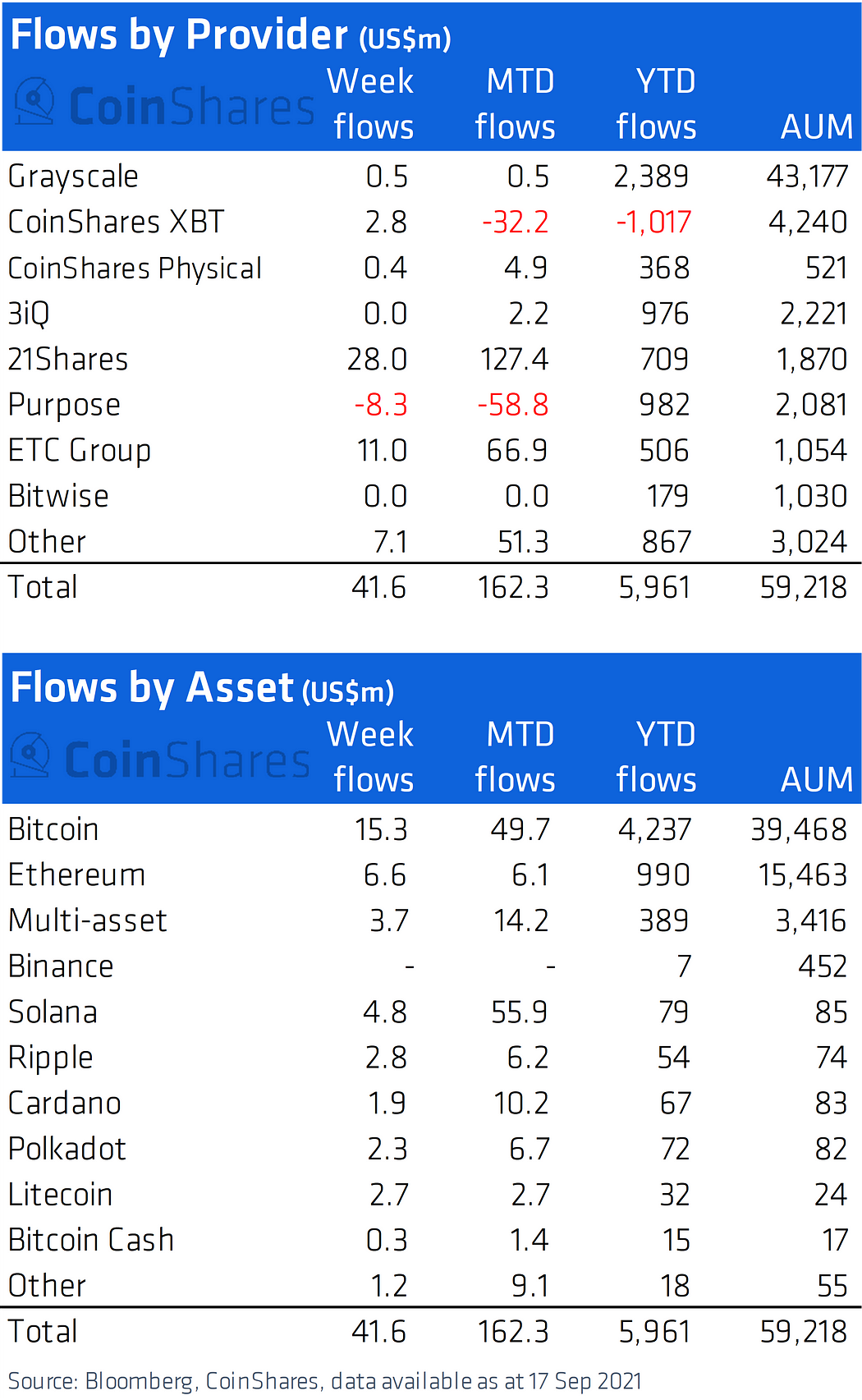

From a fresh company report CoinShares, which itself operates one of the largest crypto funds, recorded the monitored funds Grayscale, 3iQ, 21Shares, Purpose, ETC Group, Bitwise and just Coinshares the fifth week in a row, during which more capital was poured into them than left.

Last week, there was a total capital increase of 41.6 million dollars. Investments in BTC, whose managed capital increased by USD 15.3 million. It came in second ETH with an inflow of $ 6.6 million. They followed Solana (4.8m), basket of several crypto assets (3.7m), Ripple (2.8m), Litecoin (2.7m) a Cardano (1.9m).

As for BTC’s cryptocurrency king, it was only his third green week in the previous 16 weeks. At the same time, however, the second in a row in positive values, which may indicate a renewed interest of institutions in investing in the largest crypto asset. While BTC accounted for up to 81% of all cryptoinvestments in January, it is currently only 67%.

Shiba Inu reaches 900,000 followers on Twitter, overtaking Solana, Litecoin or Uniswap