White Hat Hacker Steals $3M from Cover Protocol & Returns It Hours Later

2 min readIn an extremely bizarre turn of events, the Cover Protocol, a peer-to-peer insurance coverage platform, was recently exploited only to have its good samaritan hacker return the funds several hours later.

Earlier on Monday, Cover Protocol suffered a major exploitation resulting in the loss of millions of dollars worth of COVER. Condensed down by Twitter user @Luciano_vPEPO, the hacker exploited an infinite minting bug on an incentives contract.

Using this method, the perpetrator could stake their COVER, un-stake it, claim a reward and rinse and repeat.

Unfortunately, hacks and exploitations are widespread in the cryptocurrency space, even more so in Decentralized Finance (DeFi).

DeFi, by definition, is deregulated, leading some projects susceptible to vulnerabilities without recourse. Certain projects may not have undergone thorough security and usability checks before deployment.

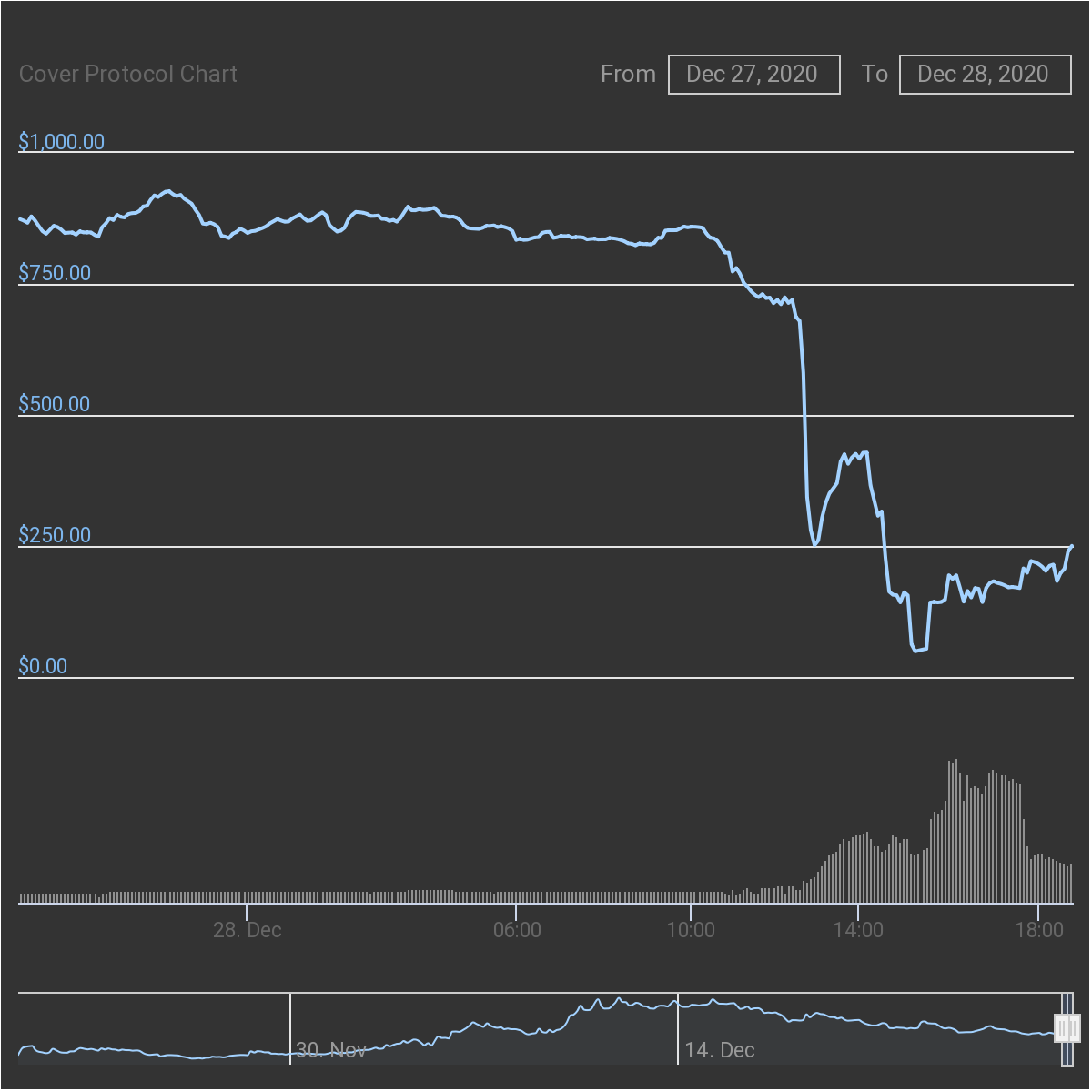

However, what happened next was perhaps more interesting. The hacker has since returned the stolen funds. Nevertheless, the market took a dive post the news, with the price of tokens temporarily dropping over 96% in value.

COVER’s market cap was already slowly retreating, dropping from a high of $59 million to $33 million. However, in the last couple of hours, it dropped to an approximate $1 million market cap.

Anthony Sassano, a cryptocurrency entrepreneur and influencer in the space, highlighted an Ethereum transaction showing the $3 million return in funds.

According to Sassano, the Cover Protocol hacker sent back the funds in the Ether profits to the original deployer. The hacker even embedded a caution message for the protocols developers:

“Next time, take care of your own sh*t”

The total amount returned was 4,350 Ether.

What is Cover Protocol?

Cover Protocol is a decentralized application that allows peer-to-peer insurance and risk coverage for Ethereum based smart contracts.

Cover is also a decentralized coverage marketplace that allows users to provide or receive insurance without oversight by a traditional third party.

Decentralized financial applications have exploded in usage this year, growing from less than $1 billion in total value locked (TVL) to close to $15 billion. With additional capital comes increased hacking and malicious actors looking to take advantage.

Though the project may effectively be dead, providing insurance for risky smart contracts appears to be an extremely useful blockchain use case. Who will insure the insurer though?

If only the Cover Protocol took out insurance on its own platform, perhaps the project wouldn’t have suffered this fate.

The post White Hat Hacker Steals $3M from Cover Protocol & Returns It Hours Later appeared first on BeInCrypto.

(@sassal0x)

(@sassal0x)

![Decentraland: Review & Beginner's Guide [current_date format=Y] 26 Decentraland: Review & Beginner's Guide](https://cryptheory.org/wp-content/uploads/2020/11/decentraland-02-gID_7-300x150.jpg)