Why Ethereum is still #1 in NFT space

3 min readTable of Contents

In recent years, the crypto industry has changed a lot. A lot has happened, especially with smart contract platforms like Ethereum. For example, in 2017 and 2018, Ethereum was still mainly used by Initial Coin Offering (ICO) projects for fundraising purposes. In contrast, today applications from Decentralized Finance (DeFi) and the non-fungible token area dominate the Ethereum blockchain.

Some alternative smart contract platforms (Fantom, Terra, binance Smart Chain, Solana) have since tried to build on that success. To do this, they have developed their own blockchains, which are often less decentralized and secure, but in return are cheaper and faster.

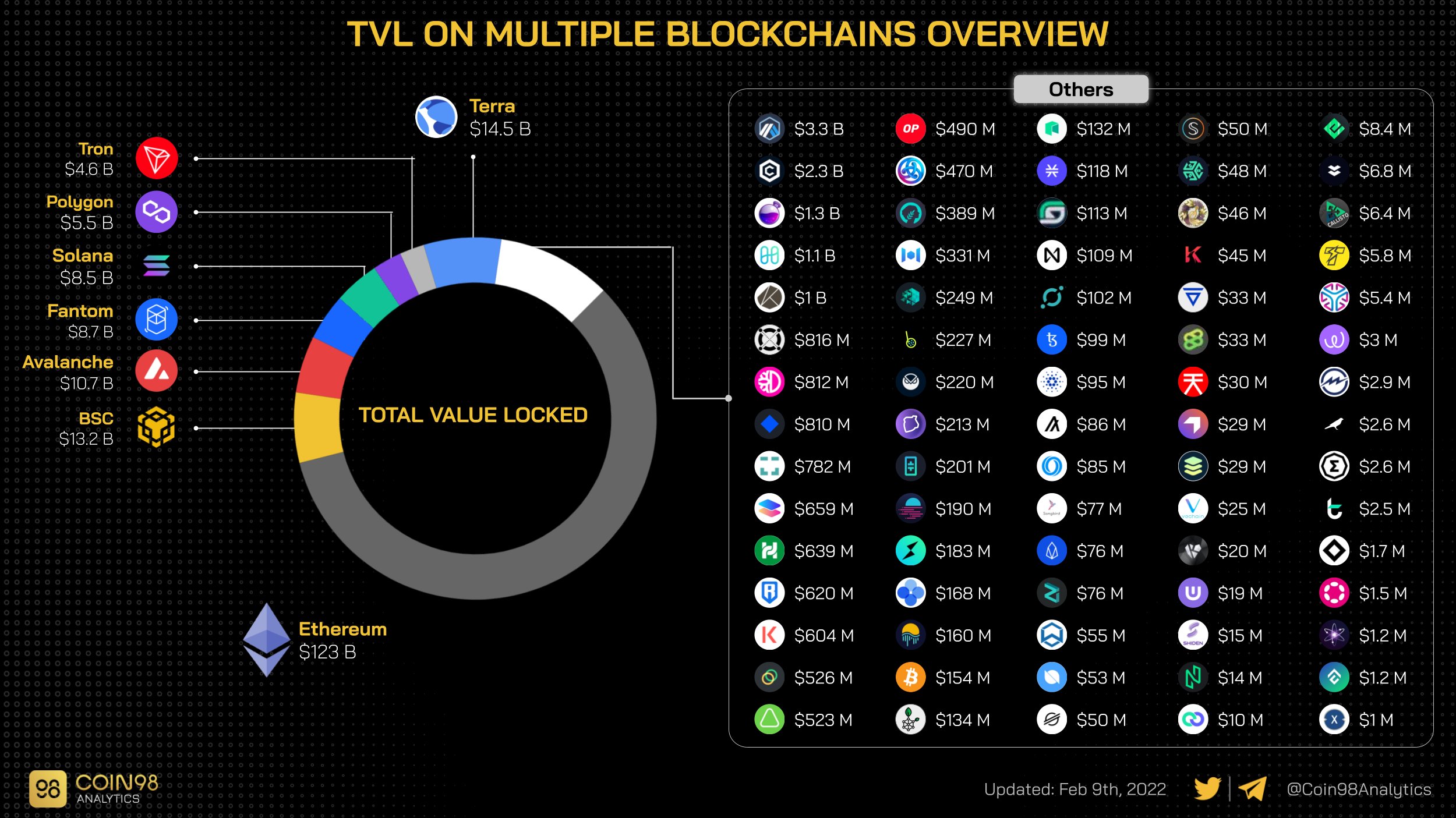

Alternative Layer 1 blockchains like Terra (LUNA), binance Smart Chain (BSC), Avalanche (AVAX), Fantom (FTM) or Solana (SOL) have succeeded in gaining significant market shares in the DeFi ecosystem.

Data from Coin98 Analytics show that alternative Layer 1 blockchains now account for over a third of all capital residing in DeFi protocols.

But while Terra and Co. were able to make up some ground, especially in the DeFi sector, the situation in the NFT sector is significantly different.

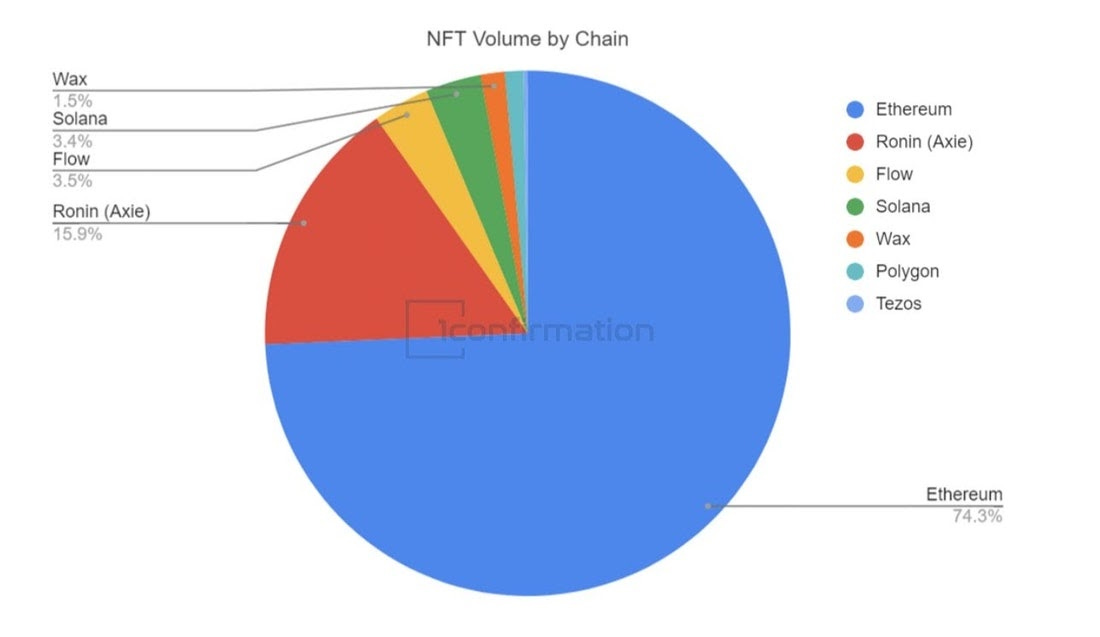

Ethereum is responsible for over 90 percent of NFT trading volume

ETH has so far been able to maintain its market share in the NFT sector. According to that User’s 2021 NFT Year in Review 1confirmation At the end of last year, Ethereum and its scaling solutions (e.g. Polygon, Ronin, Arbitrum) still accounted for more than 90 percent of the NFT trading volume.

Of course, it is possible that the alternative smart contract platforms could also gain more market share in the NFT sector over time. Nevertheless, it is surprising that NFTs, which have so far been particularly popular with small investors compared to DeFi, are still mainly traded on Ethereum.

Despite high transaction fees, many retail investors don’t seem to shy away from buying NFTs on Ethereum.

Reasons for Ethereum dominance

1. Largest infrastructure and community

Ethereum was crypto space’s first smart contract platform and has built the largest blockchain infrastructure and community over the years. For this reason, users can access a far larger number of decentralized applications and NFTs within the Ethereum ecosystem. In addition, there is significantly more capital in the Ethereum network than on other smart contract platforms. This is a great advantage for NFT traders as they can trade their NFTs in comparatively more mature markets.

2. Most active developer community

In addition, Ethereum has the largest and most active community of developers and NFT creators. Whether it’s the latest scaling solutions or experimenting with the next generation of NFTs, Ethereum is the epicenter of the NFT world right now. Reproducing or imitating this talent en masse is not easy. It is therefore a lot more difficult to reproduce the success of an NFT ecosystem than in the DeFi area.

3. Longest history

Another reason for Ethereum’s continued dominance is that Ethereum’s NFT scene has by far the longest history. Already in the year In 2015, the first NFT projects were designed on Ethereum and for many NFT collectors, older digital collectibles like the Crypto Kitties or the Crypto Punks have value precisely because of this.

4. Most secure smart contract platform

Ethereum has also maintained perfect uptime throughout its lifetime. The network thus has the longest and most proven track record of reliably securing NFTs.

5. Highest quality NFT projects

Precisely because of the security and underlying history of many NFT projects, NFTs on Ethereum are considered by many to be the most desirable NFTs out there.

So, when it comes to users wanting the best NFTs of the most interesting projects, the NFTs of other blockchains can’t quite match in terms of their perceived quality.

Conclusion

Things can change incredibly quickly in the crypto space. It is therefore entirely possible that Ethereum will lose some of these important advantages of its NFT ecosystem over time. For now, however, the benefits remain at large scale, and scaling solutions like Polygon are making Ethereum transactions low-cost, similar to Layer 1 blockchains. The fight for market share in the NFT sector should therefore be much more difficult for alternative layer 1 blockchains than in the DeFi area.