US Comptroller of Currency Warms Up to DeFi Banks

3 min readIn an op-ed published in the Financial Times, the US Comptroller of the Currency says he’s an “optimist” when it comes to DeFi banks. However, he says that legislators are not ready to give a bank charter to algorithms.

When the U.S. Office of the Comptroller of the Currency announced that money transfers could be settled in stablecoins, it was met with a lukewarm response. While the move was pro-digital currency, it did not support the beloved decentralization explicitly.

But a Financial Times op-ed written by Brian Brooks, acting U.S. Comptroller of the Currency, puts things in a different light. Overall, the Comptroller says he is optimistic about decentralized finance (DeFi) and compares the field to self-driving cars.

DeFi — The Self-Driving Banks

Brooks is a self-described optimist when it comes to the future of digital finance.

While he does not tout the famous advantages of decentralization itself, he is supportive of banks working solely through algorithms, without people. He believes that DeFi technology can be used to fight inequities in banks and currency markets.

Comparing emerging DeFi technology to self-driving cars, Brooks said that self-driving banks could be more efficient than current banks.

By freeing banks from what could be called “human error,” prejudice in banking might come to an end.

Brooks argues:

“Could we usher in a future where we eliminate error, stop discrimination, and achieve universal access for all? Optimists like me think so.”

The Comptroller proposed that legislators should come together to try to bring banking into the future, inspired by current DeFi projects:

“How different would banking in the US be today if regulators, bankers, and policymakers were as bold as carmakers 10 years ago?”

New Obstacles

Importantly, Brooks believes that calculating collateral digitally and providing loans algorithmically, as crypto DeFi currently does not come without risks.

He cites liquidity risk, such as a high-frequency trading, that could accelerate equity self-offs. In other words, trusting an algorithm to green light liquidations could end up in errors like flash crashes or manipulation.

Likewise, the Comptroller says that computers may not be able to evaluate and assess collateral or liquidity risk as accurately or holistically as humans.

Nonetheless, Brooks notes that these risks are the same risks already seen by other emerging technologies, like self-driving cars, or even the current banking system.

The main roadblock to giving a national bank charter to an algorithmic, decentralized system is that charters need to be given to humans, not computers. In other words, current legislation, based on decades-old technology, does not provide for DeFi bank charters.

He wrote in Financial Times:

“Under current law, drawn up on the assumptions of the early 20th century, charters can only be issued to human beings. But those antiquated rules should be revisited, just as regulations that still mandate the use of fax machines should be.”

With a new SEC chairman coming in after Ripple Labs’ clash with regulators, there may be some change in attitude by the U.S. government in the coming years.

This op-ed is surprisingly warm to DeFi-powered banks, though it does not support the dream of an international-dollar-ending currency that some crypto-lovers fantasize about.

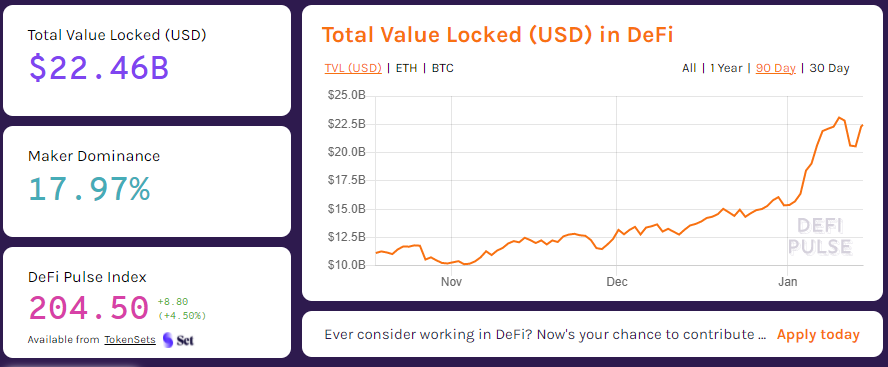

Over the last year, the popularity of DeFi has exploded, with over $22 billion locked in protocols today.

The post US Comptroller of Currency Warms Up to DeFi Banks appeared first on BeInCrypto.

![Decentraland: Review & Beginner's Guide [current_date format=Y] 26 Decentraland: Review & Beginner's Guide](https://cryptheory.org/wp-content/uploads/2020/11/decentraland-02-gID_7-300x150.jpg)