The price of the largest Ethereum (ETH) liquid staking pool, Lido Dao (LDO), may rise as part of the Release of the V2 update up nearly 20 percent in value over the past seven days. In the last 24 hours of trading, the LDO price has gained more than six percentage points to 2.24 USD, hitting a new 20-day high. The protocol upgrade now allows Ethereum tokens staked on Lido directly without triggering a lock-up period, increasing flexibility for stakers of the second largest cryptocurrency. Several whales have taken advantage of the course correction in recent weeks and massively accumulated LDO tokensto benefit from the current recovery move.

Lido: Bullish price targets for the coming trading weeks

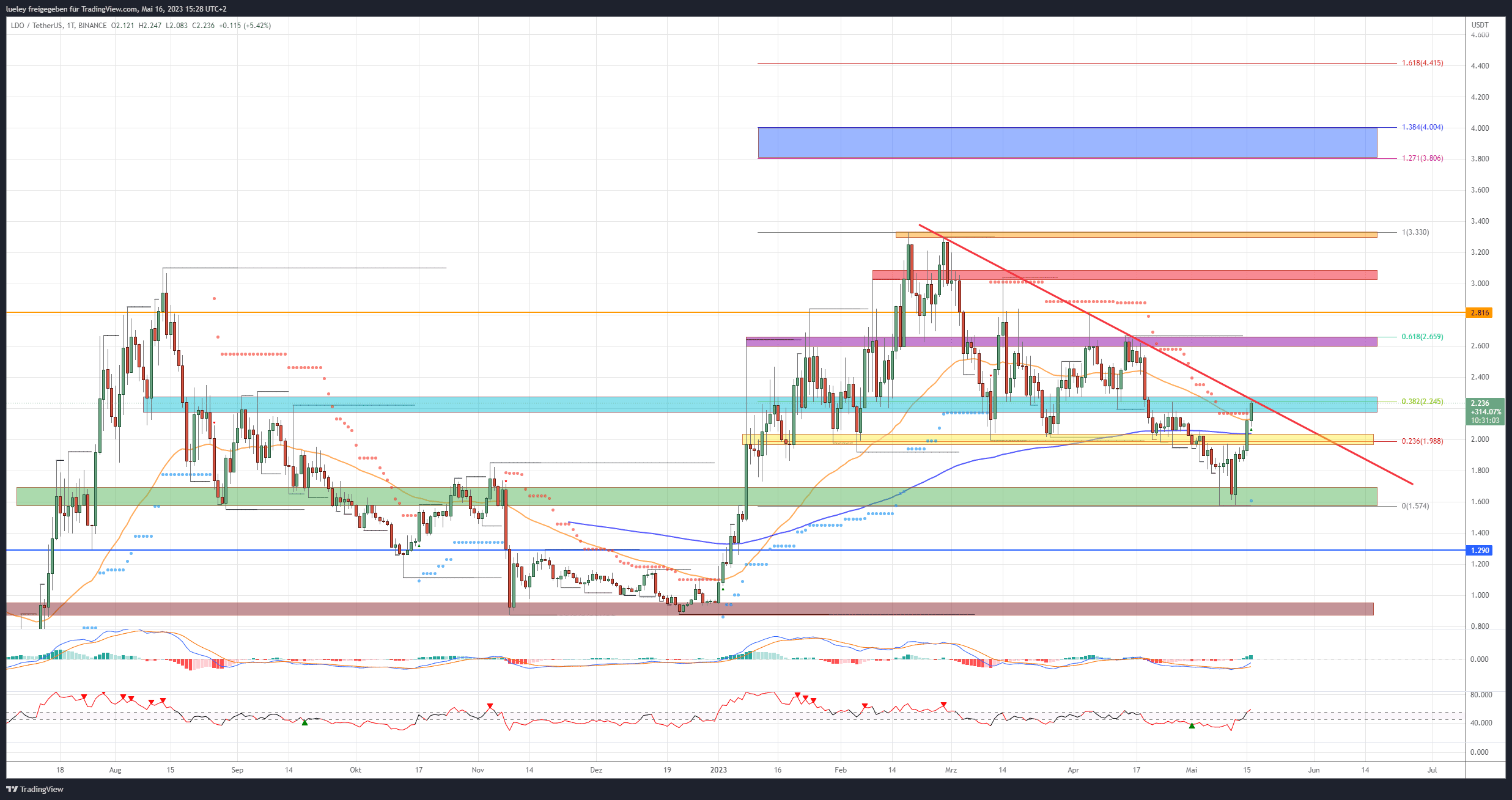

Bullish price targets: 2.17 USD/2.27, 2.60 USD/2.66 USD, 2.81 USD, 3.03/3.09 USD, 3.33 3.80 USD/4.00 4.41 USD

The price strength of the past trading days caused the EMA200 (blue) to be recaptured at 2.04 USD and allowed Lido Dao’s price to rise to the cross-resistance of EMA50 (orange) and Supertrend at $2.17. Starting from the historical low of 1.57 US dollars, the LDO price recovered by 38 percentage points. If the bulls manage to overcome the supertrend and subsequently break through the turquoise resistance area at the end of the day, the LDO price should continue to gain momentum. Stabilization above the red downtrend line further brightens the chart picture in favor of the buy side.

Then the purple resist area around the golden pocket of the last move at 2.65 USD comes into focus for investors. The first profit-taking should start here. If Lido Dao also overcomes this area, a subsequent increase up to the April high of 2.81 US dollars can be planned. The bulls have failed several times at this price level in the past. Only a dynamic breakout above this resistance level should give the LDO price a further boost and cause the price to rise towards the red resistance zone just above USD 3.00.

This would put Lido Dao within striking distance of the annual high of February 18, 2023. Here, a rebound should be planned for the first contact. If the bulls manage to sustainably overcome the orange resistance zone, the maximum target zone that can be derived for the coming months between USD 3.80 and USD 4.00 will become the focus of investors.

Lido: Bearish price targets for the coming trading weeks

Bearish price targets: 2.04 USD/1.98, 1.69 USD/1.57 USD, 1.29 USD, 0.95/0.87 USD

The bears are currently at a disadvantage after a notable sell-off back to the breakout zone from the start of the year. In the short term, the sell-side must do everything possible to ensure that the LDO price does not break out above the resistance level at 2.28 USD on a sustained basis. If a significant price bounce succeeds, Lido must then break below the support area from EMA200 and 23 Fibonacci retracement at 1.98 US dollars in order to generate further downside potential.

Only a dynamic drop below this support area increases the chance of a correction extending back into the green support zone. Plan for a directional decision between 1.69 and 1.57 USD. Currently, this area acts as an interesting buy zone for the bulls.

If the Bitcoin price weakens in the coming period and pulls the entire crypto market south, an extension of the correction to the old breakout level at the beginning of the year at 1.29 US dollars is also conceivable for Lido Dao. The buyer side should be there and stabilize the LDO price. If the crypto sector were to be sold off in the long term, a price slump in the direction of the brown support zone around the last significant lows between US$ 0.95 and 0.87 USD could not be ruled out.

From a technical point of view, investors should use short-term price setbacks for new entries. The monopoly of Lido Finance in the liquid staking sector should be expanded by the latest update and the LDO course should benefit from the Ethereum staking boom in the medium term.

Lido Dao: Looking at the indicators

The RSI has formed a fresh buy-signal in the last 24 hours of trading. The MACD indicator also shows a weak buy signal in the daily chart. If the 0 line is recaptured, this should continue to have a positive effect on Lido’s price development.

On a weekly basis, the RSI has also been able to stabilize in the neutral zone between 45 and 55 and is about to generate a fresh overall long signal.

- CryptoQuant Analyst: Bitcoin Nowhere Near Its Peak – Buckle Up, Hodlers! - December 21, 2024

- Chainalysis: $2.2 Billion Lost to Crypto Hacks in 2024 - December 21, 2024

- Bank of Japan leaves interest rate unchanged: Impact on the macroeconomy and the crypto market - December 20, 2024