Table of Contents

With an altcoin season in the making, several projects could be heading towards fresh all-time high in 2020. The question remains if or which ones will follow Chainlink’s example towards uncharted territory.

While Bitcoin remains relatively calm in its comfort price territory, lots of alternative coins have been fluctuating significantly. Decentralized finance (DeFi) and some prominent developments from several projects initiated serious price increases for various altcoins, and given the decrease in Bitcoin’s dominance, a new altcoin season booms.

Chainlink (LINK) continues to impress with its performance, marking new all-time high records one after the other. With that in mind, let’s have a look at a few promising altcoins that might also surge a new all-time high.

Tezos (XTZ)

“Tezos is a new decentralized blockchain that governs itself by establishing a true digital commonwealth.” – reads their website.

One of its most unique features concerns the governance, as Tezos attempts to build the decision-making process into the network of users, instead of development teams and mining communities.

Headquartered in Switzerland, the company raised over $200 million in an uncapped ICO in just two weeks in 2017. After over a year of trials and beta testing, the Tezos mainnet official launch came in late 2018.

Its native cryptocurrency, XTZ, reached its all-time high price in February this year, at around the $4 mark. The COVID-19 pandemic, however, plunged its price to below $1, during recent March’s Black Thursday. Nevertheless, the native cryptocurrency of Tezos has significantly increased its value since then to around $3 now, at a good spot to threaten the all-time high levels.

The fundamentals behind the project are strong, suggesting that the asset could be primed for a price surge towards uncharted territory above its current all-time high. Its real-world utilization was recently exemplified by the largest investment bank in Latin America – Banco BTG Pactual. The bank launched a token on the Tezos blockchain dubbed ReitBZ.

Tezos is also quite popular within the cryptocurrency community, primarily because of its staking feature. According to a recent report, nearly 93% of all XTZ is locked for staking – more than any other proof-of-stake-based cryptocurrency. As a fun fact, Tezos was among the first tokens to offer staking rewards, which is actually referred to as “baking” Tezos.

Binance Coin (BNB)

The leading cryptocurrency exchange Binance, which recently celebrated its third birthday, is among the most active companies within the digital asset sector. From launching a regulated UK-based cryptocurrency trading platform to partnering with the Brave browser, Binance continues “building.”

The firm has also made two significant purchases lately. Being arguably the largest so far in the industry, one of it saw Binance acquiring the leading data aggregator CoinMarketCap. After the second one, in which Binance bought the Visa debit card platform Swipe, the company officially debuted its Binance Card to users based in the UK and some European countries.

Yet, despite these developments, its native cryptocurrency Binance Coin hasn’t increased its value a lot recently. BNB reached its all-time high in June last year of over $40, but since then, it hasn’t been able to break above $30.

In the mid-March sell-offs, BNB plunged to below $10 and is currently situated at approximately $17. One report even suggested that the asset price is quite undervalued, and a surge could be long overdue. As such, it won’t be entirely surprising if BNB exceeds its coveted cost per coin of $40 soon.

It’s also worth noting that the circulating supply of BNB will be gradually reduced every quarter until a certain point, as Binance is burning tokens equal to a percentage of their quarterly profits.

Aave (LEND)

Aave is a decentralized finance (DeFi) lending protocol that enables users to lend and borrow a range of cryptocurrencies with stable and variable interest rates. The platform leverages its native token LEND to provide holders with discounted fees. The company has also previously stated that users will be able to stake LEND for governance and as a “first line of defense for outstanding loans.”

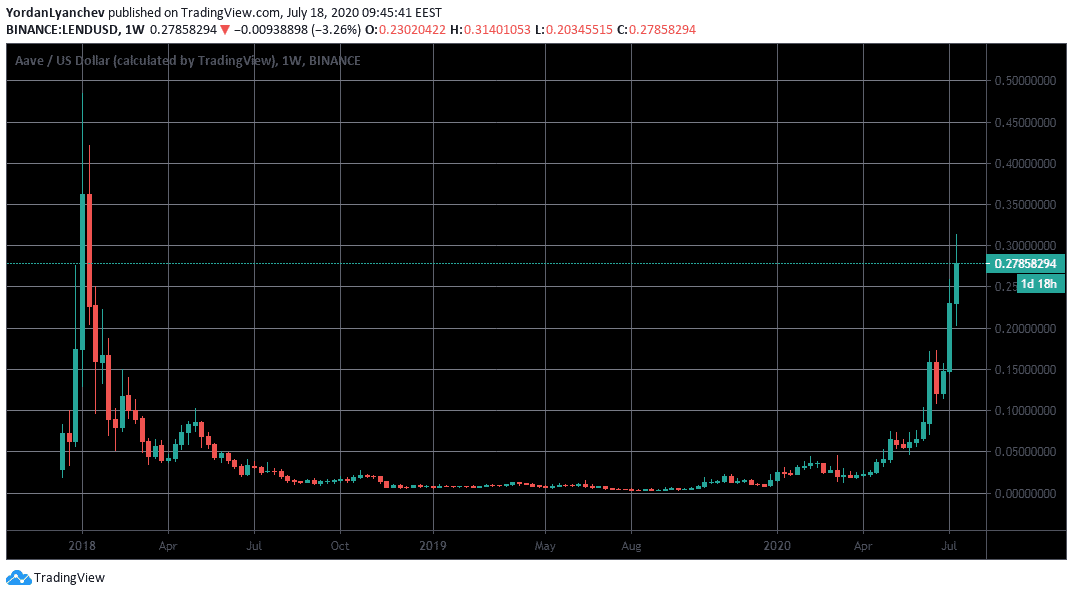

LEND’s all-time high came during the first week of 2018 at $0.48. Since then, the asset price went on a downtrend for over two years. It all changed months ago as the entire DeFi sector boomed, and most tokens related to it felt the positive impact.

As DeFi continues to grow, its most prominent representatives follow as well. LEND’s price is such an example, as in mid-April, it traded at $0.019. At the time of this writing, LEND has surged by more than 1000% in three months. Yet, if the ongoing DeFi trend continues, Aave’s native coin could indeed surpass its previous ATH of $0.48. As of writing these lines, LEND is trading around the $0.3 mark.

Brave (BAT)

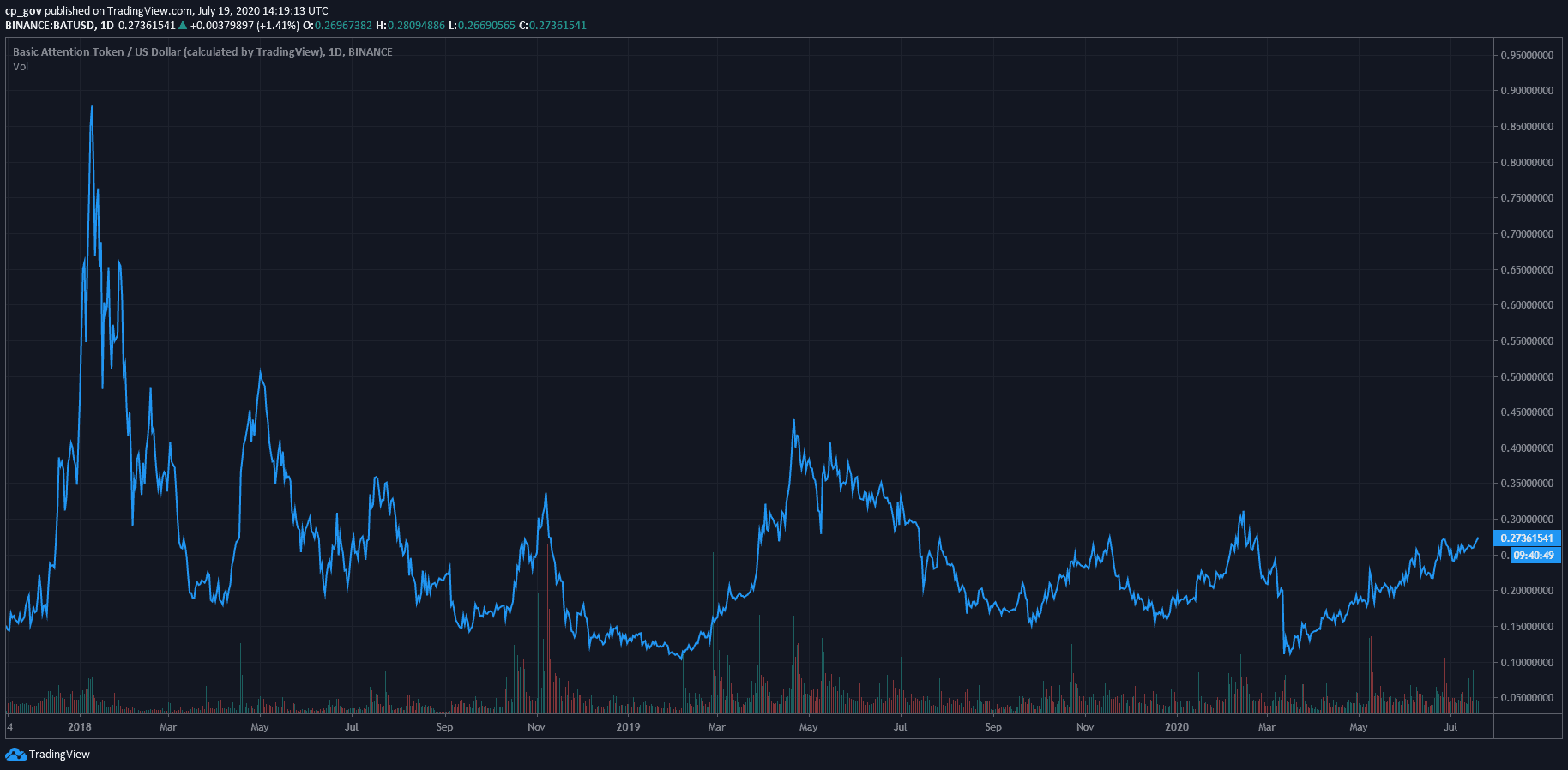

Brave is an open-source, private, and secure web browser developed by Brave Software Inc, and it operates on PC, Mac, and mobile devices. Its cryptocurrency – Basic Attention Token (BAT) – is an advertising token built on the Ethereum blockchain. It creates an ad exchange marketplace by connecting advertisers, publishers, and users in a decentralized manner.

The company behind the coin has recently entered several notable partnerships, which could ultimately assist BAT in increasing its price. Following the mentioned above collaboration with Binance, Brave browser users can seamlessly operate with cryptocurrency assets directly through a new on-browser feature called Binance widget. It essentially enables them to access the exchange’s website directly to deposit, buy, or sell digital assets without leaving the browser page.

The popular Japan-based cryptocurrency exchange BitFlyer recently announced developing a digital wallet for Brave browser users. The two companies also noted that they will launch a joint marketing campaign to expand the recognition of cryptocurrencies and blockchain among customers and improve their user experience and convenience.

Apart from some controversy, these developments could indeed push BAT towards new highs. January 2018 saw BAT’s current ATH of over $1.

Ethereum (ETH)

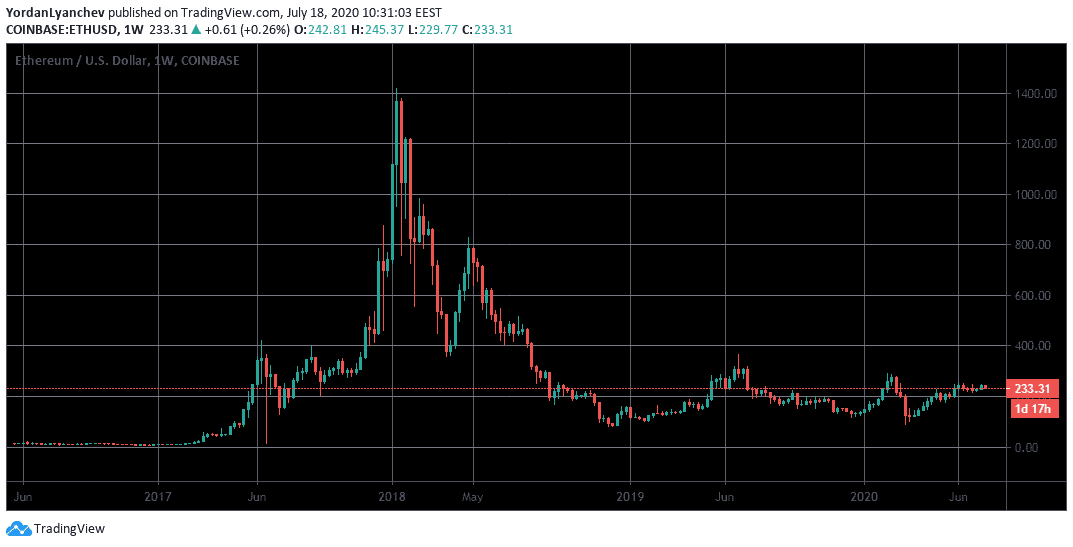

The second-largest cryptocurrency by market cap could be something of a dark horse, and the most surprising on this list.

On one side, it has numerous factors working in its favor. Those include the ongoing DeFi boom, which primarily utilizes its blockchain and the fact that it will transition from the current proof-of-work consensus algorithm to proof-of-stake sooner or later.

Upon completing the transition, which has no official date, the network should be more secure and scalable. Ultimately, the so-called Ethereum 2.0 is regarded as significantly bullish news for ETH.

On the other side, the native cryptocurrency is a long way from its all-time high days. ETH peaked at above $1,400 in January 2018, and it has lost almost 85% of its value since then. If it’s to break the ATH, it has to skyrocket by over 500%.

Although this sounds unlikely to occur at the time being, ETH has marked similar price surges in the past. Additionally, several other factors suggest that Ethereum’s price is “significantly undervalued.”

You might also like: Alt-Season: What’s Driving Some Altcoins to New Highs?

- CryptoQuant Analyst: Bitcoin Nowhere Near Its Peak – Buckle Up, Hodlers! - December 21, 2024

- Chainalysis: $2.2 Billion Lost to Crypto Hacks in 2024 - December 21, 2024

- Bank of Japan leaves interest rate unchanged: Impact on the macroeconomy and the crypto market - December 20, 2024