Where will the price of BTC go – $ 30,000 or $ 50,000?

2 min readThe conflicting price trajectory of the main cryptocurrency over the past few months has left the market in a state of confusion. From ATH at $ 69,000 in early November BTC trajectory was mostly down, with lower highs and lower lows.

Where will the price of BTC go?

As a result of the sudden crash on December 4, the price of BTC dropped to $ 42,000, and on January 7, this level was tested again due to deteriorating market sentiment.

In December, BTC recorded its largest monthly loss since the crash in May 2021, which fell 49.2% from a maximum of $ 69,000. CME BTC futures also recorded the largest monthly decline of 77.4% to $ 11 billion.

In addition, spot volumes on the 15 largest high-end crypto exchanges fell by 22.6% from November, with a total spot volume of $ 1.4 trillion. In contrast to the expected bull growth in 2022, the trend of further price declines continues.

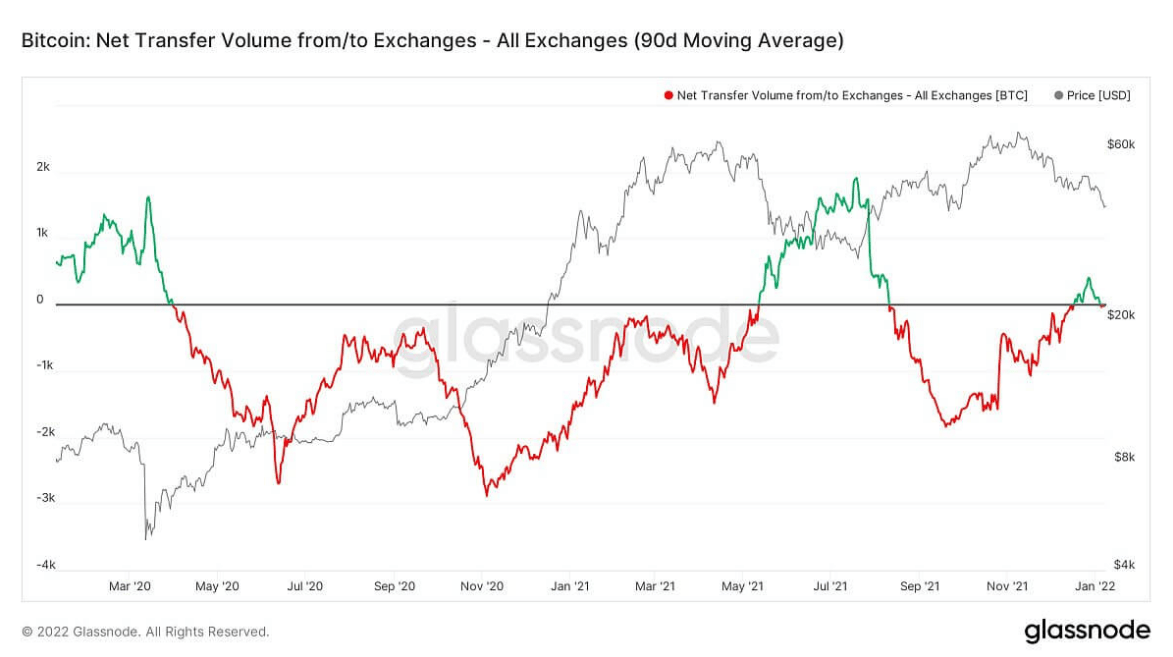

According to the BTC index of fear and greed, market sentiment as the BTC approached the $ 40,000 mark was characterized as “extreme fear.” In fact, it is the lowest value since July last year. In addition, many BTC have been withdrew on exchanges over the past week, suggesting a slightly bearish shift in investor sentiment.

The net inflow reflects investors’ intention to sell, while the steady outflow reflects the urge to hold. The recent increase in the net inflow on exchanges now does not indicate a change in the trend in general and suggests the possibility of future sales.

Now the price of BTC is very similar to its behavior in February to May, when the price reached four highs and the relative strength index formed lower highs. Four price highs, along with an RSI mimicking a similar downward trend, triggered a BTC drop to $ 30,000 last May.

Well, with BTC hovering around $ 40,000, market participants are asking the same question: where is the price more likely to move – to $ 50,000 or $ 30,000?

At the time of writing, support of $ 40,000 is BTC bulls last hope for a significant turnaround; if it persists, growth can be restored.

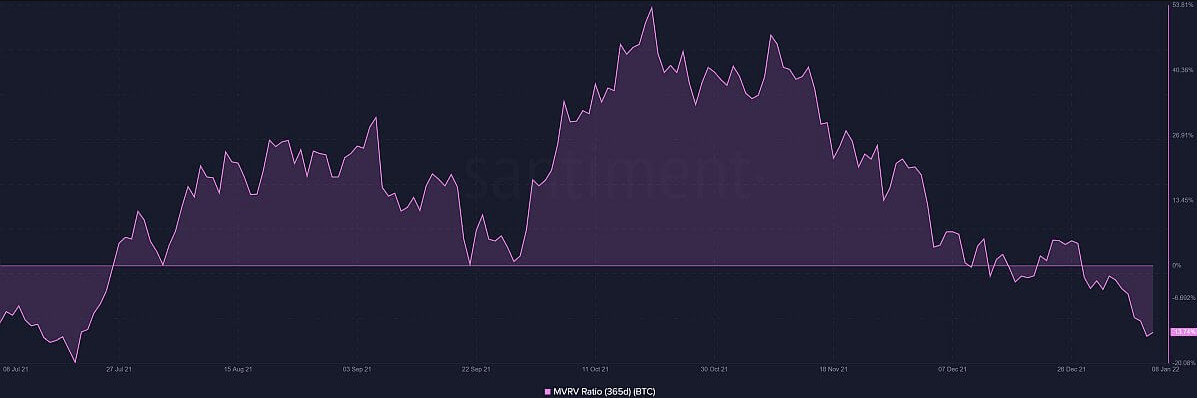

However, there is also a big bear trend line that needs to be crossed. So far, the 365-day reversal of the MVRV (Market Value to the Realized Value) provides a decent turnaround, but if the price is not maintained, bull expectations will not be met.

If BTC falls below $ 40,000, there will be a high chance of testing support at $ 30,000 in the medium term. A decisive rebound from the level of $ 40,000 could have supported the growth of BTC.