Understand possible impacts of the 2024 cycle

4 min readTable of Contents

This Tuesday (5), precisely at 07:23 GMT, the Bitcoin network mined its block number 735,000. While block mining is a banal act in BTC, the block in question marks exactly halfway through the current halving cycle.

Halving is the name given to the process in which the issuance of new BTC is cut in half. According to BTC’s schedule, the process occurs every 210,000 blocks mined. In terms of time, each cycle is about four years.

In 2020, the halving took place at block 640,000, which means that block 735,000 was mined 105,000 blocks later. This is half of the current cycle, set to end on May 3, 2024. From there, issuance will be cut in half, reaching 3,125 BTC per block.

In this guide, you can check out what halving is and how it works. However, what are the impacts of the reward cut on the price of BTC? And how do halving cycles work throughout history?

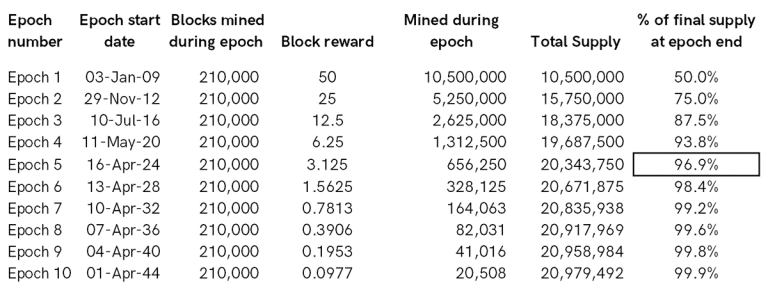

Table with past and future BTC halvings. Source: ByteTree.

Current state of the market

BTC halving cycles occur every about four years. The period between one halving and another is called the “halving season”. In this sense, the period between 2009 and 2012 was Season 1, between 2012 and 2016 was Season 2, and so on.

Currently, the market lives in Season 4 of the halving cycle. In that exact, 19,031,250 of the 21 million BTC that will exist will have been mined. That is, 90.6% of the total cryptocurrency supply is already on the market.

As the cycles progress, the supply of BTC in circulation also increases. In 2024, Season 5 will begin, in which 93.8% of BTC will have been mined. Season 6, scheduled for 2028 (est.), will have 96.9% of BTC mined.

It is estimated that BTC will have 33 cycles or epochs until 2140, when all units will be fully mined. Today the supply of new BTC is only 1.8% per year, roughly in line with gold. From Season 5 onwards, the new supply will drop to 0.8%, and drops will occur until the end.

As the issuance of new BTC is always cut, the price of cryptocurrency is affected by each halving cycle. Despite the low sampling (there were only three halvings to date), the halving has always triggered moments of appreciation in the price.

Impact of halvings per cycle

First of all, it is worth noting that halving cycles are marked by peculiarities. In Epoch 1, for example, virtually no one knew about cryptocurrency other than a few cypherpunks. Therefore, the impact of the halving on the price in absolute values was practically null.

However, the percentage increases have always been in the triple digits. Epoch 2 (2012-2016) saw BTC appreciate about 100 times, a percentage that decreased to 30 times in Epoch 3 (2016-2020). In the current Epoch 4 (2020-2024), the appreciation of BTC has already reached seven times.

In this sense, the price increase is still positive, but it becomes smaller as BTC matures and its price grows. This is a natural effect in markets that are starting to grow in size. It’s one thing for BTC to grow when it was worth $10 million, it’s another thing with a $700 billion market like today.

BTC performance by cycle

To understand the impacts of the halving on the price of BTC, it is necessary to analyze each cycle separately. Therefore, the current topic will make a complete analysis of each of the halvings and their peculiarities.

As Epoch 1 took place very early and BTC did not have a market price for much of this period, it will be left out. Thus, the analysis will start from Epoch 2.

Cycle 2 (2012-2016)

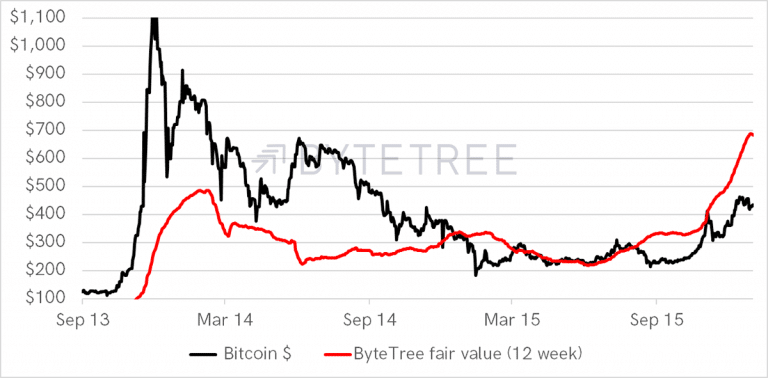

The first BTC halving took place in July 2012, when the issuance of new BTC per block dropped from 50 BTC to 25 BTC. The following year (2013), the price immediately soared 1,100% from $100 to the first all-time high: almost $1,200.

However, 2014 was a year of strong correction in which BTC lost more than 80%. By mid-2016, before the second halving, the cryptocurrency would reach its low of $240.

Cycle 2 of the halving cycle. Source: ByteTree.

Cycle 3 (2016-2020)

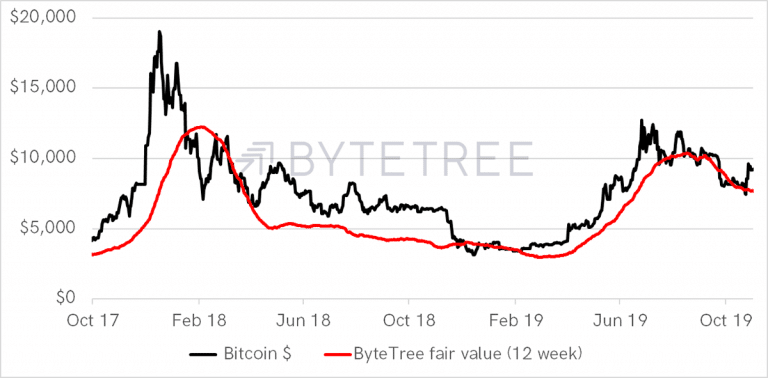

In the second halving, which took place in July 2016, the block reward cut fell from 25 to 12.5 BTC. Between July and December 2016, the price of BTC had already appreciated from $240 to around $900, that is, a 375% increase.

But the big move took place in the second half of 2017, when the price reached the historic level of US$ 20,000. Then came a new bear market that lasted throughout 2018, in which the price of BTC hit lows of $3,000.

2016-2020 halving cycle. Source: ByteTree.

Cycle 4 (2020-2024)

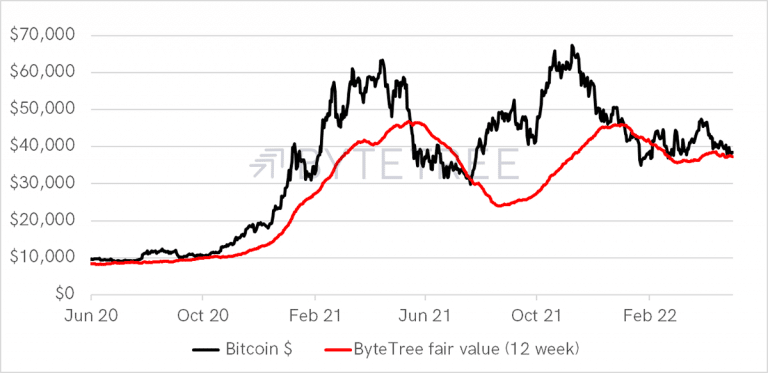

In the third halving, which took place in May 2020, the issuance cut dropped from 12.5 to 6.25 BTC for each block. This cycle had a peculiarity in relation to the others, which was the Covid-19 pandemic.

The disease led governments to print record amounts of money and distribute it to the population. This was also the cycle in which BTC actually started its entry into the institutional market. It was here that companies like Tesla and MicroStrategy, for example, started buying cryptocurrency as part of their financial reserves.

As a result, the price of BTC rose from $3,200 to nearly $70,000 at its highs.

2020-2024 halving cycle. Source: ByteTree.

Conclusion

Halving cycles are marked by a large market rally followed by an equally deep correction. However, in all of them, BTC renewed its minimum quotes, that is, it ended a cycle with its minimum price higher than that of the previous cycle.

In that sense, BTC is unlikely to collapse similarly to what happened in Epochs 2 and 3. After all, the price is pretty much in line with fundamentals in this cycle and the cryptocurrency is already embedded as a global asset class.

Halfway through the upcoming halving, BTC is trading at fair value. Its credibility in the market has never been as high as it is today. In future halvings, the trend is for its adoption to be even more consolidated.