Rising electricity prices, falling Bitcoin prices: Those who wanted to earn their money on the BTC mining market in 2022 did not have a good time. But everything will be better in 2023 – at least that is what the crypto asset manager says Galaxy Research.

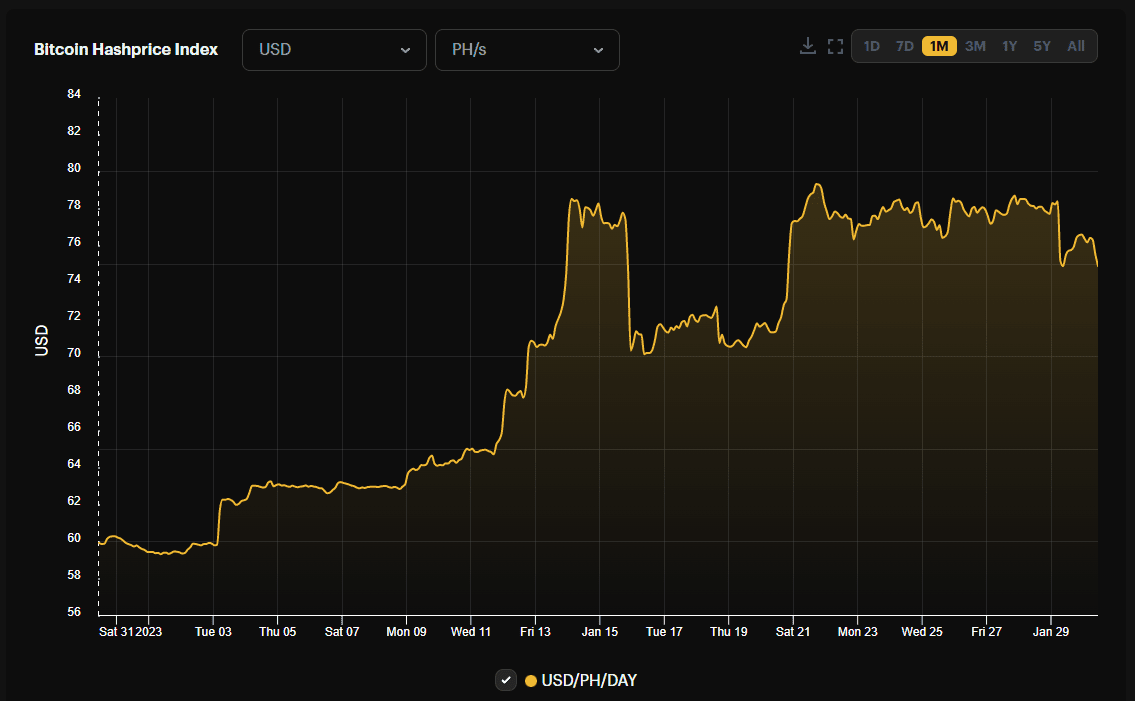

The Hashprice: A silver lining

The rising bitcoin prices come at just the right time. After all, the profit of the mining companies results primarily from two variables: the BTC rate and electricity prices. The latter are still high. However, the price of digital gold has recently been able to recover significantly; that plays into the hands of the miners.

Accordingly, the hash price curve, i.e. the expected revenue per terahash of performance, recently pointed upwards.

Things looked very different in 2022. Because just last year, the mining companies were under massive economic stress.

Galaxy Research writes:

Energy prices have risen to some of their highest levels since 1981 and have […] increased by 25 percent from August 2021 to August 2022.

The reason for the general increase in energy prices is primarily the Ukraine war and postponed supply chains as a result of the Covid 19 pandemic.

Rising electricity prices can pose an existential threat to energy-intensive mining. So it is not surprising that in 2022 many listed miners had to throw in the towel.

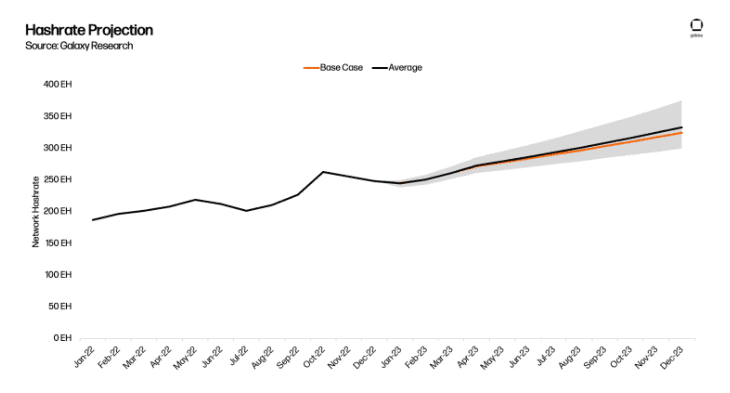

And as if the two variables electricity price and BTC rate weren’t fatal enough, the hash rate has reached new heights in the past year. According to Galaxy, the reason was long-term ASIC orders from listed miners, which could only be delivered in the course of the past year.

Network hashrate growth was largely fueled by futures-based mining machine (ASIC) orders placed in 2021 and scheduled for delivery in 2022,

Bitcoin farewell

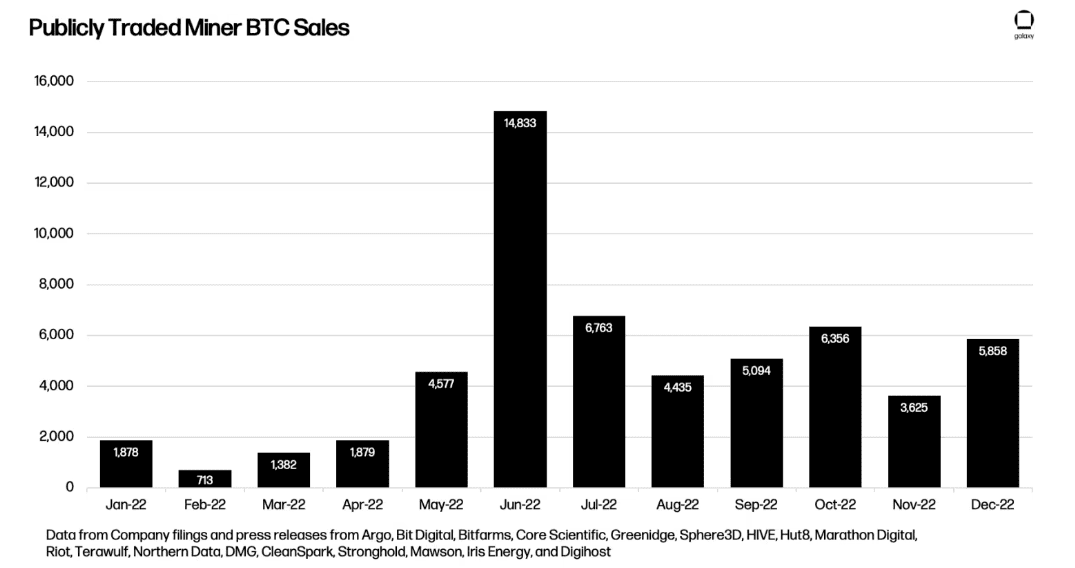

Aside from the inventory of ASIC miners, mined BTC is the most important asset on a mining company’s balance sheet. The motto is: Hodln at any price. However, when market conditions are as devastating as they were last year, many a company will go to extremes and sell their digital pot of gold.

Mining companies like Hut 8, Riot Blockchain or Stronghold made proper use of this ultima ratio in 2022. The listed miners sold up to 14,833 BTC in June last year.

This should consolidate the books of the companies in the short term. However, the selling pressure acted as an additional catalyst for further price slides on the already battered Bitcoin price. The result was a toxic vicious circle for the entire ecosystem.

For 2023, however, the authors of the paper expect a slight relaxation. Further exorbitant BTC sales are not to be expected, since the Bitcoin price is slowly heading north. On the other hand, enough time has passed to consolidate the balance sheet in other ways. Galaxy writes:

We don’t expect the same selling pressure from mining companies in 2023.

But: 2023 will not be an easy year for Bitcoin miners either. After all, prices are still miles away from the all-time high. Sales will be correspondingly low. This, coupled with persistently high interest rates, is likely to ruin the sector’s growth plans this year.

With 325 exahashes per second, Galaxy therefore only expects a comparatively small growth in the hash rate. In percentage terms, this year’s growth would only be about half that of last year.

After the Bitcoin halving in 2024, according to Galaxy, the cards will be reshuffled.

- CryptoQuant Analyst: Bitcoin Nowhere Near Its Peak – Buckle Up, Hodlers! - December 21, 2024

- Chainalysis: $2.2 Billion Lost to Crypto Hacks in 2024 - December 21, 2024

- Bank of Japan leaves interest rate unchanged: Impact on the macroeconomy and the crypto market - December 20, 2024