Why BTC is more efficient than Credit Card

3 min read

We hear a lot when we talk about the use of BTC in supermarkets, restaurants and points of sale in general, that BTC is not as efficient as Credit Cards, and that there is no way to surpass the 1700 transactions per second of its traditional networks.

This is a very common mistake. It is natural for people to think of a possible bottleneck when settling accounts with BTC at the “cash desk”.

However, it is not just a question of looking at the cash register, but at the different layers involved.

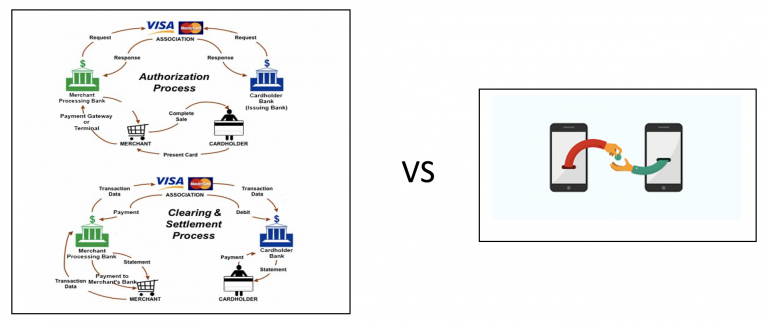

In the current system of payment through credit card “machines” there are a set of financial services that, again, in the “mouth of the cashier”, users ignore.

First you have the card issuing company, the so-called “flag” (Visa, Master, etc). Next, at the point of sale (the machine), we have the Acquiring Bank (which sometimes involves more than one bank), which is the one that settles the balances and deals with the debt generated, both on the seller and on the buyer.

Going up one layer we have the banks of both parts.

And above, a central bank, issuer and validator of the currency in which the trade took place. If it’s international, it’s 2 now. Even if it is done via debit, which makes international purchases impossible, the only layer removed is on the acquiring party.

Even though using PIX, that is, even removing Credit Cards (the center of our argument), and paying from bank to bank, we can minimally rely on three financial institutions for a sale to take place: Buyer’s bank, seller’s bank and central bank to validate the transaction.

With BTC you have zero.

BTC offers, for the first time in history, the possibility of a monetary transaction between two parties without the need for a third party for any kind of proof or validation.

Even the software used to transmit BTC currency can be free and open, unlike closed point-of-sale technology. Free Software, such as BTC itself.

But we want everything, don’t we? After all, it is better to be rich with health than poor with illness.

The solution is called Lightning. As the name suggests, it allows payments at lightning speed. It is a network built as a sub-layer of the BTC network, aiming to allow micropayments and transaction reversibility in a fast and low cost way.

With the Lightning network we have the best of both worlds: Not only do you have a custody-to-custody transaction without intermediaries, but you also get the speed you expect to pay for your dinner, coffee, grocery shopping, etc.

Anyone who has already tested paying with Lightning in places like McDonalds or Starbucks offers in some countries (such as El Salvador, where I tested it) has already managed to experience the most efficient way of getting payments right ever invented by mankind.

Now, the next time someone points out this “deficiency”, you can demonstrate to them your ignorance about how BTC does away with the role of the various middlemen in the payment chain today.

And this is just one of the many advantages BTC brings to the global payment system. That way, it’s easy to understand why it’s so valuable. And it keeps valuing.

Rug pull: understand the main scam that victimized cryptocurrency users in 2021