The debate about ordinals inscriptions on the Bitcoin blockchain is getting heated. This is not surprising given the increasing proportion of block space eaten up by pixel graphics. Because like a dataset from BitMEX Research shows Bitcoin NFTs now occupy up to 70 percent of the Bitcoin blockspace.

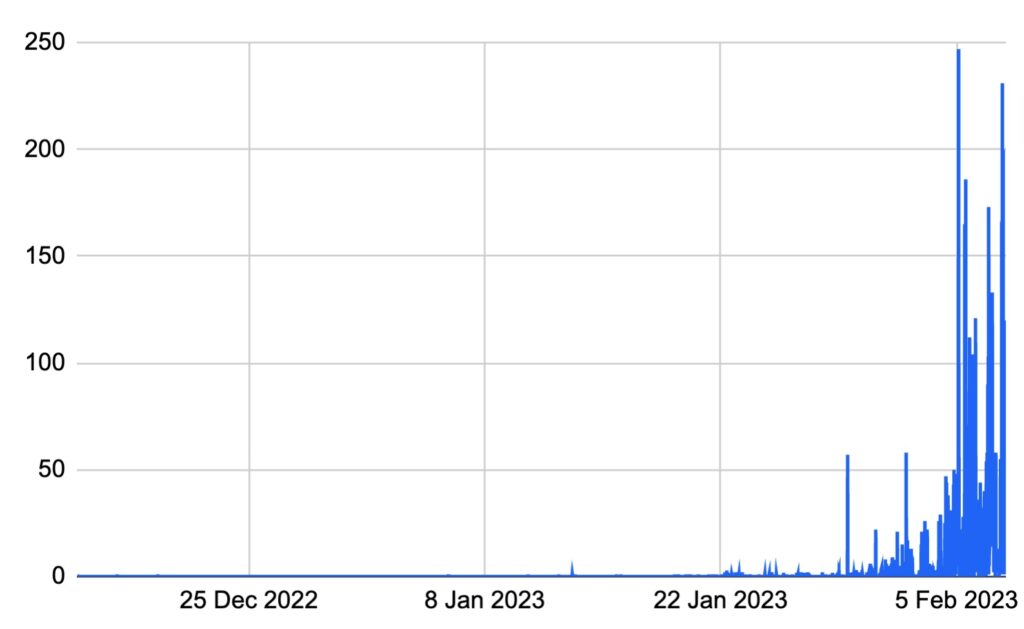

The trend is actually still quite new. An ordinal chart was carved into the blockchain for the first time on December 14 last year. A monochrome pixel graphic of a skull can be seen.

According to BitMEX, up to 250 such data records per block are now finding their way into the blockchain – an exponential increase.

Debate gains momentum

In the crypto space, the Bitcoin function extension is controversial. Lightning developer Rene Pickhardt, for example, points out the inconsistency of the protocol. Proof of Work is originally a system that is actually supposed to prevent spam. From his point of view, the blockchain is still being littered with random data packages that have little to do with financial transactions.

On the other hand: Doesn’t an open protocol like Bitcoin have to bite the bullet and also allow non-financial transactions? At least that’s what Bitcoiners like Peter Todd claim. The core developer writes in response to Pickhardt’s comment: “The blockspace has a market”.

Accordingly, the market decides which transactions get into the blocks and which do not. So if you want to send Ordinals NFTs, you have to pay for it. In the true sense of the word, there can be no question of spam.

Record amounts for Bitcoin NFTs

However, the hype surrounding the Ordinals NFTs makes the hearts of crypto soldiers of fortune beat faster. Some pixel art is sold over the digital counter for six-figure sums. Up front: The Ordinal Punks, an Ordinals NFT collection that looks suspiciously similar to the CryptoPunks. According to Degen News, Inscription 620 changed hands for 9.5 BTC – the equivalent of $214,766.

- CryptoQuant Analyst: Bitcoin Nowhere Near Its Peak – Buckle Up, Hodlers! - December 21, 2024

- Chainalysis: $2.2 Billion Lost to Crypto Hacks in 2024 - December 21, 2024

- Bank of Japan leaves interest rate unchanged: Impact on the macroeconomy and the crypto market - December 20, 2024