Table of Contents

Despite the hype surrounding airdrops, the post-launch performance of most “airdropped” tokens often tells a less-than-glamorous story. While the idea of free crypto might sound like a golden ticket, the reality is more like receiving a coupon for a store that went out of business.

So, let’s dive into the data to uncover the trends behind this phenomenon and explore why many airdropped tokens take a nosedive in value after their initial distribution.

What Are Airdrops?

Originally, cryptocurrency airdrops were a novel way to distribute tokens directly to users, typically to boost adoption, create network effects, or decentralize control. In their early days, airdrops were trailblazers for what has now become a standard strategy in DeFi and Web3 communities.

Why Do Airdropped Tokens Tank After Launch?

While the initial hype around airdrops can be thrilling, most tokens see a sharp decline in price after their token generation events (TGE). Here’s why these freebies often fizzle out:

- Tokenomics Gone Wild: Airdropped tokens are handed out for free, and recipients often treat them as disposable assets instead of long-term investments. This “dump-it-fast” mentality creates selling pressure that far outweighs any buying interest.

- Investor Psychology: Free tokens don’t feel as valuable as purchased ones. With little incentive to hold, most recipients cash out at the first chance, sending prices spiraling down.

- Lack of Liquidity and Utility: The long-term value of a token is tied to its usefulness in the network and overall liquidity. Many airdropped tokens lack real-world utility and are purely speculative, which makes holding onto them less appealing.

So, while airdrops might feel like striking gold, they’re often more like a piñata: a lot of excitement at first, but most of what falls out is just candy. 🍭💸

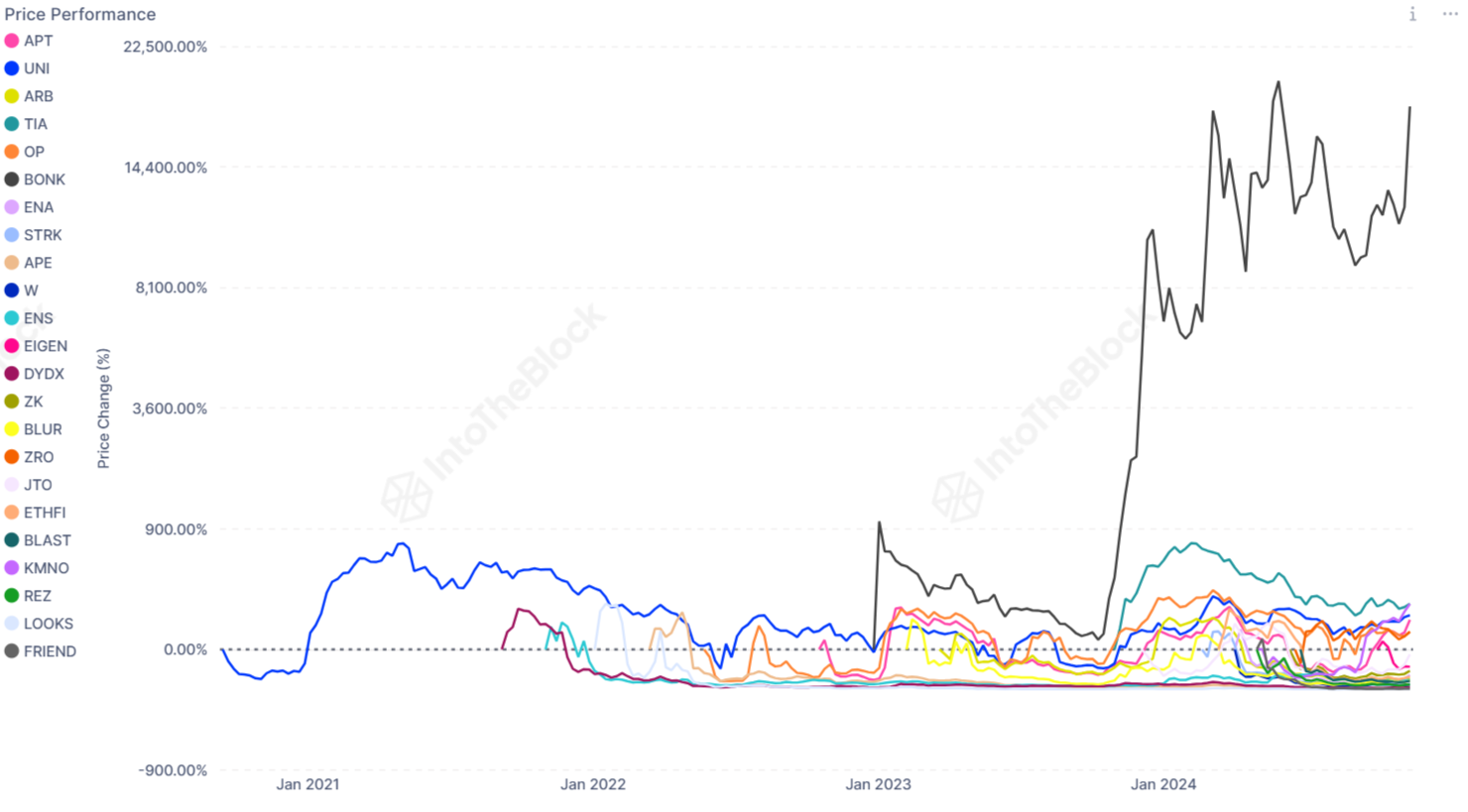

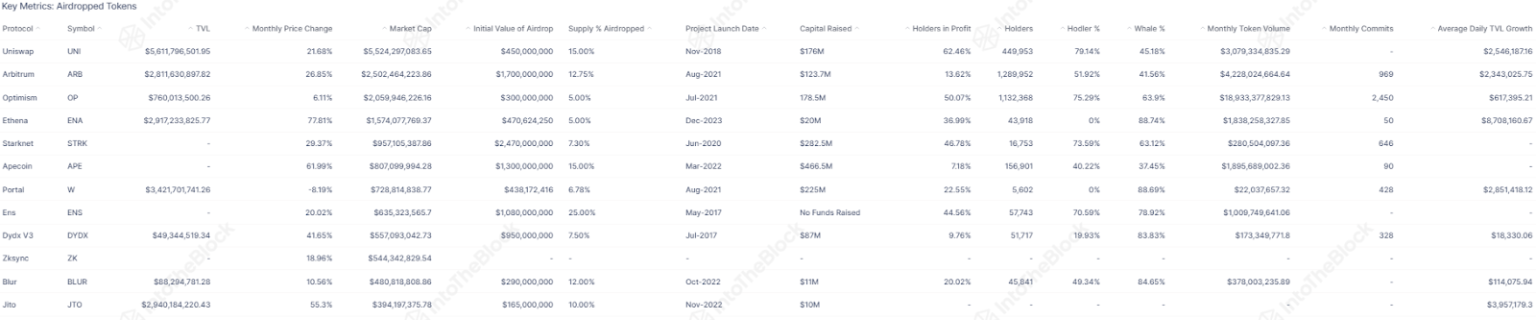

The reality of airdrop underperformance becomes crystal clear when examining recent data: out of a sample of 23 airdropped tokens, only seven delivered positive returns. The majority trended downward, driven by heavy sell-offs as holders quickly dumped their free tokens.

Case Study: Optimism’s Airdrop

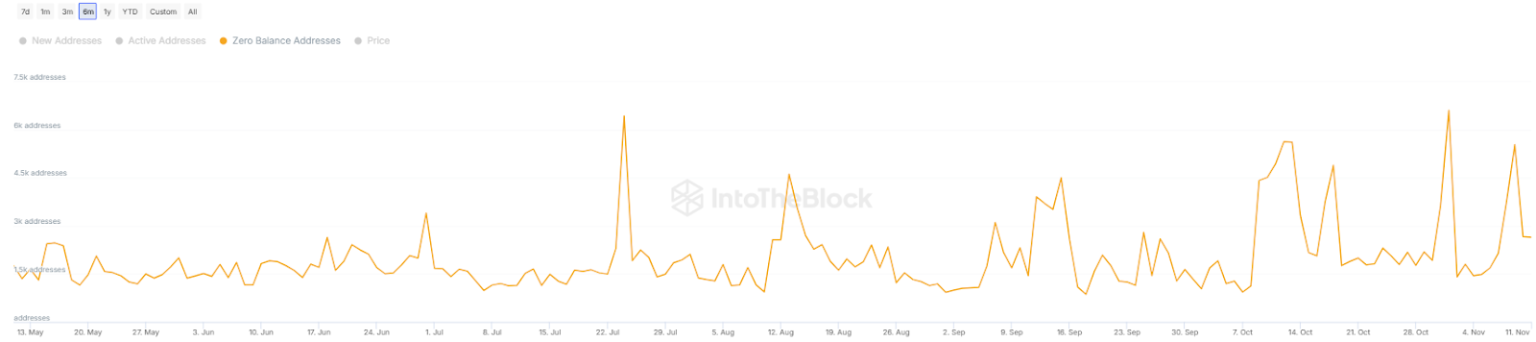

The Optimism network provides a textbook example of post-airdrop dynamics. Its $OP token, regularly distributed to network contributors, experienced a significant sell-off during its fifth distribution cycle in October.

In this round, 10,368,678 OP tokens were distributed to 54,723 unique addresses. The result? A sharp spike in zero-balance wallets, with nearly half of the recipients liquidating their holdings shortly after receiving the tokens.

The takeaway? While airdrops might look like a crypto lottery win, they often turn into a race to the exit. It’s like handing out free concert tickets only to see half the crowd leave after the first song. 🎟️💨

The chart above illustrates the sell-off behavior, showing a fivefold increase in wallet emptying after October’s airdrops. This pattern highlights the core issue: without incentives to hold, recipients often dump their tokens immediately, putting downward pressure on prices.

The Outlier: BONK – A Reason to HODL

One airdrop that defied the trend was BONK, a token that delivered substantial returns to its holders. So, what did BONK do differently?

- Staking Rewards: BONK introduced staking options, encouraging holders to lock up their tokens rather than sell them instantly.

- DeFi Integration: The project built a suite of DeFi tools, boosting trust in the token and creating a broader use case for its ecosystem.

- Strategic Ecosystem Placement: BONK was launched on the Solana blockchain. Solana’s strong ecosystem performance directly supported BONK’s value, showing how the success of a network can elevate its tokens.

This highlights the importance of where a token is launched. The two most profitable recent airdrops, BONK and Kamino, both originated on Solana—a blockchain experiencing significant user interest and growth.

Build It and They Will Come: Developer Activity and Token Success

In crypto, “build it and they will come” is more than a catchy phrase—it’s a critical factor for long-term project success. While the link between developer activity and token profitability isn’t always direct, an active and engaged development team often correlates with better price performance.

Take Optimism (OP) and DYDX as examples. Both projects show substantial monthly developer activity and consistent updates. Optimism, with over 2,400 monthly commits, retains 50% of holders in profit—a solid figure for an airdropped token.

Steady development helps projects remain relevant, adapt to user needs, and build holder confidence, ultimately supporting token price stability. In the volatile world of crypto, building a strong foundation truly makes all the difference. 🛠️📈

Rather than chasing short-term hype cycles, tokens backed by committed development teams tend to build stronger foundations. Over time, this reduces selling pressure and can transform a speculative asset into a solid long-term hold. In this way, the mantra “build it and they will come” becomes a critical strategy for tokens aiming to survive post-airdrop sell-offs.

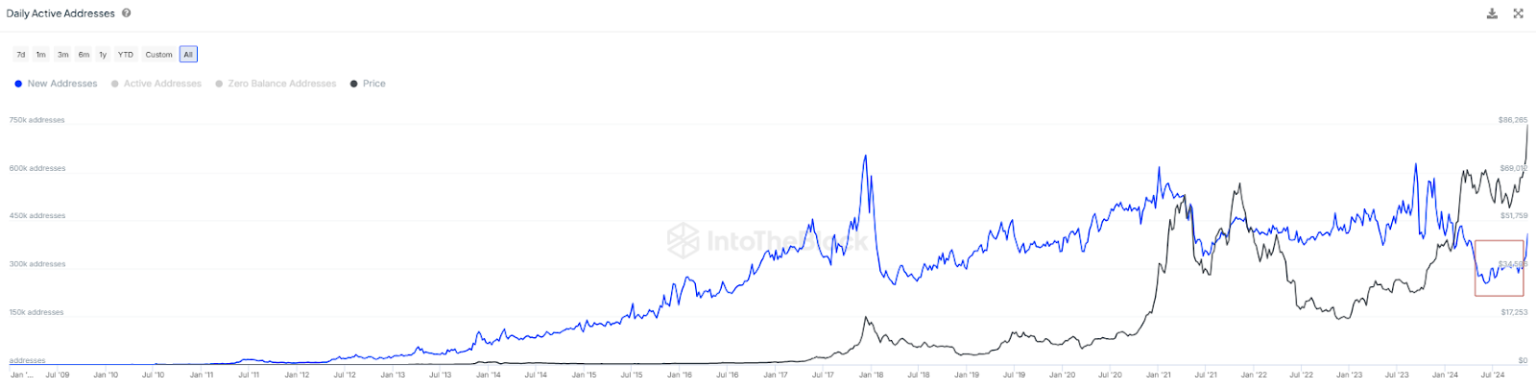

The Missing Piece: Retail Buying Pressure

While much of the discussion focuses on the selling pressure dragging airdropped tokens down, there’s another critical factor to address: buying pressure—or the lack of it.

For an airdropped token to maintain its value, it requires consistent demand from buyers, particularly retail investors willing to scoop up these tokens in the open market. Without this buying pressure, even the most well-structured airdrops crumble under the weight of sell-offs as holders cash out their free tokens.

In the current market cycle, conditions have been less than ideal for airdropped tokens. While Bitcoin has shown strong performance this year, much of its momentum has been driven by institutional interest. Meanwhile, retail participation, traditionally the engine for new demand in smaller tokens, has been notably absent.

The chart below highlights this trend: during typical Bitcoin price rallies, we’d expect to see a surge in new wallet addresses. This year, however, we’ve seen a decline, hitting new lows in address creation. This lack of retail activity has created a tough environment for airdropped tokens, as selling pressure overwhelms the market without fresh buyers to counterbalance it.

In short, airdropped tokens face significant challenges in maintaining their value without constant buying pressure and robust retail interest. While airdrops remain a popular distribution method, tokens often experience rapid sell-offs due to a few key factors:

- Limited use cases

- Lack of perceived value among holders

- Weak demand from buyers, especially retail investors

The Silver Lining

The good news? Retail interest in cryptocurrencies has shown signs of revival in recent weeks. This renewed enthusiasm could help stabilize airdropped tokens, but long-term success will require more than just giving them away.

To create lasting value, tokens need to establish real utility, active development, and sustained buyer demand. Without these elements, even the flashiest airdrops risk fading into obscurity. The message is clear: in crypto, free isn’t always enough—it’s what you build after the giveaway that counts. 🚀

The Takeaway? In a world where retail interest is quiet, and sell-offs dominate, only tokens with strong utility, community trust, and engaged development teams can hope to weather the storm. For airdrops, the challenge isn’t just giving away tokens—it’s creating a reason for people to want them. 🚀

- Michaël van de Poppe: Bitcoin to Hit $500,000 This Cycle? 🚀💸 Or Just Another Crypto Fairy Tale? - December 21, 2024

- What is the Meme Coin Bonk, Price Predictions 2025–2030, and Why Invest in BONK? - December 18, 2024

- BNB Price Analysis: 17/12/2024 – To the Moon or Stuck on a Layover? - December 17, 2024