Top 3 Reasons Why Binance BNB Maybe the Next Big Thing

4 min readFlashback to December 2020, Binance’s BNB was just trading around US$33. On February 12, 2021, BNB is trading at US$125, a mind boggling 278% increase. If you think Bitcoin rally was crazy, think again. Binance BNB’s rally trounces Bitcoin by a wide margin.

Although one can go at length to expound on the merits and faults of Binance, the fact of the matter is that most of the crypto community has at some point used Binance to facilitate their trades. Binance’s user interface is known to be the gold standard of how an exchange UI should be like. The user interface and user experience are top notch. This has created a very strong “sticky” service among its users. Competitions among cryptoexchanges are intense. To really succeed, and by a huge margin in terms of daily trading volume, requires that every moving part is well-oiled.

According to data from CoinMarketCap, Binance’s daily spot volume currently stands at around US$27 billion. This is several times larger than the next highly rated exchange, Huobi Global, with daily volume at just US$7.8 billion. We acknowledged that daily trading volume can swing up and down pretty drastically. However, throughout all the market gyrations, Binance has managed to maintain its top spot as the most actively traded cryptoexchange.

This leads us to the first reason why Binance BNB token should be taken seriously.

Reason #1: Big Gets Bigger

Any traders, investors, market makers and fund managers will concur that liquidity is the most important aspect for any exchange. The more liquidity there is, the smaller the spread and the lesser the slippage that will occur. With Binance being the top cryptoexchange in terms of daily trading volume, the network effect allows it to grow on a compounding rate as traders pile on the exchange.

This has explained why Binance system has come under stress in the last few weeks as they saw record number of user sign ups and, consequently, trading volume. Throughout most of 2020, Binance daily spot trading volume stood between the US$1 billion to US$4 billion range. In February 2021, Binance daily trading volume has grown almost 10 x to reach US$35 billion on February 11, 2021. To put this in perspective, compare it to its next closest competitor Huobi Global which on the same day yields US$11 billion in daily trading volume.

Like a massive black hole which sucks market liquidity, we believe Binance will continue to grow exponentially in terms of daily trading volume. And this means its revenue is growing in multiples too.

Reason #2: Binance Pay, Binance Smart Chain, Binance Everything

Binance recently launched is Binance Pay during their Binance Blockchain Week. Although the launch was somewhat muted, it definitely created a new tectonic shift in the Binance universe of crypto services. Payment services has always a lynchpin in the financial services sector. Any operator who commands payment service monopoly typically experiences higher customer’s LTV (lifetime value) and much reduced churn rate.

In addition, Binance has its feet wet in many other crypto services such as staking, lending and even their very own Ethereum-competing Binance Smart Chain (BSC). According to Binance’s report, their BSC has reached about 40% of Ethereum’s network activities within one quarter of launching.

Collectively, these Binance services, which are often well-executed, should see it increase the LTV of every Binance users who, most of them, enter its universe initially for trading.

Although decentralized exchanges may eat away at centralized exchanges’ volumes, the ability of a CEX to offer surrounding crypto and financial services may sustain their longevity and increase the market share of the world’s largest CEX.

Reason #3: Token Economics

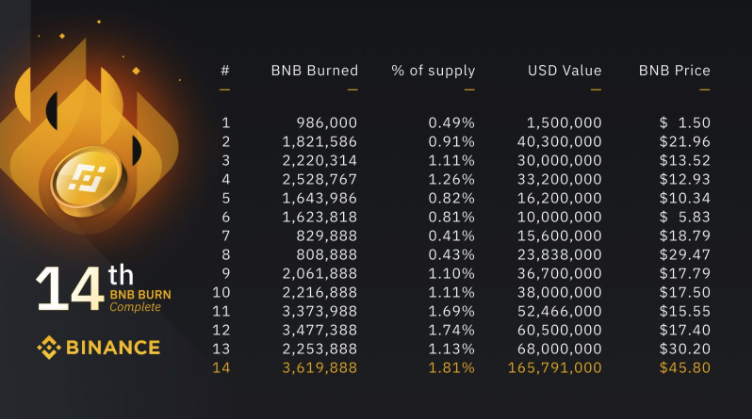

Any token price movements is affected by the basic economics of supply and demand. Underpinning this in crypto-speak is what we call the token economics. Binance has committed to burning 50% of its total BNB token supply by using 20% of its profit to execute buy back from the market. Based on their latest 14th Binance BNR Burn report, they have burned a total of approximately 30 million BNB tokens. This leaves them with about 70 million BNB to go.

However, as the price of BNB skyrockets, Binance has announced its intention to accelerate the token burn rate. This makes total sense so that the cost of buy back would be kept “low”. The last 14th BNB burn cost Binance an average of US$45 per BNB. At the current US$120 to US$130 range, Binance is going to spend almost three times more for the same. But, this should be easily offset by the exponential rise in trading revenue.

Binance is a huge cash generating enterprise. It would seem that their accelerated token burn would take on a faster burn rate in the immediate future rather than risk spending more further out as the general cryptocurrency market gets higher in valuation and market cap.

[ Read more: Binance BNB Forges Ahead Backed By Binance Pay ]

[ Read more: Travel Agency Travala Becomes the First to Utilize Binance Pay ]

The post Top 3 Reasons Why Binance BNB Maybe the Next Big Thing appeared first on SuperCryptoNews.

![Decentraland: Review & Beginner's Guide [current_date format=Y] 22 Decentraland: Review & Beginner's Guide](https://cryptheory.org/wp-content/uploads/2020/11/decentraland-02-gID_7-300x150.jpg)