The poll showed how retail changed mood very quickly in connection with Bitcoin

2 min read

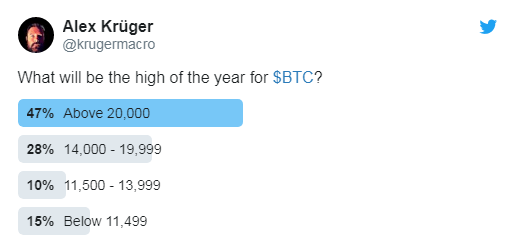

Economist and trader Alex Krüger , who frequently comments on the world of cryptocurrencies on Twitter, has posted a bitcoin poll on this social network, attended by many of his nearly 50,000 followers.

In a poll, he allowed his followers to vote for what price range Bitcoin would end at the end of 2020. The options were above $ 20,000, between $ 14,000 and $ 20,000, between $ 11,500 and $ 14,000, and below $ 11,500.

The results of the survey speak clearly – following Kruger, which due to their numbers, make up a fairly good sample of ordinary retail cryptocurrency investors, are currently extremely positive. As many as 47% believe the price will be higher than $ 20,000, which means Bitcoin will reach a new record this year. Well, only 14.5% expect the price to be less than $ 11,500.

In the results of this survey it is necessary to pause and understand what follows. Firstly, it should be pointed out that Krüger , through his voting possibilities, led his followers to the impression that the price would definitely go up (he did not mention the possibility of the price being less than $ 8 or $ 7,000 and so on). At the same time, the results clearly show that ordinary small investors need little to change their view of the Bitcoin market and become from pessimists great optimists.

As Cole Petersen ftom CryptoSlate rightly pointed out, such a rapid mood change for small investors is always dangerous, because it is this fact that smacks of the FOMO effect (people jump into the market without running out of investment opportunity) can be used by big players , so-called whales, to rob “little sheep” about their Bitcoins. Whales do not necessarily need a bullrun with exponential growth immediately. The aim of many of them is to get as many “cheap” Bitcoins.

The change in market sentiment is well illustrated by the so-called Fear & Greed Index, which has already reached 54 points, which means it is in a neutral phase, only a month ago we were in a phase of extreme fear (23 points). History shows that when this index is at its lowest (around the level of extreme fear), this is a good investment opportunity. Conversely, the higher the index value, the more likely a new bubble may burst. The last time this happened was when the BTC attacked $ 14,000 and the Fear & Greed Index reached over 90 points.

So be very careful not to be fooled by the excellent results of Bitcoin in the first two weeks of the new year. The price is changing rapidly and the best investment strategy, if you have already opted for Bitcoin, is a regular purchase that averages the purchase price.

source:cryptoslate.com

![Decentraland: Review & Beginner's Guide [current_date format=Y] 23 Decentraland: Review & Beginner's Guide](https://cryptheory.org/wp-content/uploads/2020/11/decentraland-02-gID_7-300x150.jpg)