“Shanghai” is the biggest Ethereum upgrade since the merge and is set to be implemented on the blockchain on April 12, 2023. In addition to a number of technical improvements and changes intended to improve Ethereum’s scalability and user-friendliness, among other things, the upgrade has far-reaching consequences, especially for stakers.

The Shanghai upgrade consists of four Ethereum Improvement Proposals (EIPs) in total:

- EIP-3651: Warm COINBASE

- EIP-3855: PUSH0 instruction

- EIP-3860: Limit and measure initcode

- EIP-4895: Staking withdrawals

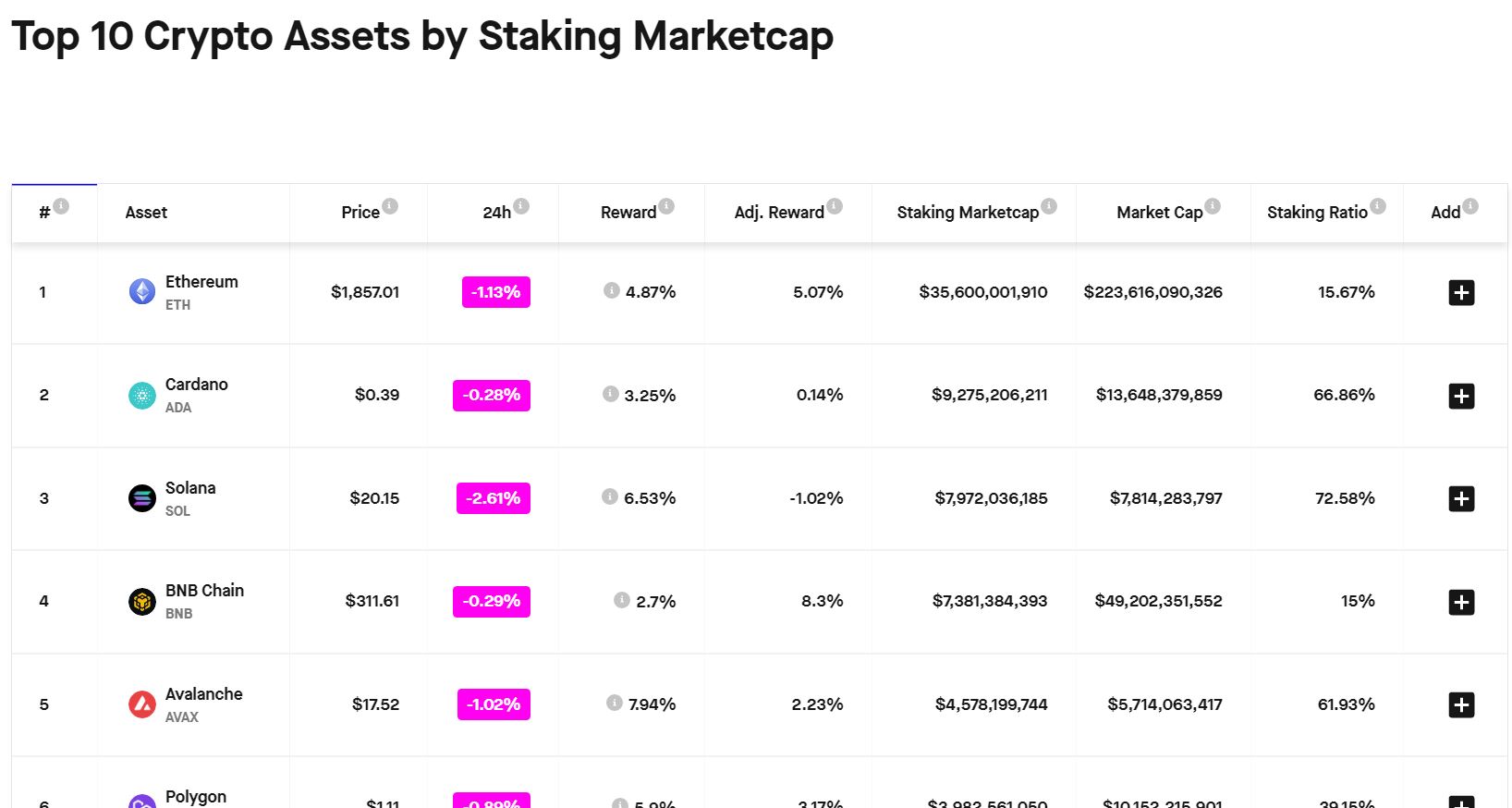

For Ethereum holders, the most important upgrade is the EIP-4895. EIP-4895 makes it possible for the first time to be able to pay out staked ether. In theory, this means that the Shanghai upgrade will give ether worth just under $36 billion or around 16 percent of the entire offer can be withdrawn and sold for the first time. In practice, however, things look a little different.

What Shanghai Means for Ethereum Staking

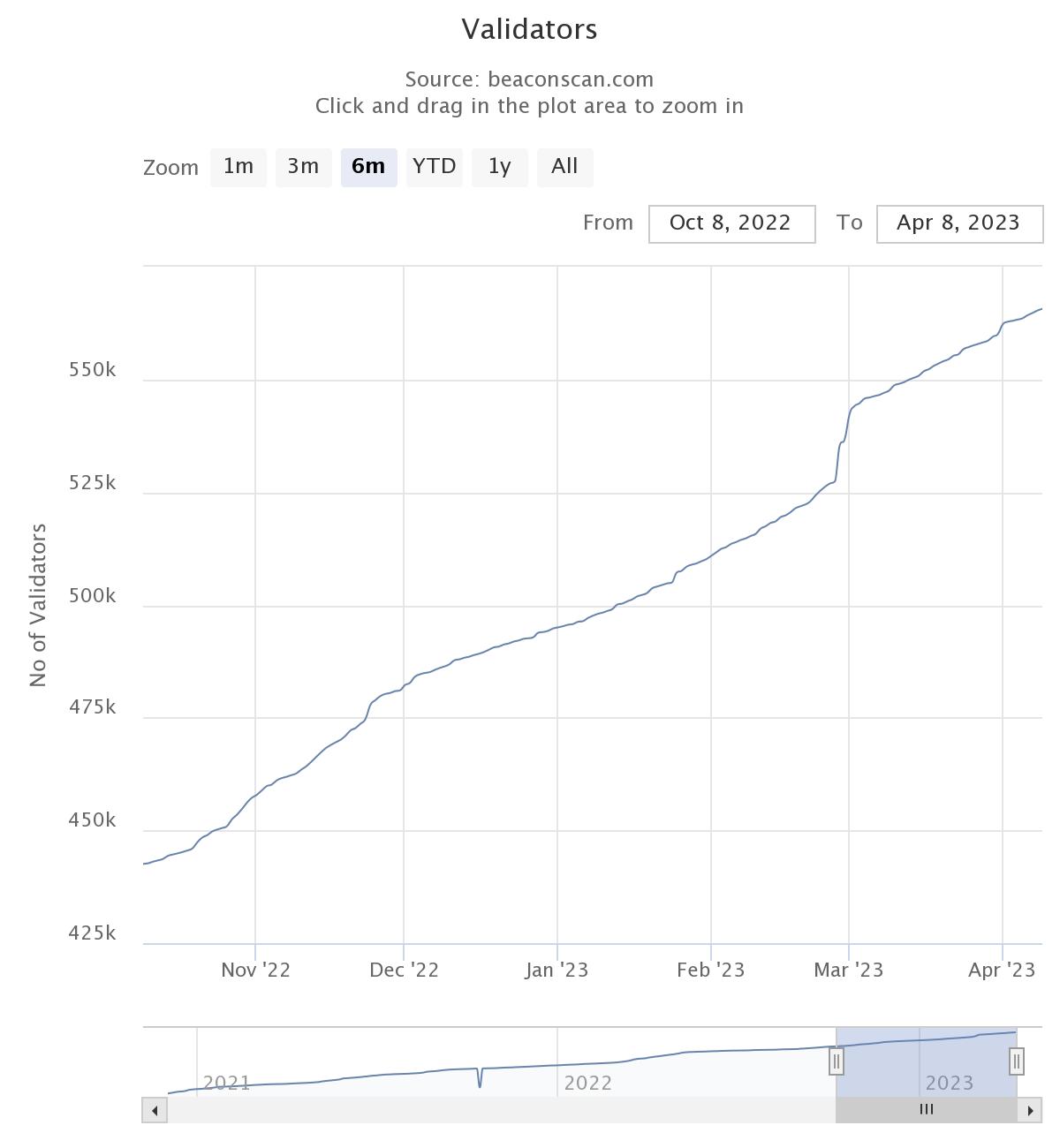

After Shanghai, staked ETH can be unstacked and withdrawn for the first time, but some restrictions apply to this process. Namely, a distinction is made as to whether staked ETH comes from earned staking rewards or whether it is part of the 32 ETH that each of the 563,000 ETH validators to set up an ETH staking validator.

Approximately a million ETH come from staking rewards worth around $1.9 billion at press time. Should all post-Shanghai holders decide to sell these ETH within four to five days. This would create selling pressure of almost 230,000 ethers or around 430 million US dollars per day on Ethereum. Since Ethereum has around $10 billion in daily trading volume, the selling pressure that will come from the release of this ETH shouldn’t have too much of an impact on the price. However, what about the remaining ETH of the validators?

According to crypto investment firm Delphidigital.io, the expected selling pressure of the remaining staked ETH will be a maximum of 58,000 ETH or $108 million per day due to the restrictions set by the Shanghai code – in the most bearish scenario. With a daily Ethereum trading volume of around $10 billion, this number also seems relatively small.

A massive ether sell-off as a result of the Shanghai upgrade seems unlikely from a fundamental point of view. However, it is difficult to predict how the majority of market participants will view the upgrade. There is definitely a possibility that many are speculating on a sale.

Why Shanghai could be bullish for Ether

On the other hand, there are also reasons that speak for a bullish event. In fact, it’s possible that Shanghai will encourage even more ETH staking in the coming months, further solidifying the network’s stability and growth. This is happening for a variety of reasons, including increased confidence in the long-term prospects of the network due to Ethereum developers’ ability to make significant changes to the protocol.

In addition, the Shanghai upgrade allows for an improved user experience as the ETH staked can also be withdrawn. This will address an important limitation of the current staking system. This increased flexibility should attract more users to participate in staking. Staking should be much more attractive than before, especially for institutional investors who rely on their investments being able to be moved flexibly.

In addition, the more users stake ETH, the greater the security and stability of the ETH network, which creates a positive feedback effect. A more secure and stable network will attract even more users to stake and further fuel the growth of the ecosystem.

- How CBDCs Could Solve Economic Problems: A Revolution in Monetary Policy and Everyday Life - March 27, 2025

- Bitcoin Near Mining Costs as Meanwhile Open Interest Hits $32 Billion – Perfect Buy Opportunity or Crash Incoming? - March 27, 2025

- 75% Chance Bitcoin Will Hit New All-Time High in 2025? Here’s Why That’s Not Just Wishful Thinking - March 26, 2025